So, there I was, popcorn in hand, all ready to pore through the €6bn in savings in Budget 2011, like a vulture picking through the remains of some European tiger. I listened to the Minister for Finance’s speech, keenly awating his switch from the mix of optimistic economic outlook and grandiose patriotic rhetoric to the nuts and bolts of fiscal measures. But no sooner was I sitting comfortably than the Minister was gone and Deputy Noonan was making quips about who bullied Cowen when he was a schoolkid.

I sat back confused. Had my internet feed missed something? I listened to RTE DriveTime and grew convinced I had in fact missed the meat of the speech. Mary Wilson spoke with all the gravity of national mourning, while members of the public were furious. Some wondered how Lenihan slept at night, while large on-street protests were about to get underway in what you could be forgiven for thinking was an eruption of popular outrage. Radio ads proclaimed newspaper analysis of the most Draconian budget in the history of humankind. One blogger even wrote: “It has been said all day on television, radio and Internet that our poorest are paying for the richest [sic] mistakes.”

So I decided to look through the various documents published on the Department of Finance’s website. And it seems that everyone was so busy denouncing what had happened in the Budget, they forgot to look at what it actually contained. In brief, the “non-debt” government deficit is expected to improve substantially next year, from €11.7bn in 2010 to €5.5bn. The “non-debt deficit” here means the gap between all government revenues and all voted current and capital expenditure. Indeed, the non-debt balance could be €2bn in surplus as early as 2013 by current trends.

Unfortunately, though, the national debt counts. And service on the national debt and next year’s promissory notes for the banks mean that the actual deficit will fall by a lot less, from €18bn to €14.5bn.

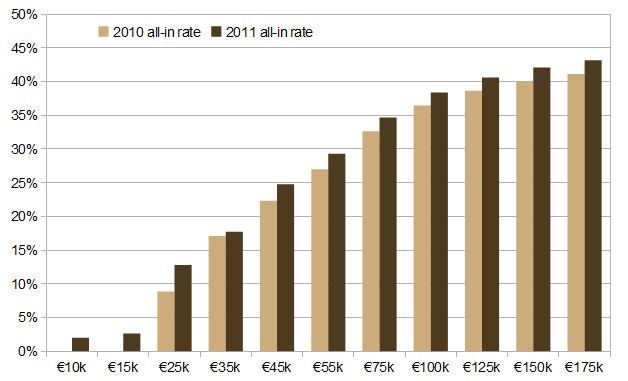

So why are people outraged? It seems people are outraged because their after-tax pay has been reduced by €20 on average a week. People seem to be outraged that someone on €175,000 a year will only stump up €3,500 in new taxes, taking their all-in tax rate to 43%, while someone on €15,000 will pay €400 extra, taking their all-in tax rate to 2.7%. People are outraged at a Budget that means someone on €55,000 a year (the typical public servant, for example) will sacrifice €24 a week in new taxes, while someone on the Jobseekers Benefit or the Old-Age Pension will not have to make a contribution [edit: DoF documents were unclear but it looks as those someone on Jobseekers Benefit will sacrifice €8 a week]. Is this really what people who are “outraged” are actually outraged about?

The graph below shows the all-in tax rate this year and next year for a range of different salary levels, based off the assumption that people are putting aside 6% of their salary for their pension. It should hopefully be very clear from the trend from left to right that in an already very progressive system (i.e. people on lower incomes pay a lot less in percentage terms in tax), everyone is being asked to shoulder about extra two percentage points on average in tax. That means, of course, that someone on €100,000 will be hit by this budget five times as much as someone on €20,000.

This is a relatively important reform of the tax system. It is one of three major reforms that will be needed over the 2010-2015 period, along with another reduction in tax credits, to bring us back into line with our eurozone peers, and the introduction of an annual property tax. (Incidentally, the removal of stamp duty without the introduction of an annual property tax is one of the odder measures of this Budget.) These two further moves, along with some gentle economic growth, could mean that public revenues reach as much as €58bn by 2015.

Nonetheless, the government had promised to bring about €6bn in savings in this Budget and tax measures will deliver only about €2.5bn. Where will the rest come from? Well, here the outgoing government has – perhaps understandably – relied on some low-hanging fruit. Capital spending was always going to fall from peak levels of €9bn in 2008 to about €4bn by 2014 or so, to bring us back in line with our OECD partners. This budget takes us from €6.3bn planned for 2010 to €4.7bn planned for 2011. This is a one-off easy €1.5bn or so to find and no future government will have this luxury. Ditto the approximately €600m the Government has found through “asset disposal”, selling mobile phone licenses and various other one-offs.

This means that we are up to €4.5bn of the €6bn adjustment this year without looking at the single biggest line in the Government’s finances, the €55bn in current public expenditure. This is projected to fall to €53bn next year but this is relatively small fall in spending in the grand scheme of things. This is due almost entirely to the Government tying its hands at the start of the year through the Croke Park Deal. The bald truth is that current expenditure by the Government will need to fall to about €46bn a year by 2014/2015 if the Irish government is to reach its targets.

Watching the reaction on Twitter, I feel I might be the only one, but I am actually more optimistic now than two days ago about the prospects of Ireland getting its deficit back under control by 2015. That is not an excuse for complacency, however. In reality, there are four main headings to current expenditure: social welfare, health, education, and “the rest”. Social welfare is – by and large – out of the hands of any government and one can only hope that the bill falls steadily by perhaps 2% a year, to reach €19bn. Therefore, it will take proactive 5% year-on-year reductions in health, in education and in other current expenditure, if Ireland is to reach its targets. In that sense, every Budget until 2014 will be as tough as this one, when it comes to spending.

The easiest answer, when faced with a difficult task, is to give up and despair. In this, the media must share some culpability. After all, advertisers have to record their ads about “draconian budgets” (and professional protestors have to book their marching slots) well in advance. The blog I quoted earlier went on to say about Budget 2011:

I feel guilty, I feel fear for the future of this joke we call Ireland, the children of the future will be left with a billion euros bill, they will be left with sheer tortured life’s. Many of our elderly and young will taste death thanks to our politicians.

There is, however, no way you can spin the numbers of Budget 2011 so that it looks like the poor, young and old, are paying for the rich. As I mentioned last week, for every euro being pumped into the banks, two euro are being borrowed for the black hole of public expenditure. The spending cuts and tax increases Ireland is enduring at the moment are a natural reaction to Ireland’s over-spending and under-taxing during the 2000s, not the bank bailout.

While it may make terrible headlines, yesterday’s Budget was not some Draconian horror show visited on the Irish public, a symbol of our lost sovereignty. It was instead a relatively important step back towards fiscal sovereignty. It is up to those who can see this to make sure reasoned debate about restoring Ireland’s public finances into balance replaces blind rage.

Jonathan Leonard ,

Good post Ronan. Nice to see an objective view of the budget which focuses on what it wil do not how much less everyone is going to have. I’m offically sick of sorrow and anger cover in the media. We’ve a presentation From GT in work tomorrow will be interesting to see if they’re as even handed.

Hugh Quigley ,

Ronan, another good piece of analysis – I too was wondering listening to Brian Lenihen’s short sharp bullet style presentation, expect the grandstanding exposition near the end where all the TD’s clocked in to qualify for their expense allowances were heckling, how the doomsayers were going to justify the title of most draconian budget ever in Europe.

Ronan Lyons ,

People can check out how much people on average are contributing in this Budget (and with the first link find out for themselves), via:

http://www.thejournal.ie/budget-calculator-2011/#basic-calculator

http://www.thepropertypin.com/viewtopic.php?f=19&t=34804

Quite astonishingly, the sample size is already above 40,000 over at The Journal! (That’s more than 2% of all workers!) Average hit so far is about 2.5%.

Cian ,

“while someone on the Jobseekers Benefit or the Old-Age Pension will not have to make a contribution.”

…jobseekers getting an €8 cut no?

Ronan Lyons ,

Hi Cian,

Well spotted. I was working off this line:

“There will be a reduction of €6 per week in the rate of Jobseeker’s Allowance and Supplementary Welfare Allowance for those aged 22-24. The rate of payment of Jobseeker’s Allowance and Supplementary Welfare Allowance for those aged 18-21 is unchanged.”

And had missed this line:

“The maximum personal rate of payment for all weekly schemes (…) will be reduced by €8 per week from the first week in January 2011…”

If the former is just a subpoint of the latter (which is not clear from the layout), then JSB will be reduced. Thanks for pointing that out, I may amend the text,

Ronan.

Caelen ,

I think there is a lot of merit to this analysis, however I think it would be worthwhile to look at everybody’s tax burden after the minimum cost of living has been subtracted from their gross income. I think it saying “someone on €15,000 will pay €400 extra, taking their all-in tax rate to 2.7%” does not give a reasoned view point on the tax burden that person faces.

I think a much more revealing figure of tax burden would be to look at the % of someone disposable income is spent on tax.

I realize that there could be lot of discussions about what is someone’s disposable income, but off the top of my head let’s assume the minimum cost of living in this country is €12K a year. So someone earning 15K a year has €3K in disposable income. Under the new budget they are being asked to contribute €400 or 13%.

Whereas a person on €175K disposable income is €163K and pays 75.25K in tax or 46%.

While this way of looking at things doesn’t materially change my perception of higher earner’s tax burden. It does materially change my perception of a lower wages earners tax burden.

If we continued looking at tax burden in terms of affordability I’m pretty sure we would find that it is families with children which are by far the most taxed group in society.

Laura ,

“So why are people outraged? It seems people are outraged because their after-tax pay has been reduced by €20 on average a week”: a very petty statement if you are looking from the perspective of somebody on 50k+ a year and taking in 3000 a month after tax, very different if you are fighting to survive on 25k which equates to about 360 a week.

Laura ,

Another point is that the person who would have paid 70,000 tax on a 1 million euro MacMansion now saves 63,000, while a FTB must stump up about 2,000 for a 200k modest home. The difference is that taking 2000 euro away from somebody who has probably struggled to save any kind of deposit is far harsher than giving a cash bonanza of 63k to a MacMillionaire.

Rob ,

I agree that there is a lot of scare-mongering in the media that is largely over-egging things. I do think that care needs to be made, however, when comparing rich with poor. Losing 213 euro a month when you’re earning 150K a year is somewhat different to losing 50 euro a month when you’re earning 18.5K (calculated for single earners). Yes, the 150K earner is contributing more in overall terms, but proportion of change is not the same, and one is cutting into basic living expenses and the other disposable income. I agree that the tax base needs to be widened and there is a need for a property tax, but care needs to be made when introducing them. I think the government needs to be much clearer about what is going on – largely what is happening is the tax cuts of the mid 2000s are being undone. If you could afford to live on the tax rate in 2003, then you probably should be able to now. You’re paying no more than then and you’re salary has probably gone up more than inflation in the intervening period. If they explained things this way, it may help dampen some of the analysis that suggests that we’re paying massively more tax than we’ve ever done, etc.

Ronan Lyons ,

Hi Caelen,

I take your analysis. If you set some bar, clearly those closest to the bar are going to feel it most. And I don’t want to be glib about people on less than €20k losing €10 a week. But I would make two points:

(1) Ireland’s system of tax credits and levels of child allowance actually mean that a household on the average wage with one earner and two children pays almost nothing in tax (it was negative as late as 2008). In almost every other OECD country, they contributed about 20% or their income in tax. Is that sustainable?

(2) We need to look at how we can put in place a system that is sustainable. Clearly, half of all earners paying nothing in tax is not sustainable. While we can look at the incremental change brought about by this Budget alone, that is forgetting the bigger picture. Who pays what now? And how do we get to a situation where people pay the right amount.

Unfortunately for people earning less than €40k, this is going to mean a greater proportional adjustment, as they were the ones – unpopular as this point will surely be – who benefited most from the Celtic Tiger taxation system. It will still mean, though, that someone on €100k will pay more in % terms and a lot lot more in € terms in tax.

@Rob – I agree that most of the problem now is about communication, rather than the measures themselves, which will have to be introduced largely regardless of who is in power.

Ronan Lyons ,

Incidentally, I may not always agree with Michael’s analysis, but I think his post today highlights some of the perverse outcomes of “straightening out the system”:

http://notesonthefront.typepad.com/politicaleconomy/2010/12/the-creepy-is-in-the-detail-which-the-government-didnt-reveal-social-welfare-rates-will-fall-by-4-percent-exc.html

Short version: if you earn €1m this year and next, you’ll be better off next year.

Caelen ,

Hi Ronan

On the whole I agree with your points and I don’t want to seem to be taking an opposing point of view.

1. Is this optics? Does it include all taxes paid by that family; employer’s PRSI (just another tax on wages in my view), VAT, excise etc. I assumer here as well that talking about about a family with married parents.

2. I agree entirely with this point

On a slight but related tangent. I don’t think enough has been made about negative incentive and the fact that the bulk of high wage earners in our society are effectively ‘volunteer’ tax payer to this country.

I know the high tech sector very well and the sector has effectively 100% employment with nearly every company actively looking for experienced developers. This group of people, who pay a disproportionate amount of the countries income tax, are highly mobile and actively recruited by overseas companies. If high taxation on their salary creates a competitive disadvantage for Ireland they will move abroad and unlike other sectors there isn’t an experience Java programmer on welfare that can set up and take the job. The job and the resulting tax take will be lost to the country.

I am sure this isn’t the same in all industries but one could find an element of truth in it everywhere you look – “Why should I do that overtime if I’m only going to be 48% of it” or “why should I go for that promotion’ or sales execs trying hard to win business overseas “why should I stay away from my family for another week in order to close the deal”.

In my view we need we need to do more than just balance a budget. We need tax people who can afford it, while not damaging incentives to work. Given that if you tax the people who can afford it then you are damaging the incentives of the people who are going to contribute the more it takes an extremely brave government to do anything other than target those who can’t afford it.

In summary there aren’t any right answers in this budget. As you point out though there is a way to somewhat address this problem and that is to tax something other than income. If we taxed property or wealth in some other way then we could model things to tax those who can afford it and not remove incentives. A big miss in my opinion.

Tyrone Slothrop ,

Ronan,

Another very interesting and well thought out article.

I have to say that, personally, I am unimpressed by this budget as, yet again, the FF lads have hit the people who can’t really fight back and who would, generally speaking, need the most.

After all disabled folk, full-time Carers, single Parents and kids don’t really have the time to march on Dail Eireann.

Heaven forbid they should cut the regular Dole payments by more than €8, we couldn’t have that lot clambering outside Leinster House. Remember what happened after the ‘Grey Brigade’ had their day in the protesting sun? That just wouldn’t do at all!

They have, once again, avoided being anyway heavy on the middle-classes. Wouldn’t want your average voter and party backer having to feel the pinch more than is absolutely necessary. So instead, just spread the hit across all divides making it a much “fairer” situation.

I wonder will the government be reducing the rent of social housing tenants after these cuts take effect? They are very quick to up these rents in line with budgetary increases but, alas, I can’t see this happening.

Sparing the middle-class and taking tokenistic pot-shots at the top earners might just save a few votes for the FF gang when the election rolls around, after all mummy and daddy voted FF…right?

I am aware that Cowen doesn’t enjoy the ‘fringe benefits’ of someone on the Dole so you can see why his salary wasn’t reduced any further but the capping our dear President’s salary at 250k is somewhat farcical. I have no idea what she is on right now and, quite frankly, I’m afraid to find out.

/Rant

Ronan Lyons ,

Hi Tyrone,

Thanks for the comment. It will indeed by interesting to see what happens social housing rents now in the new year. By all accounts (OK, the Daft.ie report), market rents are down 25% from the peak.

Ronan.

Cian ,

Ronan, what is your take on the labour market activation elements of this years budget?

Jack Richards ,

Look it is time to face facts. Lower and middle-income groups have been hammered. Do you want me to list out all the effects? Please remember ALSO that local charges (co. council/corporation) and VHI will also rise as a result of cutbacks-which are part of the budget. There have been slashing cuts in health. There is a new 50 Euro transport charge for primary school pupils. Transport costs for secondary school pupils will also rise. School capitation grants have been cut. Parents will have to stump up to fill the gap. University students will pay more

Petrol and diesel price rises will increase costs for business. This will be passed on. So it is time to face facts.

In relation to the capital budget what projects will be cut? Pro budget spin doesn’t put bread and butter on ther table.

People are not fools. Stealth taxes are part of the budget. Never forget that.

Many more businesses will now go to the wall.

Finally would you care to explain how the country will make debt payments over the next few years? The markets are not fools.

The country ain’t seen nothing yet. An ordered default is necessary- and quickly at that. Otherwise the game will be up within two years.

Ronan Lyons ,

Unfortunately, Jack, it is indeed time to face facts. You can take whatever stance you want on imposing losses on senior bondholders (and remember the EU-IMF money was given precisely to avoid losses to senior bondholders). But what would you do after we’ve defaulted and we still have the largest structural deficit in the OECD? How would you close the gap? No amount of default gets us away from the fact that we have a taxation system where the majority of money is contributed by the very top tier, i.e. where the average Irish household has been getting away with underpaying for the last 10 years.

In relation to how the country will meet its debt repayments, it will do this as any country with a 100% debt-GDP ratio does. In Ireland’s case, in 2012 out of total revenues of about €55bn, the government will be spending perhaps €6.2bn in debt service.

I’m not sure why you’ve given Ireland just two years, even though we have enough cash to do us until 2015. But in general, there are two strategies now: give up (and then do what? I’m not sure), or get stuck in and try and get this country going again. As you’ll notice from last week’s post, there have been numerous economic policy mistakes over the past 15 years. But, for example, Ireland is still the world’s most successful attractor of FDI jobs, on a per capita basis. Let’s use our strengths and the lessons we have learnt from the last 15 years to our advantage.

Conor ,

Hey Ronan

That’s a nice chart. Also, it’s important to show what total tax paid is for different level earners. There was alot of funny headlines going around today claiming the low paid are paying more tax than the higher paid which is plainly wrong.

Here’s a table of effective tax rates I did up which are valid for 2011 based on yesterday’s budget changes.

http://icampaigned.com/blog/?p=246

Eoin Grace ,

Unfortunately, while some decent steps were made in this budget, it was ultimately one of cowardice and a desperate attempt to keep Fianna Fail from total annihilation in the upcoming budget.

Leaving both contributory and non-contributory pensions for the over 65’s who vote in such large numbers untouched while reducing welfare for the younger members of society (who receive far less welfare in the first place, spend more of the benefits they receive rather than saving them and vote less) is only justifiable in the mind of an electioneer.

The changes to stamp duty “to stimulate the housing market” just smacks of not learning their lessons from the past. The housing market needs to be left to find it’s level, removing artificial supports such as our high rental allowance limits (or the holding of properties back from the market via NAMA) in place would have been more constructive in letting the market find it’s true level.

Leaving the quangos, Public Sector numbers and salaries untouched are the final indicator that this was indeed an Election budget rather than the required (and long over-due) structural overhaul of our tax system and public spending.

Budget 2011 was entirely crafted to allow Fianna Fail turn to the electorate and say “You want us back now don’t ye? Sure those other guys’ve only gone and cut your pensions, salaries and colleagues jobs” to their core support bases: the PS workers and OAP’s.

Ralph Smith ,

Excellent post Ronan a tonic to the tabloidesque hyped up nonsense I’ve been reading across traditional and social media for the last few days.

Jack Richards ,

Ronan thanks for your reply. However I would suggest that you take a look at this:How the ‘social charge’ makes Cowen’s a Millionnaire’s budget…

http://sluggerotoole.com/2010/12/08/how-the-social-charge-creates-cowens-millionnaires-budget/

Ronan Lyons ,

Hi Jack,

If you click on Michael’s original blog post, you’ll see that I was the first to comment on his findings. I think Michael’s point is an important one, both in terms of the current perceived fairness of changes (the journey) and the ultimate contribution of all parts of society (the destination).

That doesn’t change any of the points I made earlier, though. Ireland desperately needs a sustainable tax system.

Thanks for following up,

Ronan.

Budget 2011 Gross & Net Pay Chart | Our Man in Stickens ,

[…] Ronan Lyons has a chart over on his blog here showing what the effective tax rates were in 2010 and what they will be in […]

Billy O'Mahony ,

Hi Ronan,

Point of order. Are your figures correct?

I make out the All-in rate for 2010 to be 39.2% and 2011 40.9%. Which is quite a bit different from yours.

RW:

tax_2011:

srcop: 32800.00

credit: 3300.00

‘usc_11’ on 100000.00…

10000.00 @2.00% = 200.00

6000.00 @4.00% = 240.00

84000.00 @7.00% = 5880.00

Total for ‘usc_11’ = 6320.00…

‘prsi_11’ on 100000.00…

6604.00 @0.00% = 0.00

93396.00 @4.00% = 3735.84

Total for ‘prsi_11’ = 3735.84…

‘income_tax’ on 100000.00…

32800.00 @20.00% = 6560.00

67200.00 @41.00% = 27552.00

credit: 3300.00

Total for ‘income_tax’ = 30812.00…

Total Taxes: 40868

Nett Pay: 59132

All-in Rate: 40.9

tax_2010:

itax_able_income: 100000.00

srcop: 36400.00

credit: 3660.00

‘income_levy_2010’ on 100000.00…

75036.00 @2.00% = 1500.72

24964.00 @4.00% = 998.56

Total for ‘income_levy_2010’ = 2499.28…

‘health_levy_2010’ on 100000.00…

75000.00 @4.00% = 3000.00

25000.00 @5.00% = 1250.00

Total for ‘health_levy_2010’ = 4250.00…

‘prsi_2010’ on 100000.00…

6604.00 @0.00% = 0.00

68432.00 @4.00% = 2737.28

24964.00 @0.00% = 0.00

Total for ‘prsi_2010’ = 2737.28…

‘income_tax’ on 100000.00…

36400.00 @20.00% = 7280.00

63600.00 @41.00% = 26076.00

credit: 3660.00

Total for ‘income_tax’ = 29696.00…

Total Taxes: 39183

Nett Pay: 60817

All-in Rate: 39.2

Dirk ,

Forgive the newbie question, but when you say “all-in tax rate” are you just using another term for effective tax rate? If not, do you mind explaining, in layman terms, what you mean by all-in tax rate? Many thanks.

Graham Williams ,

@ “Incidentally, the removal of stamp duty without the introduction of an annual property tax is one of the odder measures of this Budget”

The only odd thing about the removal of stamp duty is that this measure wasn’t in either of 2009’s budgets. The high rates were only introduced as market-cooling measures after the Bacon Reports – they were ludicrous in an already frozen market.

sam ,

Hi Ronan,

Excellent analysis above with regard the budget. My own view is similar to yours but I would emphasis the point you made about the next budgets being just has hard as this one. They picked some of the last remaining low hanging fruit.

In terms of real ‘pain’ and fairness there is of course loads of low hanging fruit remaining but the gate is securely locked on the public service pay orchard for now.

If this gate remains locked the next budgets will be much harder for those who really are struggling and therefore this budget has not frontloaded the correction at all.

Still the worst is still to come, and this will be very bad for confidence.

I said back in 2008 that we need to to deflate everything by about 30% before we can grow and sustain jobs again, and by and large I stand over that. The longer we take to make the adjustment the slower we will grow afterwards because of the drag the increase debt burden will put on the economy.

With regard taxation, I think I disagree with you slightly also. I don’t think broading the tax base in Ireland to levels in the EU is fair until the cost of living is brought more in line with the EU also.

This high cost of living is a burden being imposed on the lower paid by the higher paid particularly in the semi-state and state sector. An otherwise excessively progessive taxation system makes sense in this situatoin therefore as it enables the lower paid to survive in the inflated bubble causes by excessive wages at the higher end (by higher end I mean wages in excess of 35k which would be considered high in any other country).

In additon to the higher general cost of goods and services, the lower paid also do not have to live pay for more services compared to their EU peers.

To conclude this point, I think the those overpaid and undertaxed at the higher end (>35k) must lead the internal devaluation. I know those with internationally tradable services cannot be over taxes, and this is why the focus needs to be on cutting pay in sheltered indigenous sectors such as PS, semi-states, and various professions.

Anyway, keep up the good work.

P.S Do you know where I might find a normal distribution of salary levels in Ireland. We here a lot of talk by unions/labour etc of teacher, guards, nurses on ‘relatively modest incomes’.

From what stats I have picked up I understand that circa 80% of workers earn less than 50k per annum and 50% earn under 25k (i.e median). The point being that Unions are largely representing workers in the top 20% and almost all in the top half, yet proclaim values incompatible with the interests of their own members. If there really cared about the low paid and unemployed they would ruthlessely cuts costs which would enable deflation and increase in the real value of that €188 unemployment benefit.

Ronan Lyons ,

Hi all,

Apologies for the slight delay in approving some comments.

@Billy

I think the difference is in pension provisions. I took my figures from Dept of Finance, where 6% of income was assumed to be set aside for pensions. I don’t see that in your calculations. If that’s not the root, then, you might send on your analysis to the Department, as they would presumably be interested in knowing if they have made a mistake.

@Dirk

One man’s “all-in” rate is indeed another’s “effective” rate. I’ve used “all-in” as it is – not always it turns out! – easier for lay people to understand than effective rates.

@Graham

My bewilderment is that this move – without instituting the annual property tax that Ireland so desperately needs – only creates problems down the line when it is introduced. If current anger about rescinding overly generous tax credits during the boom years teaches us anything, it’s that reference points are hugely important, e.g. it’s easier to go from €5,000 tax-free income to €12,500 tax-free income via €10,000 (which we didn’t do) than via €18,000 (which we did do). Going from one form of property tax (on transactions) to another (on site values) would have been far easier as a straight swap than via essentially no property taxes, which is what we’re back to.

@Sam

Thanks for the comment. There are comparisons of the cost of living in general which have Ireland about 15% above the EU average, so I could certainly back an argument that says tax credits here should be 15% greater than France/Germany… but that would actually have us back down at €8,000, not €18,000… or €16,000 as it currently stands. This argument could be modified to reflect as you note the cost of healthcare or education and how it varies for less wealthy households across the EU, but I see the argument for reducing tax credits as essentially a strong one.

On income distribution, the Revenue Commissioners produced a report in 2008 using 2006 tax receipts. It found largely as you describe: the median income was about €25k. If you check out my post on income tax (http://www.ronanlyons.com/2009/07/28/a-little-quiz-on-irelands-income-tax/), the link to the Revenue Commissioner source is there.

Thanks one and all for the comments,

Ronan.

Seamus Finn ,

Ronan,

As usual, a sane voice and balanced perspective. With respect to the “All in tax rate” graph; for the bands that you are using do you have a head count for each wage band i.e. what is the workforce distribution across each band?

Regards,

Seamus