The latest Daft.ie Rental Report, for 2011 Q4, was published this morning and features a commentary by Minister for Social Protection, Joan Burton. Three key findings of the report are outlined below:

- Rents in the final quarter of 2011 were slightly below those of a year previously (€818 compared to €822 for the national average). The figure for January is actually slightly up on a year previous, up by 0.5%. These changes are relatively small and suggest an overall picture of stability in rents nationwide, with the average monthly rent within about the price of a pint of €820 since mid-2010.

- This stability, however, masks a split between Dublin and Cork on the one hand and the rest of the country’s rental markets on the other. In Dublin, the average rent has risen from €1,042 in mid-2010 to €1,065, while in Cork it has risen from €831 to €882. In Galway, Limerick and Waterford cities, over the same period the average rent has fallen by €20, €30 and €40 respectively, while in the rest of the country the average rent has fallen from €652 to €630.

- The driver of these diverging trends is relatively obvious: the number of properties sitting on the market. In Dublin, the total number of properties available to rent fell from 4,300 on January 1 2011 to 3,500 on January 1 2012, a fall of almost 20%. Outside the major cities, however, there were 11,300 properties available to rent on New Year’s Day this year, down just 100 from the same day last year.

Long-standing property market sceptics should rightly have a follow-on question here: a fall from a very high level initially could still leave an oversupply of stock on the market. That’s a fair point, so really what we want to know is the balance between supply and demand.

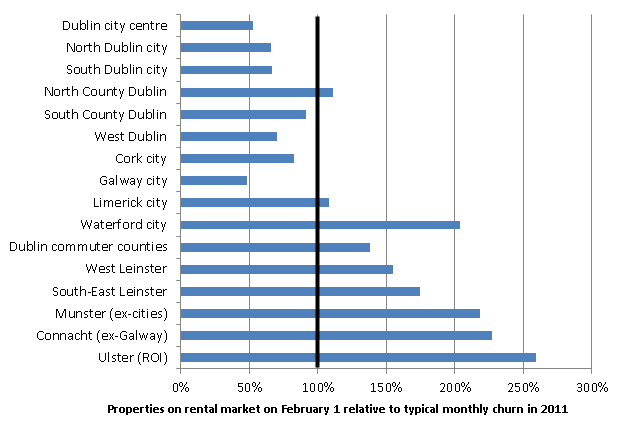

There’s no easy way of measuring demand but a handy rule of thumb is that the number of properties on the rental market at any one time should not be greater than what the market can handle over the course of a month. When stock sitting on the market has been significantly greater than one month’s transactions, we’ve seen rents falling but when stock is less than 100% of what the market can handle, we see stable or even rising rents.

The graph above shows that relationship between how many properties are sitting on the market around the country and how many each regional market can usually handle over the course of a month. There is a clear difference between Dublin, Cork and Galway – where stock is well below what the market churns through over the course of a month – and the rest of the country, in particular Munster (ex-cities), Connacht and Ulster, where stock sitting on the market is more than twice what the market handles in any given month.

Indeed, there is such significant oversupply in Munster, Connacht and Ulster that the question there is really: why are rents not falling by more? Surely, with such competition for the attention of tenants, landlords would aggressively cut their rents to compete.

The answer may lie in Minister Joan Burton’s commentary to this report. She focuses on rental supplement thresholds. Analysis by her department that mirrors my own from last November finds that for large swathes of the country, rents have settled at levels that look remarkably similar to maximum rent supplement levels.

It is of course entirely possible that the natural balance of supply and demand just happens to be at these two-year old thresholds. If that’s the case, then reduction in rent supplement will have little impact other than delivering the taxpayer some much needed savings.

If, however, the taxpayer is funding a price floor in the private rental market, then its removal will not only save the taxpayer money, it will also boost Ireland’s competitiveness and economic recovery by lowering accommodation costs for Irish workers and consumers.

The end of a single national property market was flagged over a year ago. We are now seeing that clearly in the rental market and I would not be surprised if it spreads into the sales market in coming quarters, with stabilising prices in the cities and falling prices elsewhere.

Ahura M ,

Hi Ronan,

Regarding the number of properties available to rent:

1. Are people who access Rent Supplement less likely to move? And any idea if this would be significant (e.g. Dublin’s drop from 4.3k to 3.5k, ‘x’ may be explained by higher %age of renters receiving rent supplement)?

2. Less people moving jobs. Job creation has dived, so it’s reasonable to infer fewer people need to move to be closer to new work location. This could impact churn, but (again) I’ve idea of how significant this might be.

3. Punter inertia. If rental supplement has created a floor, private renters may not be motivated to move as cheaper opportunities aren’t available. In general, assuming lower net incomes and fears over future austerity, it would be interesting to know what proportion of renters are willing to increase their current spend on rent to move and upgrade their accommodation versus those seeking to spend less.

Ronan Lyons ,

Hi Ahura,

Thanks for the comment and questions.

On (1), I think realistically the Daft.ie Report is a barometer of the non-Rent Supplement market. Very few landlords on Daft will accept rent allowance so trends in the Report should be seen as reflecting primarily the actions of non-RS tenants.

On (2), my sense is that the opposite is usually the case. When people could live in their home village and get a construction or retail job easily, why move? Now, however, I think we’re seeing a return to the normal laws of economic geography – people agglomerate to generate jobs and income. I’ve no conclusive evidence for this (yet!) so that’s just my claim for now.

On (3), I agree. I would love to see a system where RS is an income supplement, rather than a payment in arrears to landlords. That way, if someone haggles and gets a good deal, they keep the savings. The current system creates a huge class of tenant who’ve no incentive to haggle, and the taxpayers foot the bill.

R

Treas ,

Ronan,

Can you plot changes in sales supply versus changes in rental supply over the last year or so by any chance?

It would not surprise me – particularly in the urban areas – if a fall in rental supply happened at a similar timeframe to an increase in sales supply even if there is not an exact match in numbers.

Ronan Lyons ,

Hi Treasa,

Thanks for that suggestion – will pop that in the blog to-do list.

Ronan.

Ahura M ,

Thanks Ronan,

I should probably clarify some of my points.

Re Pt1: I’m thinking of tenants that have lost their jobs during the course of their current tenancy. They have gone from earning an income to receiving rental supplement. As moving whilst receiving rent supplement isn’t easy, they are more likely to extend current lease. This changes market dynamics as ‘churn rate’ for this (increasingly large) cohort slows. Impact on Daft.ie: landlord advertises less frequently.

Re pt2: It would be interesting to get measurements on this. Ireland is a pretty small place. I’d argue that people usually move within the island when they have secured a job. Moving to look for work in an Irish context probably means emigrating. The new dynamic (I suggest) is that nowadays people are moving work less frequently. Assuming renting enables greater mobility, an example might be a renter changes workplace from Sandyford Industrial Estate to the IFSC. I think there is a high probability that such a person would move house/apartment. During the downturn, the ‘changing jobs’ dynamic has slowed considerably. Impact on Daft.ie: lower churn, less ads.

In summary, I’m trying to think of changing dynamics that increase average tenancy durations. Which in turn may result in lower numbers of adverts on Daft, though tenancy duration is only one of many factors. I have thought of one additional question: Do landlords who apply to social housing authorities (RAS scheme?) continue to advertise? I guess this could reduce some daft ad numbers.

I think you’re spot on about lowering the cost of accommodation in Ireland. We need to cut cost of living which, hopefully, in turn should improve competitiveness. There is little focus on maintaining quality of life on less money. Unfortunately, this means heavier losses for property owners (though, if the economy dies, their property will be worthless. A bit like a US ghost town after all the gold had been mined).

laura ,

Ahura M. Good points, but in a lot of cases (in fact for the vast majority of single renters), rent supplement may not be an option if redundancy occurs because the gap between the permitted rent and the actual rent is too high.

Secondly, I’d dispute Daft’s relevance in talking about the subsidized segment of the private rented sector. We know that as much as 50% of the entire private rented sector is now entirely dependent on state subsidy. Yet look at the daft ads and you’ll see that less than 10% of advertised Daft places either fall within the rent limits for the unit size/people size and accept RA tenants. So to me, this suggests that either Daft ads are not accurately describing the true rates of rent landlords are willing to accept (i.e. they advertised a speculative ideal rather than reality), or that the vast majority of RA permitted units are not advertised on Daft – or for that matter, anywhere. I suspect that a great number of RA tenancies are Advertised via word of mouth or local supermarket small ads.

If this is the case then really, the data from Daft is far less relevant and useful in analyzing this sector than it might immediately seem.

We really don’t know enough about

Liam Clancy ,

Ronan, very interesting and, indeed, accurate prediction made by you back in February. We operate a letting agency in Dublin city centre and this spring there has been a serious shortage of properties with very little choice for tenants. Current tenants are staying put in their exisiting properties and are managing to negotiate small or zero rent increases.