The end of the first quarter of 2012 saw not just the usual quarterly reports – such as the Q1 2012 Daft.ie House Price Report discussed elsewhere on the blog – but also the deadline for paying the €100 Household Charge. The charge has been the focus of a campaign of resistance that is surely more to do with the principle than its size (the increase in Band A motor tax was almost as large as the Household Charge but I don’t recall anyone complaining against that particular flat tax).

In fact that campaign has succeeded in one way already: while it had originally talked about the charge applying for 2-3 years on an interim, the Government is now not going to go through all this again and desperately wants to bring in a fairer property tax with Budget 2013 this coming December.

Where’s all the property wealth?

What sort of base is there for property tax? The latest Daft.ie Report gives county-by-county figures, which can be combined with information from 2006 and subsequent completions (or alternatively Census 2011 information) to reveal what wealth there is in residential real estate around the country.

The total amount of wealth in residential property peaked in 2007Q4, at €564bn. 37% of all this wealth (€208bn) was in Dublin (home to just 28.5% of households in 2006). A further €37bn was in the four other cities – their 6.5% being roughly in line with their 7% share of all households. Since then, the trickle of new completions has not been nearly enough to offset the fall in property values. The stock of homes as of Census 2006 has fallen in value from €525bn to €255bn, as of Q1 2012, while including the value of new completions in the years since 2006 increases the total value of all residential property to €294bn.

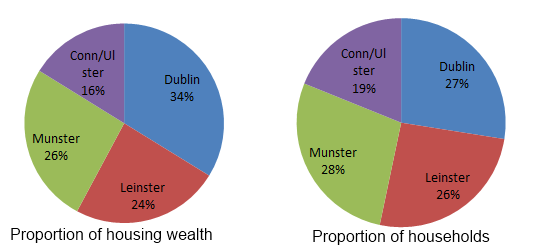

Dublin is now home to just under €100bn of housing wealth, as of early 2012, while the rest of Leinster and all of Munster are home to €70bn and €76bn in housing wealth respectively. Connacht and the three Ulster counties are home to about €48bn of housing wealth. The relative proportions that each of four regions makes up of Irish housing wealth and Irish households is shown in the two pie charts above – you can see that rural households need have no fear that any property tax will hit them hardest. Quite the reverse: any property tax will have to make sure that it doesn’t overly punish urban life, which is so crucial to subsidising the rest of the country.

Where’s all the wealth?

These are statistics that the political class would do well to heed. To recap our Econ1010, there are three main types of tax: those on incomes, those on consumption and those on wealth. Ireland is also home to some of the world’s most punitive rates of taxation on income and consumption, so hence there is increasing interest in wealth taxes.

There are four main forms of wealth: (1) cash/deposits, (2) equities/shares, (3) debt/bonds, and (4) real estate/property. In Ireland, as of 2006, deposits made up 10% of Irish wealth, equities a further 8%. Pension and investment funds – wealth holdings of unknown type but likely to be a mix of mainly equities and bonds – made up a further 11% of wealth. But it was property that was the overwhelming type of wealth in Ireland, making up 72% of all wealth. The vast bulk of this was residential property. And that picture is not likely to have changed substantially with so much of Irish equity wealth being invested in the banks, which are now all next to worthless.

So when people talk about taxing wealth in this country, they are talking principally about taxing the homes that we live in. In second place comes taxing the deposits we have in the bank. Make sure to mention this to the next person who says “We don’t need a property tax, we need a wealth tax”.

Barra ,

Think chart 1 from Central Bank QB article on household net worth updates those figures in last para. Housing assets still overwhelming component of household wealth. Don’t know if has been updated for later than 2010Q1. http://www.centralbank.ie/publications/Documents/Irish%20Households,%20Assessing%20the%20Impact%20of%20the%20Economic%20Crisis.pdf

Yields or Bust ,

@Ronan

Just looking at the numbers.

Value of housing at q4 2007 €564bn and with the likely fall in housing when the dust finally settles at -75% to -80% leaving a realitic value of c€125bn plus the €39bn you say has been added since gives a ‘value’ of €164bn.(I’m not entirely sure that your assumption of simply adding the values in the interim actually makes sense but we’ll run with it) But this is still a nonsense because the mortgages against this ‘value’ is somewhere in the region of €115bn so in net terms the real ‘value’ is c€50bn.

Taxing €50bn at 1% generates a €0.5bn p.a. before taking into consideration those constrained by income difficulties. On a good day it would be very difficult to generate €250m.

Ronan Lyons ,

@Yields or Bust

A fall of 80% is far in excess of what is suggested by fundamentals. What you are talking about is an average house price of about €75,000, well below the long-run average of €100,000 which dates from a time of much higher and more volatile interest rates. And this in a country where the average rent is about €10,000 a year. Given your moniker, surely you would agree that a 14% yield is incredibly high for a region of the eurozone.

I’m also not sure why you are looking at net wealth, rather than gross wealth, particularly given tax relief on mortgage interest. Either way, you might be interested in reading the CB report on household wealth linked above by Barra: http://www.centralbank.ie/publications/Documents/Irish%20Households,%20Assessing%20the%20Impact%20of%20the%20Economic%20Crisis.pdf

The net worth of Irish households is about €450bn.

Yields or Bust ,

@Ronan

Not so.

Thus far most of the so-called experts have been badly wrong when it comes to house price predictions. Given the latest results from the Allsops auctions (only significant seller of volume in the current market) suggests that falls north of 75% in most areas of the country will be the required level to clear the market – based on fundamentals this makes sense to me. The numbers:

Per Daft.ie low in average residential yields July 2007 was 3.12%.

As you have demonstrated before the adjustment required from asking rents/house prices to contracted has on average being about 7%. So to get to contracted from asking needs to be adjusted lower to 2.90%.

We know that nominal rents since 2007 have fallen by c25% on average since the peak so adjusting for this would see peak yields at 2.18% (2.90%*.75) and further adjusting to a more realistic long run yield in a housing market with significant over supply and no credit will in my view see average yields moving to 9% (long run average in a ‘normal’ market historically excluding the madness since 2001 would have seen rental yields at c7% to 7.5% in any event so a 9% yield in the current market is about fair).

So to move from a peak price adjusted yield of 2.18% to 9% requires a PTT fall of about 76%. As you’re no doubt aware without access to credit interest rates are largely a meaningless pricing parameter. In addition we are likely to see falling rental supplement payments have a continued downward effect on nominal rents over time – I’ve assumed in the above that nominal rents remain stable. This is not the case in many parts of the country. So in fact on fundamentals 75% to 80% falls look to me about where house prices will get to on average. I’m open to correction but I believe Cormac Lucy recently came to a similar sort of number.

Tax relief on mortgage payments at best eases the burden marginally – the killer here is the fact that wage rates are falling in real terms and I know of very very few employees who are likely to see any sort of wage growth going forward to compensate for debts which are massively over the value of many dwellings, meaning there is fact no ‘value’ in many properties, hence the rationale for using a net figure. The basic tenet of a tax is to levy it against a ‘profit’ of some description. With falls in house prices as I expect, many will be running in negative equity teritory making the collection of any sort of tax hugely difficult – as recent experience testifies.