— A 2012 version of this blog post, one including VAT and other unavoidable taxes, is available here —

Income taxes are, with VAT receipts, the biggest generators of tax receipts in Ireland. It is likely that in 2009, income taxes will contribute between 35% and 40% of total tax receipts, a figure of perhaps €12.5bn. Given the importance of income tax, then, it’s vitally important that the taxpayer understand what the system is and what it isn’t. In that spirit, I examined Revenue Commissioner figures on who pays what in income tax in Ireland. It was an eye-opening experience!

In that spirit, here is a quick quiz, three questions, about Ireland’s income tax system. I would have only got one of these right beforehand…

And, just to see where we think we should be, one more quick question:

And now, to reveal the answers, with some interesting facts about Ireland’s income tax system along the way:

- Ireland’s top 0.5% of earners, the 11,714 people who earned more than €275,000 in a year, paid almost 18% of all income tax, over €2bn in total. Their average tax rate was 27.5%.

- Almost 770,000 people earned less than €17,000. Understandably, given tax credits, these workers paid a tiny amount of tax, €20m in total. Their average tax rate was about 0.5%.

- It’s in the middle, though, where things seem to go all screwy. The median earner, earning about €25,000, paid just 4% in income tax! As I argued before, we seem to have got ourselves into a situation where the typical Irish worker pays hardly any income tax and yet seems to think they are heavily taxed.

So, to go back to the quiz above, the answers are:

- Option 4 – the average millionaire pays six times the income tax rate of the average worker. There’s one thing the system ain’t and that’s regressive!

- Option 5 – amazingly, two thirds of the 2.2m people paying income tax in Ireland paid an average rate of less than 10%.

- Option 1 – as per above, the median earner pays about 4% in income tax in Ireland, compared to 20% in the OECD.

I look forward to seeing what the answers to the final question are. My own belief is that we should be aiming for about 15%. This would make us fiscally sustainable, while keeping us an attractive place for labour in the OECD. Somewhat bizarrely, though, I feel the prospect of people paying as little as 15% of their income in tax could also spark riots in the streets!

The income levy has at least brought everyone up a notch or two, something which seems necessary, when looking at the average tax rates paid compared to other countries. This should be formalized in the December budget, by lowering the tax-free allowances and increasing the standard and marginal rates by 1%.

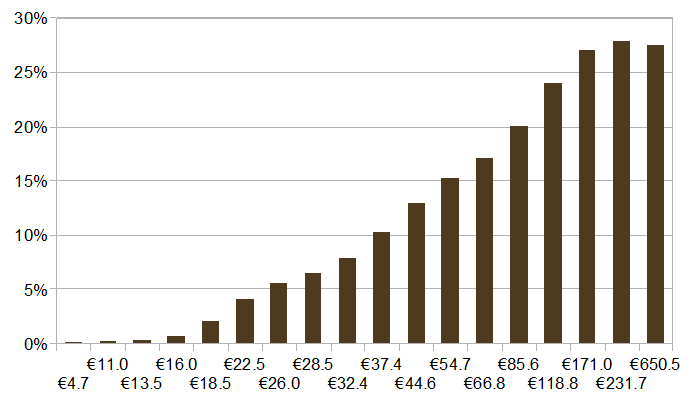

To close, here are the average tax rates paid by different income groups, according to the Revenue Commissioners 2008 report.

fergaloh ,

Quick example of relative costs –

Luxembourg, a monthly bus pass for the city costs EUR 22.5, a national bus pass costs EUR 45

Dublin Bus monthly bus ramble pass costs EUR 110

Ronan Lyons ,

@Fergaloh

While the comparison does not account for the extent of public services and the cost of living, I would make the following two points:

(a) comparisons of the cost of living do suggest that Ireland is about 10-15% more expensive, but this is more than compensated by the tax differential

(b) the extent of public services in Ireland generally compares more favourably than most people in Ireland think [Ireland’s health service for example is in line with the EU median] – if people want even better public services, they will have to pay more in tax

While I appreciate you taking the time to comment, I avoid personalising comments myself and like those commenting here to try and do the same – you have no idea how much or little I earn [I earn nothing from this blog, for example, but it does cost me time and money].

Thanks,

Ronan.

Phiz Hicks ,

So these revenue figures capture the total income of everyone in Ireland, from the beggars on O’Connell Street to Denis O’Brien? I reckon they’re just a “garbage in, garbage out” statistic. You lot might be good at economics but that’s like being good at astrology.

michael ,

Your figures are hard to understand. I am self employed and earning about 85k, I have calculated that I have paid 63% tax and thats just at a cursory glance at wages and spending, I am certain it would be higher if I really got into it.

I included

income tax,PRSI,Levy’s,second home, VAT, Car Duty,Tax on fuel only !!

Ronan Lyons ,

Hi Michael,

I fear you are being a bit disingenuous. The post is explicitly about income tax (direct income tax), not services such as insurance (PRSI) or compensating your fellow citizens for the costs you impose on them (car and fuel duties). As you are self-employed, you may also enjoy a wide range of benefits that other workers don’t, such as your company owning various assets of which you have exclusive use (saving you VAT) or paying for your expenses (thus the cost comes out of your gross salary, not your net salary).

Thanks for your comment, though.

R

michael ,

You are correct I was being a bit diningenuous, you see I am fed up of hearing economists and politicians on about the comparitively low tax we pay when in fact the opposite is true. Whats the pont in talking about income tax and not looking at spending tax, if you do its only maths and means nothing.However You will find one of these politicians using your figures to suit their own ends next when they lie!

DMC ,

Hi Ronan,

Interesting analysis. I refer to your post to anonymoussquirrel, your figures seem wrong unless I’m missing something fundamental.

36,400 – 3660 = 32740 @ 20% = 6548 and not the 3620 you mentioned so your circa10% is actually more like circa17% before factoring in your last quarter 11,600 @ 41% and also you haven’t factored in PRSI and or USC. Hmmmmmmmmm.

Mike C ,

Much food for thought in your analysis Ronan. While I understand your point about PRSI,it is involuntary and based on income and feels very much like a tax unless one claims benefits (dental, maternity, etc.)

@DMC – Ronan’s sums look fine to me: you need to distinguish between allowances and tax credits: the latter are credits against tax on income and are deducted from the notional tax liability as shown in Ronan’s calculations i.e the sum is (36,400*20%)-3660 = 3620.

Who pays tax in Ireland? The little quiz revisited | Ronan Lyons ,

[…] three years ago, I posted a little quiz on Ireland’s income tax. There were four questions – on what percentage of income was taken in tax for the typical […]

Leeser ,

Hi Ronan,

While factually correct about income tax, would it be possible to calculate the actual average net pay that people take home (ignoring voluntary pension contributions etc). So Gross pay – Income tax – PRSI-USC. Then a comparison of net income/gross income would show different statistics…

As you said the other main income for the government is VAT, which comes from the Net Pay, i.e. tax on already taxed income…

What matters to most people is the net pay they come out with.

Ronan Lyons ,

Hi Leeser,

Hopefully you’ll find all the answers here:

http://www.ronanlyons.com/2012/04/10/who-pays-tax-in-ireland-the-little-quiz-revisited/

Paedophile continues to molest cousins because of HSE "cutbacks" - Page 5 ,

[…] […]

Michael Fitzgerald ,

What I am trying to find out is: How many people earn less than the average wage and what percentage of the working population is that?