Last week, the World Bank Doing Business rankings for 2011 were released. These rankings are, in my opinion, the best direct measure of the competitiveness of one country’s business environment. The reason is that while other rankings are often based on small samples of the opinions of businessmen, this one is based on very concrete metrics of how long it takes to do things. For example:

- Starting a business in New Zealand takes 1 procedure that lasts 1 day and costs 0.4% of average income. In Malaysia, there are 9 procedures taking 17 days and costing 18% of average income.

- In Hong Kong, registering a property takes 5 procedures over 36 days, costing 4% of the cost of the property. In Georgia, a major reformer over the last few years, registering a property takes 1 procedure, lasts just 2 days and costs 0.1% of the property’s value.

- Paying taxes in Germany is a chore – 16 payments, taking 215 hours – compared to Kuwait where a similar number of payments only takes half the time.

This is not to say that Georgia and Kuwait are more productive than Hong Kong and Germany. What it means is that – in those areas at least – it’s easier to do business. The focus is on efficient regulation – not wasting anyone’s time more than you have to. The reason that this is so important for governments is that, while building a very productive labour force takes generations, they control every last aspect of the ease of doing business.

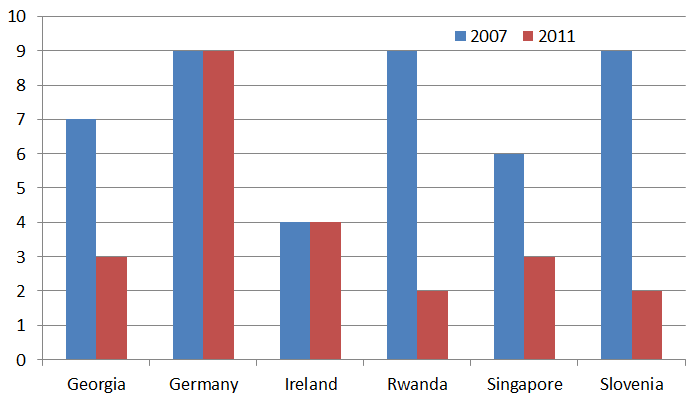

Take Rwanda, which has actively changed its business system in the last five years. The number of procedures required for opening a business is down from 9 to 2, while the number of documents required for exporting is down from 14 to 8. Making a country an easy place to do business is a decision a government can make overnight. The graph below shows for a number of countries how many procedures it takes to set up a business in both 2007 and 2011.

In the overall rankings for ease of doing business, Ireland ranks 9th, down one place from last year but still in the top ten worldwide and up from 15th in 2005. The registration of property, where Ireland ranks 78th, is the only blackspot across the nine different headings produced by the World Bank.

Staying one of the world’s best places to do business will key for countries like Ireland, as they struggle to recover from a domestically-driven recession. Without wanting to encourage complacency, I think it’s probably a good idea to take a step back from the overwhelming flow of negative news and see if Ireland’s competitiveness is reaping dividends.

Just how good is Ireland at attracting business? Short answer – very good. The property bubble may have created a whole load of jobs that couldn’t be sustained across construction and retail in particular – and we’re living with the consequences of that now. However, it also suppressed jobs Ireland should have been attracting from overseas. And the halving of property costs in the country now means Ireland is much more competitive than we were five years ago. If this sounds like guff, read the latest IBM GILD report on investment . Five cheery headlines you probably missed last week, amidst all the doom and gloom:

- Ireland is in the top ten – not per capita but in absolute terms – when it comes to attracting business support service jobs. No mean feat when you consider that the top six in the ranking are all significantly larger economies.

- Ireland is also in the top ten – actually up one place to ninth – for jobs created in R&D. Again, only Taiwan is of a similar scale, in terms of economies in the top ten.

- Amazingly, Ireland was also one of the largest FDI job creators in 2009: 19th in the world, again in an absolute sense, not per capita.

- Dublin is one of the top 20 cities in the world for attracting FDI projects in 2009.

- Overall, Ireland created more FDI jobs per capita in 2009 than any other country: almost 2 jobs for every 1,000 inhabitants.

Five fantastic headlines which you probably didn’t see last week. So much for 2009 – and indeed 2008, when the picture was just as cheery. What about 2010 and 2011? The great news is that the pipeline has continued into 2010. Here are a dozen good news stories from around the country during the last month, with an average of 100 jobs each:

- 50 jobs in business market research in Galway

- 60 jobs in finance in Dublin

- 275 jobs in accountancy in Dublin, Cork, Limerick and Waterford

- 100 jobs in online betting in Dublin

- 30 jobs in insurance in Cavan

- 20 jobs in nutrition products in Mayo

- 105 jobs in energy in Dublin

- 250 jobs in healthcare in Mayo

- 50 jobs in software in Galway

- Up to 120 jobs in IT in Dublin

- 50 jobs in finance in Sligo

- 100 jobs in software in Dublin

I am by no means suggesting that these 1,200 new jobs are a panacea. But it’s important to remember that many of the jobs Ireland has lost in the last three years are jobs that probably shouldn’t have existed in the first place. Given that these jobs had to go sooner or later, announcements like the twelve above are unambiguously good news. They represent Ireland catching up on where it should be. It’s also worth noting that, as a modern services economy, Ireland’s future lies not in attracting 20 projects of 1,000 jobs each a year, but 200 projects with 100 jobs each.

Despite the doom and gloom of the recession, making sure the country is a good place to do business must remain a priority – for the Irelands of this world as well as the Georgias and Rwandas.

Brian J Goggin ,

But arranging 200 projects will take longer, and require more procedures, than arranging 20 ….

bjg

Gerard O'Neill ,

I hadn’t seen the IBM report Ronan – thanks for that. You’re right about doing business in Ireland – I find it easier to run a business now than at any time in the past 20 years. There are more talented people, with reasonable salary expectations, than before; more suppliers willing to compete for my business; and more cost effective means for selling to prospective customers (including the web).

The recovery will come one job at a time, one new business win at a time. It may not get our media excited, but who gives a damn? Employers and employees, investors and lenders know that the real world of business growth comes from the factors you list in your post.

Micro is reality, macro is just ‘sound and fury, signifying nothing’.

Donal O'Brolchain ,

Thanks, Ronan.

Growth in new businesses (eg. Aldiscon, Ryanair, Riverdance, IFSC) was absolutely essential to complement the 1980s fiscal consolidation and EU funding which led to the industrial and commercial growth up to 2000.

The absence of any perceptible reform of the way we govern ourselves (which is far more than having elections) means that we still have a lot of work to do to limit the scope for the kind of excesses we have experienced during the past 10 years. We need far more checks and balances on the powerful – be they elected or appointed, public or private.

C.O'Brien ,

Ronan, admirable as your concensus is you have overlooked the elephant in the room that is Ireland is a one trick pony in terms of job creation.How many of the jobs listed above are indigenous? I think you will find the overwhleming majority are down to FDI. Take that out of the equation and Ireland is in a very bad place. One stroke of an EU pen deproves the ONLY reason why FDI choose Ireland, it has nothing else going for it.

Ronan Lyons ,

Hi C.O’Brien,

Thanks for the comment. Perhaps you’ve missed the point slightly with the post. It was almost entirely about FDI jobs! It wasn’t saying “we shouldn’t try and create jobs ourselves, FDI will do the trick”. It was saying, “whatever amount of jobs we create for ourselves, we can always have more by harnessing FDI”. And we are the best country in the world at this, per 2009 figures, and certainly Top Three over the last decade.

Practically every region, city and small country in the world tries to do this, precisely because small economic regions can’t in and of themselves create new jobs as there are limits to domestic market size.

I’m not sure what EU pen you have in mind, but given that firms are here for at the very least (1) corporate tax, (2) a well-educated, English-speaking and currently partly idle labour force here, (3) the freedom to attract labour from anywhere in the EU to here, unlike practically every other EU country, and (3) eurozone-access to EU markets, it would have to be a pretty serious pen.

Perhaps I’ll do a separate post on indigenous job creation – although that is almost by definition trickier to track.

Thanks,

Ronan.

C.O'Brien ,

Hi Ronan,

Perhaps you have missed the point. All well and good “harnessing” FDI but they currently make up c.70% of our exports and employ roughly 150k people DIRECTLY, you could easily triple that with spin off employment. I dont disagree fundamentally with your points 2 & 3 as factors in the decision making process on investing in Ireland but it would be extremely naive to believe these would be considered factors if our corp tax rate was say 25%. 2 & 3 would become neglibile.

Ireland is pimping itself on the back of the corp tax rate, policy & strategy beyond that is non existent, lets not kid ourselves.

I would like to see your take on indigenous job creation and how that sits within the economic make up of the country in terms of employment, exports & GDP versus FDI. It will make for pretty grim reading.

Rgds

David Clarke ,

Ronan– Good insights as usual. Just to back up your analysis (and refute C.O’Brien): I’m a director of locally-founded technology company which was acquired by a US corporation 2 years ago. We’ve doubled our staffing locally since then and now employ 50 people in Dublin, and will double again the next 12-18 months. We are finding it easier to hire very highly skilled technology professionals here than in the Bay Area. Are these ‘indigineous’ or ‘FDI’ jobs? Does it really matter?

In our case at least, this has nothing to do with corporation tax. I have a number of peers in a similar position- for example Amazon have a rapidly expanding strategic technical and infrastructural commitment to their Irish operation. I think enlightened policy choices will enable a sustained competitive advantage in this area vs. the likely transient effects of corp tax rates.

Ronan Lyons ,

@C.O’Brien

Thanks for responding. As I worked for a few years in the whole area of competitiveness, FDI and economic policymaking, I hope I’m not missing the point when I write about competitiveness!

It’s clear from both your comments that you do not approve of Ireland’s strategy since the late 1950s of harnessing global trade and investment to boost living standards here. That is a perfectly valid opinion. I would stress, though, again having worked in this area, that most regions in the world would happily pay a fortune to trade places with Ireland tomorrow, to have the jobs and exports engine that we do. That tells me something.

You seem to believe that indigenous exporters and jobs are somehow crowded out by FDI exporters and jobs. If our medical devices sector is anything to go by, nothing could be further from the truth. As David Clarke points out, is there really a distinction any more? I can’t think of any region in the world where there is always a ready supply of indigenous exporters with new jobs. Yet for a small region in the global world economy, the global FDI market represents an ongoing opportunity to win new jobs. And, in that race at least, Ireland is top of the world!

Antoin ,

The reality is somewhere in between. It is good that we have FDI. Itis also true that we should be generating more indigenous jobs.

C.O'Brien ,

Ronan,

I dont think the issue is competitveness my dear friend, its economic policy. The fact that you worked in that area gives you a well formed opinion but can also give off the impression of blinkeredness.

How many indigenous Irish companies are listed on the NASDAQ? Compare us with Israel, a country with even less resources than Ireland (granted 3m more population) but has 10 times the amount of NASDAQ listed companies.

Yes, of course there has to be a distinction! Take away INTEL & Microsoft from the Irish economy, we have a huge vacuum on numerous levels.

The argument for countries being jealous of us does not translate, we have a VERY low CT rate, this is not complicated and no need to make it so. I dont see any other country trying to copy our model do you? Why? Because they have a coherent strategy! Lets not lose sight of the jobs we have here and do our best to nurture but its naive and downright shortsighted to think this is the perpetual panacea to our economic ills.

C.O'Brien ,

Re – David Clarke. Not teaching you to suck eggs but ostensibly it would appear that your business is indigenous by virtue of its original formation, the fact it was bought over by an external party is a by product of success and would not ordinarily constitute FDI categorisation due to the business already being in situ.

As for the casual dismissiveness of the corp tax rate, of course its not me for me to say if its a differentiator for your parent company but if you look beyond your organisation, which with all due respect is a small player in the economy and there is unfortunately not enough of your type, the american chamber of commerce has gone on record to say that US MN’s will take a strong hard look at their Irish operations if the CT rate was to fundamentally change. Don’t think that Amazon and the like would stay here if their tax liabilities were to significantly change. I am sure you would not like to put your casual outlook on CT to the test and see what the reaction is like.

Rgds

COB.

Ronan Lyons ,

@C.O’Brien

Clearly, we’ll have to agree to disagree. If it were as simple as a low corporate tax rate, everyone would be doing it and we would not be the most successful country in the world at attracting FDI. In fact, lots of countries are out-doing us in relation to low headline rates of corporate taxes – such as Uzbekistan, Albania and Saudi Arabia – but they are not in the same FDI league. Not only that, but even many of the large firms who are here don’t pay their corporate tax here, they pay it in Bermuda… so why do they have thousands of jobs here? It’s obvious that something else other than corporate tax also matters.

Perhaps you should be less focused on the headline rate of corporate tax and focus instead on the actual rate paid. In Ireland and the Baltics, it’s about 16%, in Portugal it’s 18.5%, in the UK it’s 23% while in Scandinavia it’s about 25%. We’re below average, certainly, but certainly not wildly out of line. Another suggestion for you would be to be less focused on HQ-driven definitions of company ownership. Those Israeli firms will more than likely not be Israeli much longer – they’re now fair game for anyone to buy them. In fact, Irish people, through their pension funds, probably own a small part of these companies. You would no doubt be much dismayed if Ireland created 10 success stories only to sell them on on a foreign stock exchange to foreigners.

In relation to naivety, it was naive of Ireland to think it could cut itself off from the rest of the world economy and hope to thrive, as was policy until the late 1950s. As long as economic integration across continents is an economic reality, direct investment – the majority of which will come from non-Irish residents – will remain probably the single most important policy this country has for generating wealth through trade. If the level of economic integration falters, then we’ll have lots to worry about, not just our FDI strategy.

R Larkin ,

Have to take issue C O’Brien with your point about corp tax. Many of the large foreign companies do pay tax at 25% effectively because of surcharges on retained dividends. 12.5% is payable on profit, but unless you distribute that profit via dividend (which a lot of the US companies cannot because of US tax law) you pay a surcharge.

The tax rate, even at 25%, is one of the lowest in Europe.

C.O'Brien ,

Yes Ronan, appears we may have to agree to disagree. A few points though.

a) Fifty years of solo economic policy. Wheres the contingency?

b) Israeli companies may well end up with foreign owners, only natural in a freeworld market, does that by defnition negate the fact that they were indigenous to begin with? When wedgwood bought into waterford glass did that mean it cease to become an indigenous enterprise?

c) Albania, Uzbekistan and even Saudi (despite their resources) are hardly luminaries on the world stage so I dont think you are comparing apples with apples there.

d) Apart from CRH & Glanbia, Ireland has few success stories to speak of in indigenous terms and despite their successes they are not with an asses roar of the much heralded “smart” economy. Where is Ireland’s Nokia / SONY etc?

e) Plenty of countries would swap places with Ireland, indeed but Im sure Ireland would swap places with the USA & China just as quick no?

f) I am not suggesting that Ireland remove itself from the industrial economy but am doing my utmost to highlight the lack of a coherent economic strategy in Ire and the lack of contingency. You can dice the numbers on the CT rate and you admit yourself that we are still the most attractive option, when routing hundreds of millions through Ire this makes one hell of a difference, even at a few % points. The countries you highlighted, do they all have an IDA which will divy out huge inccentives for job creation also on top of a leading CT tax rate? Would be interested to see analysis on that.

Will look forward to your piece on the rest of the economy apart from FDI, lets see what that reveals. If thought out and analyzed in the correct manner you should arrive at the same conclusion.

We’ll leave it at that.

Rgds

COB.

Ronan Lyons ,

@C.O’Brien, I think the fundamental difference between us is what economists call returns to scale.

You see a world of constant returns to scale, where Ireland can be a scaled-down verison of China or a US just on a smaller scale and money spent on FDI is money not spent on promoting local firms.

I see a world of increasing returns to scale, where there are spillovers and agglomeration effects. Ireland is not the US on a smaller scale, Ireland is Delaware in a different continent. Money spent on foreign firms boosts local firms (and is also not illegal under EU law, lest we forget practicalities!). Israel is where it is largely because of spillovers from spending on military, which is a necessity for Israel and an untouched luxury here. The power of some of these agglomeration effects is an area of active research. You might be interested in all 3 parts of Geoffrey West’s talk at Techonomy: http://www.youtube.com/watch?v=BIU-xSoSKFw

R

C.O'Brien ,

Hi Ronan,

I think the contagion in your constrained outlook for a cohesive economic strategy for Ireland is blunting your ability to discuss anything other than the wonders of FDI in our fair land. We have a fundamental difference in opinions alright, you are tying yourself up in knots here and have ended up with a constant returns to scale argument as basis for your entire outlook? Seriously?

You have totally misinterpreted the points made on China & the US. You said there would be countless countries looking to swap with Ireland, no doubt but I was making the point that Ireland would equally harness the good things about the chinese & US indigenous markets also in a heartbeat. This doesnt mean we should be them.

Re: Israel & miltary spending, I am sure you could analagize till the cows come home on Ireland and similar GDP spends vis a vis Israel, just because we dont spend it on the military doesnt mean we dont spend an equal % on something else, military example is a mute point to be honest, nothing more than symantics.

FDI has evolved in Ireland over the last 50 years and luckily for Ireland technology has meant that when manufacturing went elsewhere we had the likes of INTEL / DELL / Microsoft to fill the vacuum.

You seem all too consumed by vertiable feast we are enjoying currently and do not see anything but this trend continuing as we are obviously so much better than every other country in the developed world arent we? If Ireland continues to immerse itself in pimping itself perpetually to the US MN family we may find ourselves asking WTF if that tap is ever turned off. Where was your economic vision then Ronan?

Rgds

COB.

C.O'Brien ,

Over to you Ronan.

http://www.zerohedge.com/article/what-will-happen-ireland-and-various-mncs-when-ireland-finally-forced-hike-tax-rates

You say Ireland inc will be fine though so we can all relax.

Rgds

COB.

Ronan Lyons ,

@C.O’Brien

It is somewhat ironic that on this post I’m being mocked for saying corporate tax is not important, while on my next post, I’m being derided for saying that Ireland’s corporate tax rate *is* important, particularly given that yourself and the other commenter are more than likely in agreement.

Anyway, the point I have been making all along is that a high corporate tax rate alone is not enough to do anything, as many small countries around the world have found out. In technical terms, it may be necessary, but it is not sufficient. Regardless of the mess of Ireland’s government finances, Ireland’s trading sector is performing very well and that this is due to the competitive environment in Ireland – regulation, tax, English in eurozone, labour supply and so on (although there is a shortage of skilled labour). If the EU were to insist, for reasons of political expediency, on a small increase in Ireland’s corporate tax rate (say to 15%), I don’t think there would be much of an impact. However, if the EU were to insist, for reasons of fiscal illiteracy, on say doubling Ireland’s corporate tax rate, future growth in Ireland’s real economy would indeed be very much at risk, as France’s finance minister pointed out over the weekend.

Eleven reasons to be cheerful | Ronan Lyons ,

[…] few weeks ago, I outlined some of the great successes that IDA Ireland has had in recent months. Since then, there have been more job announcements. Five of the larger ones […]