The latest Exchequer figures are out today, and the headlines talk about tax receipts and government spending down. Scratching the surface, though, most of the falls seem in line with expectations. So where are we? Three months on from the toughest Budget in a generation, it’s time to take stock.

The best place to start is the big picture on Ireland’s government finances. In 2007, gross expenditure by the state was €63bn, while gross receipts were €61bn. This year, expenditure will be €69bn while receipts will be €50bn. The fall in revenue has been driven by tax receipts, which have actually fallen by €16bn and have been offset by other forms of revenue, including levies. The increase in expenditure is accounted for by increased social welfare payments (up €5bn) and debt servicing (up €3bn).

The 2010 deficit, therefore, is estimated to be €19bn. Expressed in relative terms, the deficit is 11% of our national output. Only the UK and Greece have bigger deficits. Ireland’s 2009 deficit – excluding the (one-off?) €4bn ploughed into Anglo – was €21.5bn. So we can see that Budget 2010 was certainly a step in the right direction but we’re not there yet. Not by a long shot.

First, a bit of good news. Figures out last week show that 2009 spending came in €360m less than what the Department of Finance expected at the time of the Budget. Even more encouraging, this was spread across all major areas of expenditure, except social welfare, which is to be expected, given unemployment. All things considered, the overall result was a €300m improvement in the deficit for 2009 – that’s 2% of the way there for free!

Last week, Minister Lenihan announced that he wants to bring about cuts of €3bn in 2011, to further reduce the deficit. The Minister has highlighted two areas of savings: €1bn from capital spending, and €2bn from an as-yet-unspecified mix of spending cuts and tax increases.

Unfortunately, cutting €3bn does not bring about a reduction of €3bn in the deficit. For one thing, “odd” forms of revenue – in particular levies from the banks – are estimated to be particularly high this year. Expecting €3bn from such sources in 2011 – rather than the €4.5bn of this year – undoes some of the good work. Also unhelpful is the logical consequence of large deficits – servicing the national debt. Money spent paying back our growing national debt is likely to rise from €4.6bn to €5.8bn in 2011. The painful truth is that, when looked at in conjunction with other developments in State finances, the Minister’s proposed measures worth €3bn would leave the deficit almost unchanged next year.

What is the plan for the next five years? In December, following Budget 2010, I outlined a scenario for the next five Budgets that would reduce the deficit from €19bn (or 11% of output) back to what the EU has demanded, about €7bn (or about 4% of output). It involved a lot of productivity improvements in the public sector, as well as relying on average growth of 2% from 2011-2015. How does it stack up now?

Put bluntly, after grasping the nettle of public sector pay in Budget 2010, there are now eight further things the Minister for Finance, whoever it may be, needs to do between Budget 2011 and Budget 2015. Three are in relation to taxes, while five are expenditure-related. These are:

- Bring Ireland’s income tax system back into line with our OECD peers, by taxing the average earner 20% of their income, not 2%

- Replace the growing menagerie of levies and social contributions with a single, easy-to-understand and easy-to-apply social solidarity levy (see below)

- Replace stamp duty with a sustainable property tax that promotes investment by homeowners in their property and prevents land hoarding or speculation

- Achieve €2bn in efficiencies on the money spent on Social Welfare and FÁS (currently €22bn)

- Maintain an appropriate level of investment in future-proof infrastructure

- Bring about significant and ongoing annual productivity improvements of 5% in expenditure on health (€3.5bn savings in total)

- Bring about significant and ongoing annual productivity improvements of 5% in expenditure on education (€1.9bn savings in total)

- Bring about significant and ongoing annual productivity improvements of 5% in expenditure on other public services (€2.5bn savings in total)

On the spending side, this involves cutting current expenditure from €55bn to €45bn. In other words, each and every year until 2015, annual savings of €2bn must be found, well above what the Minister has in mind even for Budget 2011. Assuming further pay-cuts are not an option, from an industrial relations point of view, this means that significant productivity improvements will be required.

On the taxation side, there have been few signs that anything will be done about income tax changes or the new property tax. The ‘social solidarity’ levy, however, is likely to be introduced in Budget 2011 and will more than likely be the source of the €1bn in new tax revenue the Government will seek in 2011. What will its introduction mean for average workers?

Currently, there are a variety of health, income and PRSI levies, and cumulatively they mean a total tax rate starting at 4% for someone on €10k rising to about 12% for those on incomes over €75k. (This is entirely separate to income taxes.) To raise an extra €1bn in revenue, the social solidarity tax would have to be structured something similar to the following lines:

- 0% on those earning less than €10k,

- 8% for those on incomes of €10k-€25k,

- 10% for those on €25k-€75k, and

- 13% for those earning more than €75k

The important thing to note is that for most full-time workers, the rate would stay at 10% – exactly what it is now when adding up health and incomes levies and PRSI. In other words, the damage done in the last two years is here to stay but should not get much worse. The reason the State would get €1bn more is that various anomalies at the two ends of the income distribution would be removed.

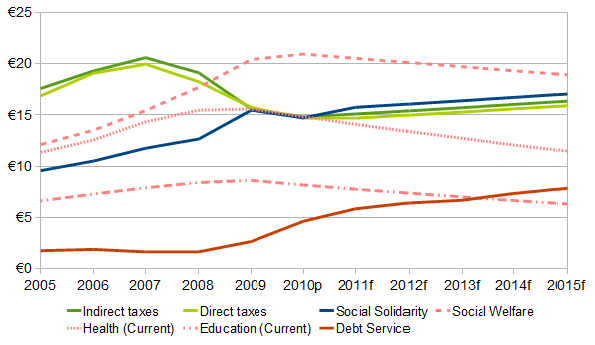

One important thing to note is the size of this new income source for the government. A consolidated and expanded social solidarity would bring in close to €16bn next year, compared to about €15bn for direct taxes (income tax and corporation tax) and indirect tax (VAT). The graph below shows the business end of Exchequer finances, revenues from direct, indirect and “social solidarity” sources, as well as four key spending areas: social welfare, health, education and debt service. Notice that we will be spending more on debt servicing than we will on education by 2015 – and that’s grasping the nettle. Without large-scale action on the deficit, debt servicing could overtake spending on health by then.

If, in Budget 2011 this December, the Minister were to raise €1bn each from a social solidarity levy and cuts in capital spending, and €2bn from productivity improvements in the public sector, rather than the €1bn currently pencilled in, the good news is that it would almost certainly be the toughest budget in the current crisis. (I will easily forgive readers who could have sworn they’d heard that one before.)

The bad news is that it would more than likely only just win that title. The deficit would have to be reduced by an average of €2.5bn every year each year between 2012 and 2015, in order to get our books back to the kind of imbalance acceptable at EU level.

Joseph ,

It’s going to be interesting to see how they are going to go back to a bunch of people they’ve levied and cut (the pay of) to get productivity improvements.

You might have thought they would do it the other way around…. get the productivity improvements first then….. that’s how it’s done in the private sector anyway.

Ciaran Daly ,

I think the key to new taxes is gradual phasing in wherever possible.

I think you might be detecting what I’m detecting, namely slippage in the amount of cuts needed for future cuts. e.g. the total silence and failure to implement the McCarthy efficiencies in time for budget 2011.

What do the government spend their time doing?

Also, I think the best way to deliver the efficiencies in health and education would be to threaten further pay cuts, and negotiate compromise for reform.

Good post.

Any thoughts on a flat tax?

Brendan O'Reilly ,

Well done on getting the ball rolling on the 2011 budget! Your analysis makes very interesting reading. However, in the light of recent decisions regarding the funding requirements for Anglo, Irish Nationwide & the EBS, the €2.5bn available to reduce the deficit is likely to see its substance significantly reduced, perhaps by €2.0bn a year for the next 10 years.

There hasn’t been much recent mention of a residential property tax in goverment circles, & I doubt the necessary structures will be in place by 2011 to implement anything other than a very crude one. The major reservation I have about an RPT is that, if it is implemented on an “ability to pay basis” ie., income above a certain level, we might be better raising the projected revenue through an increase in income tax &/or social solidarity tax, which have efficient collection systems, rather than spending scarce resources on developing another collection system.

Ronan Lyons ,

Hi Brendan,

Good points – I think the more property tax mirrors income tax, the less useful it becomes. There needs to be clarity (rather than a rush into the tax) about what it is supposed to achieve. Two guiding principles could be, for example:

(1) Preserve the incentive for people to invest in their property, especially in making it more energy efficient – land tax would be most appropriate

(2) Ensure homes are allocated in an appropriate fashion, e.g. families in large homes, elderly couples in smaller homes suited to them – likely to prove much more controversial (“By gum, I’ve bought this house and will stay in it till I die and then my children will be forced to sell it and split the moneys”), but quite common in the USA; value tax more likely.

Thanks for the comment,

Ronan.

jj ,

I bought one house only because there was not property tax. If the goverment put one, I will feel traited. I will want back my money back( the value of my house). I do not want my house now.

David Gomm ,

I feel as I am on disability allowance there is a need to pay a small amount depending on ability to pay.

As everyone’s circumstance is different I would welcome the opportunity because once you stop all benefits accrued are wiped out and you have to start again.

Melanie GAlvin ,

Hi, after reading comments on the upcoming budget 2011 its embarrassing to be irish. yet again major plan of attack is on for the ordinary working person. im down 350 a month as a single worker with fixed mortgage, not paying bills and soon no home im sure, now you tell me im facing more cuts. so that means no food. may as well be dead. wow didnt i see a pic of sean fitz on the golf course. Probably meeting up with cowen and lenihan for lunch. Since i was Brought up an honest person now the only people in this country with ethics are drug dealers. Politicians are ignorant, private sector workers are thick greedy b’s with low IQs and any public sector workers who sold out and voted yes to croke park crap bs deal is a dirty traitor. what ireland needed was all out strike in public sector with no emergency cover. Try bleed in casualty with no nurses or doctors, try and organise teachers for all your kids for every topic and every level plus find your own classrooms and oh insuring the building. no child would ever be eductated without us in the public sector and teachers salaries then would be outrageous. oh and try and be psychic and know the dates of all opd,surgery appointments since you hate clerical so much in the public sector, doing all this yourselves without a public sector would show just what a pack of whimps this country has. Ye would fall apart if private sector actually paid tax for once the country would be fine. Irish people have brilliant public sector we stood have closed the country down to teach ye averous b’s a lesson. Yes i am a public sector worker on 27000 grand a year, no i have never have bonuses, overtime or thankyous from any of you ignorant b’s,isnt it ironic social welfare is paying the same to families as what i earn. so i joined the club now im pregnant, soon to be single mom, 6 months maternity leave on the way, two months sick leave as im an older mom, and while my mother minds the kids (twins) for 50 quid i will be out working for cash in hand payment doing fake tan and nails, claiming my child benefit of 300 a month and getting knocked up all over again god willling. Life is much easier when you are dishonest. I have finally decended to the low levels or irish morality . Im making sure my kids never fall in the honesty trap if they are stuck living in scumbag ireland they can learn a trade and work for cash in hand payments so they can have a life no matter what comes crashing down.

Ronan Lyons ,

Hi Melanie,

Thanks for your comment. What is interesting is that you refer to the lack of recognition of the work you do in the public sector – no bonuses, thank you, etc. Hopefully, when we are designing our economy, society and public services for the next generation, we recognise what motivates people – and it’s not just money.

I can’t agree with you on the tax evasion comments, though. It’s worth pointing out that millionaires by about 30% income tax on average, not 0%. Some do get away with zero but rather than join them at their game, we should tighten the system so that they can’t do that.

R

David ,

its embarrassing to be irish with a goverment taking every cent forom its people, its hard enough trying to stay a float. even with people earning €45k per year does not mean that they have spair cash everybody has bills some more that others you might earn more than others but your bills are greater, how much of a pay cut will the goverment give themselves in the year 2011

Melanie GAlvin ,

Hi Ronan, thanks for your comments, i should learn not to post comments when i get bills. I feel like the child be bullied in the school yard and that everyone is out to get us public sector workers. I have no problem with high earners, i know they pay tax, its just those people who knock on door cleaning window to plumbers etc doing tom jobs etc, even 20 euro goes straight into their back pocket while i have actually had 4 paycuts, the 2 one percent levies plus 7.5 per cent pension levy and the 7.5 percent pay cut plus of course the usual tax and the 6.5 per i already paid to the pension. i dont get a state pension nor a stamp but still pay prsi. People believe what they want to believe. I lose my 2 weekly pay monthly to the penny. Tax evaders however small have to be stopped and nobody in this country should get unemployment benefit without attending some course or work scheme monday to friday 9 to 5. its only fair. thanks a lot. Calmer today. Until of course the next bill arrives.

Dave D ,

The worst thing about this whole debacle is the protracted nature of it.Why are we still talking about what to do 3 years in ?We are in for a long tough time of it and the battle now is about who pays for the mess,the rich or the poor.The first thing is this government governed over the biggest crisis in the states history,by any measure they are guilty of gross incompetence and possibly treason.Oh look theres Bertie in a cupboard selling Sunday newspapers as we face the results of the policies that he presided over.This country engaged in a sickening spiral of greed and non accountability that still exists today.Watching Capitalism essentially fail has taught me that it doesn`t work,the free market that is.Why?Because you just cant trust the markets to behave with a social conscience,its not what they do,thay make profits.Governments govern for the good of the people and thay have committed a crime against the people of this country.They are guilty.Do not be fooled,this is an international crisis, but don`t led that hide the sickening, crude, perverse, greed that probably all of us to some degree got caught up in.Time to get back to basics,re humanity and morality.

john byrne ,

if the goverment want to cut the jobseekers allowance and disabilaty and peoples income they need to drop prices of other things eg groserys and petrol, etc its hard to survive on 196 as it is and when it drops in the budget will make it harder. why dont the government take a pay cut since they are the best paid. coulod any of the goverment officals sevive on 196? i dont think so

GIL ,

If you do so, the crises in your country will be so big that you will never get out of it…Your tax system is one of the most fair in the world…It’s what keeps your economy healthy…the problem was your banking system that ruined everything…so first of all you must take care of the banking system, and then you can try to raise a little bit the taxes, but carefully, otherwise industry will move from Ireland to other countries as it is happening all over Europe…be careful..

Mary ,

Hello there, I am reading your comments and I am fascinated by all of it. I am a non Irish National as we are called here. I have been here for 4 years now and I have gotten 1% pay rise since I have started working. I work in the NGO sector. My pay has been slashed 3 time and this year, I took another 7% pay cut to ensure that the organisation would survive for a wee while longer. I have no private insurance, no bonuses, no extra holiday pay and as I am highly qualified I am being paid so little money I wonder why I am doing this. Well I love my job and in my line of work, you do not do this work for the money. However, I have bills to pay being single and it cost me a lot as I do not have a partner to share the cost of rental and so forth. I also take care of my parents so half of my money goes to them to ensure that their rent and medication and so forth is paid. So I don’t think I can take another cut this time and I am not interested in paying more for a bancrupty that has nothing to do with me. I work full time and at times over 50 hours for the same pay and I assume all my expenses. I do not own a house or go out or go on holidays or buy expensive clothes. I can t do that.

I am thankfull for the opportunity I have had to work in Ireland but I can’t afford doing my PHD here as it is so expensive.

I can see that people in some ways are responsible for the mere fact that this government was elected by the people for the people. There has been opportunities to sack them but Irish people are too busy complaining instead of being pro active. So what is it going to be? Either you take a stand and do something about it or feel victimized and stay in that space. Of course, it time of crisis, the poorest always pay for the mistake of a government. But people put them in power. NOW is time for action not victimization. After all, during the celtic tiger, everybody was happy wasting massive of money in party and overpriced housing and so forth. I saw that rampant poverty and bad infrastructure even in time of bounty. Not much has changed I reckon and it seems that Irish people do not learn from the past and past mistake and recession.

Kindly, Mary

Ronan Lyons ,

Hi Mary and GIL, thanks for both those comments – nice to have non-Irish perspectives, one from here and one from abroad.

All the best,

Ronan.

Richie ,

If we do not re-structure then we have no hope of addressing the state of our finances….We waste far too much on stupid things.

eileen ,

i am a loan parent i have too kids one school going the other 4mts old i live off 225 a week after i have bills paid i have nothing left till pay day again im findin it hard as it is but to take money from me as well as others i have to drop a bill witch means i go into deth so the contry can come out of a death we didnt put it in we trusted the goverment and they let us down theyve played with our money like a bunch of 2 year olds would ashamed to be irish one of yer comments said i think at this point every irish person is

johnobrien ,

Hello i just am making a coment on the budget for people on low income. I t5hink the goverment should get a 20 persent cut in their salery. they should tax the ritch. andleave the old age penshions and socal welfair alone. i am a person living alone i am finding it hard to get on with life. Ithink the banks should pay back what they borrowed of the goverment. no wonder the country is broke

lisa o byrne ,

my names lisa im 26 livin with my 10 yr old daughter i think its a discrace dat loan parent and monthly allowance is deducted im strugglin 2 feed an cloth my daughter as it is from last yrs cuts and the only solution to irelands problem is foreigners be sent back home to there onw country an nigerians,its so unfair that we have to suffer because you’s let them into our country that its gone so bad none of us irish can even get a job in our own country

Anna ,

How much money could we save if our politicians stop staying in 5 star hotels and flying around in private jets? Thats where we need to cut back. Not by taking money from the people who have the least. Notice how the government themselves are never directly affected. They live in their own world. We the ordinary people are just a costly Nuisance.

eileen ,

i so agree with you lisa they opened our country to foreigners and instead of our money stayin in our country it wit back home to theres funny thing is in my home town a new chip chop has opened run by them 2 new shop same run by them im not trying to be horrible to any one but i cant afford to make it tru the week with 2 kids but there in the post office pickin up there [our]money and runnin shops all over town gas isnt it if this is our goverment now i worry so much abot the way it will be 4 my kids…..its good to see other loan parents havin there say only thing is lisa wat we scream and shout abot wont be changed id love to give one of them 225 put them in my house pay rent coal bill petrol school lunch shoppin and let them see the way they make us leave there mistakes but we hav to pay 4 it

Minie ,

Could anyone tell me why people keep voting in the Finafail Government,did they think we would never see a poor day, by keeping them in power,are they the government that gave us all the perks, in return for we keeping them in power, why are the people not punishing them, for what they have done to us, our Country, and generations of people who are still not born, who will be paying for the mess they have made,for generations and generations, it looks like in the last 10 years they took there eye off the ball, they were all a sleep, no one governing and no one answering where all the money went, The government appointed the regulater who was a man named, Patrick Neary, they are suppost to keep an eye on him, to see if he is doing his job,and he in return, is suppost to keep an eye on the banks,and we the people who vote the government in, are suppost to keep an eye to see if our politicans are runing our country and minding our money. So were we also a sleep or are we too close to our politicans, that we were all controled, or under a spell,that we did not see what they were up to,and that we are still covering up for all the lies that they filled our heads with, and using excuses like sure they are all the same ah sure when i cant vote finafail i wont vote atall,The bottom line is as long as we the people will stay in deniel, that it was not the fina fail government that we put into power, were not the cause of the downfall of our country,and sold out our soverignty,if thats so, we will never learn and corruption will forever grow,because for me, from the outside looking in, it looks like the banks,the big developers the government,and greed by the big boys, and loyalty to keep a governmentin in power for self interest, and not the national interest, and who were all in each other pockets, and now they are brainwashing us all, by saying thats in the past, forgive and forget. it all happened by accident, and no shame in any of them.We owe it to the generations and generations of people who are to come after us, to get these peope punished and behind bars, for what they done to us and our country.

Patricia McNamara ,

I am embarrassed as an Irish person to read some of these comments. The foreigners are not the problem. I cannot believe that a person on social welfare could say that the government ‘played with our money like a bunch of 2 year olds’ if you are on social welfare you are not contributing to society or paying taxes it is therefore not your money they played with. I am absolutely shocked at the ignorance of some of the comments posted & even more embarrassed that so many of you cannot spell perhaps if you thought to learn some basic spelling you too could have a job. This is a rant I know & there are many willing to work, I also understand the mess that the government, banks etc have got us into. I just wish people would consider that they have a roof over their head, food on the table & obviously a computer & internet access to have posted here, there are so many people living in real poverty the world around, stop moaning, learn to spell & more importantly please oh please educate yourselves.

donna ,

to mr patrick mcnamara you might think you sound so smart and educated correcting people on their spelling mistakes when all they are doing is voicing their opinion and while they are doing that they are feeling dispared and angry so yes some of their words are spelled wrong god i wish i was as holier than thou as you are it must be lonely up on your pedestal (did i get that right) there are plenty of highly educated people out of work at the minute so for you to say learn to spell then you’ll get a job is ignorant, some people don’t go on social welfare for the fun of it they are forced by a government that refused to do something when they were told there was problems so don’t pigeonhole everyone just because you have a dim view

oh yeah by the way while you correcting spelling most people write the word and not just put a symbol

donna ,

oh and again for mr mcnamara you said people on social don’t contribute to society well i’ll have you know i volunteer to teach at my daughters school 3 days a week and i don’t get paid for it but i like to do something for my community

Patricia McNamara ,

Tanx fir de comnt Donna (little joke!) I went on a rant, it was perhaps not obvious but i understand really well that there are many on social welfare who do not want to be. I feel like many Irish people that my own job is not secure and very well could find myself in social welfare sooner or later. The comment about the foreigners is what got by back up, it was not foreign nationals who caused our issues & to say they should go home is a common ignorant statement. I also did say that This is a rant I know & there are many willing to work, I also understand the mess that the government, banks etc have got us into. I am sorry that it hit a nerve it certainly was not an attack on those that are willing to work. I too am entitled to my opinion.

paul kelly ,

@ patrick hopefully your job will go,because then you will know what its like to try and survive on the pittance we get.if you look at the statistics you will see that more than half the people on the dole have worked when times were good,and a lot of them are well educated.and if your opinion is a bigoted one maybe you should keep it to yourself.

"foreigner" ,

Regarding the comment of the foreigners:

What about the millions of Irish people who left the country when they felt that they have a chance for better life abroad? Should they be sent back to Ireland as well???? Every coin has two sides… PEACE!!!

Dude, where’s my six billion? Perspective on Budget 2011 | Ronan Lyons ,

[…] I feel I might be the only one, but I am actually more optimistic now than two days ago about the prospects of Ireland getting its deficit back under control by 2015. That is not an excuse for complacency, however. In reality, there are four main headings to […]

Peter Gillen 18 ,

This is not directed to anyone.

i understand what everyone is saying and think that the main problem is no regulators. no regulation on the government, banks, old folks homes, anywhere. I think that many people can scream about how little money they have but somethng needs to be done. the government havent got a clue . Why are high income earners not getting screwed? its highly unfair to break people who have so little . . but the IMF are pulling the strings now and they make decisions on statistics. it will get worse. i might not be able to go to college next year! it doesnt matter whos fault it was. we are in the EU and our decision making is in the EU. i am not ashamed to be irish. why should i be when it was a handful of people that didnt do their job and regulate??

Annette ,

could you please outline for me the main savings or cuts that occured in this years budget. I am helping my daughter reserch budget 2011 and i feel that im swamped with so much information. THANK YOU.

Annette ,

could you please outlihne for me the main cut/saving made in this years budget 2011. Im swamped with so much information. Thank you

sandy ,

Can I just say that (no exergeration) every single lone parent what ever is politicaly correct, I know is not living life in squaller and starving and there children are better dressed than mine because I cant afford the same chlothes etc than the lone parents, I live in a private rented house im married with 2 children my husband and I work and we still have no money left by the end of the month because of bills etc,our rent alone is over 1000 euro and we dont get any help from the goverment so its out of our own pocket, we dont get back to school allowance so we have to try and save a little every month for the start of school year, if any of my family get sick im up the creek without a paddle because we cant afford private medical insurance how i would love to have a medical card but because we we work we cant get one,so please all you lone parents stop moaning you get a lot as it is, when i ask why dont you go to work the answer is always the same because I would be down in money if I had to pay rent etc compared to being on the DOLE,,,,, well welcome to my world without handouts working people are normally down in money just we dont moan about it, we are to busy earning a crust.