The latest Daft.ie House Price Report was released this morning and contains what may be surprising reading for some. Across three different metrics, there were signs of improved activity in the market in the first three months of the year. Given we sent out press releases to journalists before midday on April 1, I did worry that some of them might think it all just an April fool!

Increased optimism

But the signs are there. The fall in asking prices in the first three months of the year was, at 1.4%, the smallest fall in asking prices seen since prices started to fall in 2007. “Smallest fall” mightn’t sound like particularly good news for homeowners but what was particularly interesting was the fact that the average asking price rose in a number of regions.

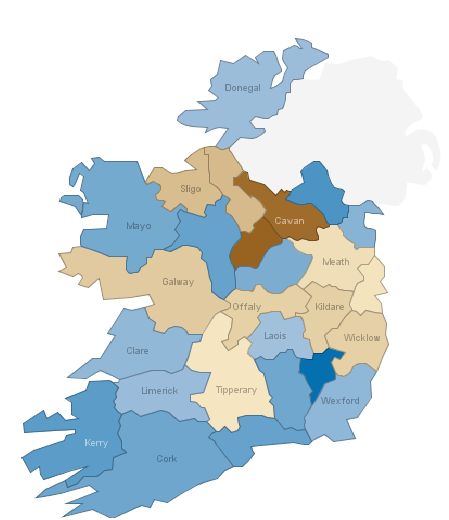

Of 26 counties, the average asking price rose in eleven. An average price increasing at the county-level despite general falls is not unheard of – every other quarter might see one or two counties buck the trend, before falling again the next quarter. However, eleven in one quarter is as many county-level increases as the previous seven quarters put together.

Over on Manyeyes, I’ve visualised the changes over the last three months by county – an overview is given in the graph above. I think what’s interesting is that there is an obvious difference between the “bottom half” of the island, so to speak and the stretch from Galway over to Dublin. This less than random scattering of increases also suggests something more fundamental at work.

Shifting properties

Why are sellers in many parts of the country being more optimistic, though? Some – such as NAMA Wine Lake – believe that we can read very little into analysis of the actions of 27,000+ sellers and this is probably just noise. However, what are other metrics telling us? Sellers may be more optimistic if properties are shifting.

There is some evidence, particularly in Dublin and Leinster, that properties are shifting. The total number of properties for sale in Dublin is at its lowest since mid-2007 while the slow and steady decline in the stock sitting on the market in the rest of Leinster continues: there are now 14,000 properties for sale in the province, down from a peak of 18,000.

One other metric we’ve been pioneering in the Daft Report is the proportion of properties selling within a certain number of months. Typically, one might look at time-to-sell of the average property coming off the market but in a market where some properties have been up for three or more years, averages will get skewed and not give a fair indication to someone selling at a realistic price now of how long it will take to sell a property.

The report gives the proportion of properties selling within four months of listing, for both December (30%) and March (33%). And – like the average asking price and total stock on the market – it does suggest a slight improvement in conditions in the first few months of 2012. One third of properties now find a buyer within four months. In Dublin, that figure is 40%.

As I’ve been saying on radio this morning, I wouldn’t be take this report and run off popping open the champagne in the certainty of the market having stabilised. Instead, it’s a step in the right direction. Recovery in the property market is about activity (not prices). There’s evidence from today’s report that conditions did improve in the first quarter of the year – but that could easily be undone by trends between April and June. In particular, without sufficient lending by the banks, it’s unlikely we’ll see any stabilisation and recovery in the property market.

The daft-myhome conundrum

For those paying attention, there’s an obvious clash between what this Daft Report is saying and what the alternative report, by Myhome.ie, is saying. Whereas the Daft Report shows these three indications of improved market conditions, the Myhome report reads like the Daft Report from January: they’ve seen the largest fall in their series yet.

I learnt recently that there is one large methodological difference between the two reports. While the underlying methodology, hedonic regressions, is the same (and is also used by the CSO and was previously used by the ESRI), Myhome use all properties listed on their site come late March, no matter how long those properties have been listed. Asking prices however reflect sellers expectations and in my own opinion it should only be expectations formed (i.e. properties listed) during the quarter that are counted.

The other difference is the sample size available to each website. Daft has approximately 50% more properties listed for sale than Myhome and this is particularly pronounced outside Dublin (in the capital, to the best of my knowledge, it is pretty much even).

Sean ,

Spoke to an AIB manager last week & they said they’d trebled their Q1 mortgage lending over Q4, thin as it was….Perhaps the faintest of pulses detected

Mike ,

On the differences between MyHome.ie and Daft.ie reports – sample size is irrelevant if the sample is not representative. Are these data representative ? Highly unlikely.

Is there any proper research into house price trends ? Relying on half baked guesses from proxy data may is a terrible state of affairs for the home buyer/seller to be in. It seems straight forward enough for an academic program or research institute to go and get some actual data direct from households: randomly poll anonymously asking how much did you pay, when did you buy ? Validate with the flip side: how much did you sell for and when.

Dreaded_Estate ,

Do you think the differences between the daft index and the myhome index could in any way be due to myhome including all listings while daft including just new listings.

Anecdotally, I have noticed a large number of price drops on existing properties in the last quarter which will not be picked up by Daft but will be picked up by myhome.

I understand that new listings are a good indication of sellers expectations, but could a price drop be indicative of a revision of an existing sellers expectations?

Ronan Lyons ,

Hi Dreaded_Estate,

Thanks for the comment. Not all the reporting has carried the full description of the differences in sample usage. Daft uses two samples: new listings and those who revise their prices. So of the 27,600 observations in Q1 2012, 12,700 were “price changers”, not new listers (a further presumably 25,000 or so were “price non-changers”). Given that myhome also include all those properties (presumably it is the bulk of their sample), this can’t explain the difference. If anything, it should be the other way – the Daft index should respond a lot more quickly to a revision in seller expectations. Looking at the daft.ie report stats, the Q1 quarterly change for new listers was -0.7%, compared to -3.5% for price-changers – both a far cry from -7%.

I’ve thought a good bit about the differences but can’t come up with an easy story to explain it away, given the similarity in previous quarters. One thing I do notice is that what myhome spotted in Q1 was spotted by Daft in Q4 2011. This suggests the following story:

– Q4 2011 did actually see a dramatic fall in asking prices for new or relisted properties (as per daft), but this was hidden in myhome by the relatively small number of new listings in Q4 being drowned out by long-listed properties at higher prices.

– The end of 2011 and start of 2012 saw a large number of long-standing properties (i.e. pre-Q4 2011) on myhome coming off the site (either sold or withdrawn). They were replaced in the myhome dataset by newly listed properties at prices similar to those from Q4 2011.

– In such a circumstance, the large fall seen in Daft in Q4 2011 would only be seen in Q1 2012 in myhome.

R

Dreaded_Estate ,

Thanks Ronan, very reasoning on the possible reasons for the differences.

Wealth taxes and property taxes in Ireland: understanding the tax base | Ronan Lyons ,

[…] Browse All Posts « Signs of life or April Fool? The latest Daft Report […]

Property Tax is a Wealth Tax in Ireland by Ronan Lyons – Smart Taxes Network ,

[…] end of the first quarter of 2012 saw not just the usual quarterly reports – such as the Q1 2012 Daft.ie House Price Report discussed elsewhere on the blog – but also the deadline for paying the €100 Household Charge. The charge has been the focus of […]

Anonymous ,

Thanks for all your interesting information – you wrote recently in Bus Post regarding some change in falling house prices in 1st. qtr. Might this have anything to do with the large numbers retiring from public service and using lump sums to finance properties for themselves or children??? -just a thought??

Mary O Hara ,

Hi Ronan,

The quarterly change in house prices Ireland map has no legend. How should I interpret it.

Regards

Mary