The latest Daft Report is out today, showing a further 3.7% fall in asking prices between June and September. In his commentary, Patrick Koucheravy comes up with the best estimate I’ve seen yet on the typical fall in land values around the country: 75% as a credible minimum average fall for land values.

What else does the report reveal? Two things in particular are worth highlighting: the rate of property price falls, and the rate at which properties are selling. After that, I’ll do some tea-leaf reading on when prices may level off, followed by an update of the number of households in negative equity around the country.

Are price falls easing?

The year-on-year rate of change in the index is, at -16%, the slowest rate of price falls since late 2008. This may sound like clutching at straws, but one thing we do know is that when prices do level off, that will have been preceded by a period of ever-shrinking property price falls. Going from about 20% year-on-year to about 15% year-on-year may be the first step in that process.

Perhaps more importantly, there looks to a change in dynamic in what’s driving the fall in the national average property price. For most of the recession, house prices in Dublin have fallen by more than elsewhere, in percentage terms each quarter. But for two of the last three quarters, that trend has reversed, with falls in Dublin below those in the “Rest-of-country” region (i.e. outside the five main cities). We may not be anywhere near there yet, but at least it looks like we’ve stopped diving further into the sea and may slowly be making our way back up to fresh air.

Are properties selling?

The total stock of properties on the market is doggedly stuck at 60,000, and now has been for over two years. This might suggest no – or at least very few – properties are selling. In fact, it seems that some properties are selling, and without difficulty. Again, Dublin is different from the rest of the country. In general, about 40% of properties posted for sale in April had sold by October 1. But in Dublin, the proportion is much higher, with only one in three of the properties posted for sale in the capital still for sale now.

Where might property prices level off?

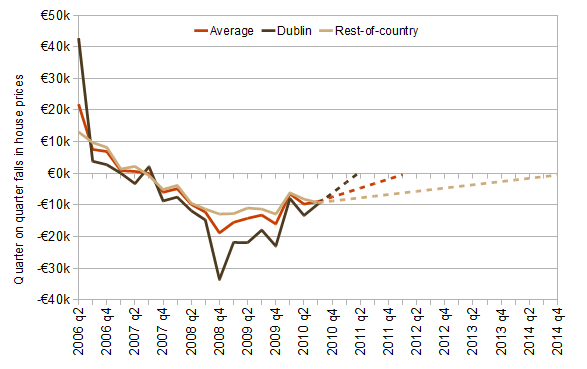

There are plenty of ways one might try to calculate where prices level off – for example looking at the amount of oversupply, or my favourite yields. However, sometimes – as people who work in financial markets may tell you – statistics rather than economics can reveal what may happen. Consider the euro change in average property prices each quarter since early 2006. This is shown in the graph below, for the country on average (red), for Dublin (dark brown) and for outside the major cities (light brown).

What it reveals is that the quarter-on-quarter change in house prices worsened (i.e. got more negative) all the way until late 2008. Since then, particularly in Dublin, the falls each quarter have got smaller. The dashed lines take the average “improvement” in falls since late 2008 in each of the three lines and work them forward. For example, the falls in Dublin are getting smaller by on average €3,400 each quarter. If the easing off in house price falls seen in Dublin continues, house prices in the capital could stabilise as early as mid-2011. Outside the main cities, though, the equivalent “improvement” is just €400 a quarter. If this were to continue, prices might not level off until late 2014, something that may tally with yield or oversupply arguments.

No matter which way one looks at the housing market, though, it seems that a divide is emerging between Dublin at one end and the rural parts of the country at the other.

How many are in negative equity?

In the summer of 2009, I did some work, looking at county-level house prices and Live Register figures, as well as figures from the Irish Banking Federation on loan-to-value, to try and estimate the incidence of negative equity and unemployment around the country. With a year of new information, both from the property market and from the labour market, it’s time to revisit the numbers.

The figures are, as may be expected, frightening. About 200,000 mortgages are in negative equity, based off the best public information we have about who borrowed what and when. Small amounts of negative equity are, in the main, not an issue, if people keep their jobs and thus can keep up their payments. However, what is very worrying is that negative equity seems to hit some groups particular hard. It does not taper off up at the top. In fact, 100,000 mortgage-holders are in negative equity of greater than €50,000 – what anyone would term severe negative equity.

In many respects, this is a Greater Dublin area problem. Of the 100,000 in severe negative equity, two in five are in Dublin while a further 17,000 are in its four commuter counties. These are also the most likely to have bought smaller “ladder” properties at the height of the boom. In contrast, very few people in Limerick, Longford or Mayo are in severe negative equity, as house prices were lower there to begin with.

In a scenario where prices fall 55% from the peak, as some think possible, current figures suggest that 330,000 households – or more than half of mortgage-holders – would be in negative equity. What is particular worrying is that the new additions would not be as significant as the doubling of the numbers in severe negative equity of more than €50,000. Without knowing more about the relationship between mortgages and unemployment, it also suggests that if the Live Register reaches 500,000 next year, something in the region of 70,000 households – 4% of all homes – could be in both negative equity and unemployment/underemployment.

Daft : Latest figures suggest a 75% fall in land values ,

[…] with all the various house price reports, is the latest estimates of the number in negative equity: House price falls of 40% suggest 100,000 in severe negative equity Seems to be, unsurprisingly, bunched in Dublin and surrounding […]

Des ,

The thing I find amazing when I look at the “bottom of the market” predictions is that you have failed to account for the 20 billion (give or take) that we must take out of the economy.

Now it is open for debate how this will be done but it would naive to think that this will not be done by taxing of people and a reduction of public sector salaries over the next three years.

Two other factors of note to consider: Looking at the employment figures it’s clear that the 18 – 28 is the worst hit by employment and of the number of houses bought over the last few years its clear a large amount of excess rental properties which will fall into that negative category.

So the question is this, while properties in parts of Dublin will always have a market at the right price , how many people are left from the bubble in need of housing (with the required finances)? And at what price would property need to reach for it encourage investors and how many investors will want to get back in?

Ronan Lyons ,

Hi Des,

As I mentioned and linked in the post, there are economic discussions of where house prices may go… but the problem with them is that there are huge bounds of uncertainty. Hence, economists are terrible at making predictions (which to be fair to us is not in our job description). When economics fails, people turn to the pure numbers, so today’s post was an exercise in looking just at the numbers not at the economics (which I’ve done if not to death then in detail on the blog over the past 18 months).

It would be wrong, though, to think that house prices are going to be “cheap” – as distinct from affordable – no matter how bad things get. You reach a point where there are simply too many people working in the country, yes even with the unemployment that we have, who all need to live in homes. Where that lower bound is, though, is open to discussion. The most common metric is the yield, or annual rent relative to the house price. NAMA has said 6% (compared to Celtic Tiger yields of 3%) – some people are saying 8%. We’re currently about 4% on average and up to 6% in some of the city areas.

On new taxes and on public sector expenditure, I’m not sure if you’re familiar with the blog – you’ll find many thoughts of mine on that in the “Irish Economy” section, particularly in relation to Budget 2011, Croke Park, property tax and our EU target for 2014.

Joseph ,

Ronan – “it also suggests that if the Live Register reaches 500,000 next year, something in the region of 70,000 households – 4% of all homes – could be in both negative equity and unemployment/underemployment.”

That is seriously worrying. I think it was last August that I did a ‘back of a fag packet’ calculation and predicted half that number (34,000). How much is 70,000 x the average mortgage?

What makes you think that the Live Register might reach 500,000 next year? That’s also a seriously worrying prospect for Ireland.

Ronan Lyons ,

Hi Joseph,

70,000 times €275,000, which is probably close to the average mortgage for the period suffering negative equity, almost entirely 2004-2008, is in the region of €20bn.

The 500,000 on the Live Register is a scenario used to give an upper bound, based on the pessimistic outlook as of mid-2009. With the Live Register easing off in late 2009, it looked like it wouldn’t happen, but with it increasing again in 2010, it doesn’t look impossible. The average for Q3 was just short of 460,000 and two quarters out of three this year it has deteriorated by about 20,000.

Scary stuff indeed,

R

Rory ,

From the Daft data, is it possible to quickly isolate:

1. Houses that have gone Sale Agreed but have been relisted within 7 months

2. The difference between the advertised price prior to Sale Agreed and the newly advertised price.

This could be interesting if we expect the relisting price to be closer to the price at which the sale was agreed (before falling through) than the original list price.

It makes sense to me to relist at a small differential above the “sale agreed” price, as I’ve an indication that this is market clearing, rather than relist at the original price. But maybe there are other factors at play?

Garo ,

Ronan,

A couple of problems with your otherwise excellent analysis.

1. To measure falls in Euro terms is not correct. Since as house prices fall, the Euro change becomes smaller. A 30k drop on a 600k house is not as bad as a 20k drop on a 300k house. You should use % change on the graph. That obviously did not happen so your graph’s prediction that Dublin prices will level off by 2011Q2 could also be wrong.

And yes, -20% to -15% does seem like clutching at straws.

2. Your extrapolation just looks at the last q-o-q change. That is way too little to extrapolate from. Using an average from the last 4-5 changes to get a trend line would have been better. For instance, the 2008Q4 to 2009Q1 change predicted that Dublin prices would level off by 2009Q4.

Ronan Lyons ,

Hi Garo,

Thanks for the comment, but I think we’re going to have to disagree.

On (1), euro amounts were chosen for a reason and that reason is accessibility. The trend I talk about is there with percentages (but less pronounced, as you spot, due to mathematics). But more importantly, if I said house prices have fallen 40% already and have to fall another 25% to balance out, the general impression taken away from my analysis would be that the fall from peak to trough would be 65%, whereas in fact it would be 55%. Hence, I have used euro rather than percentages, because if we talk in percentages, most people think “from the peak” but I could mean quarter-on-quarter or year-on-year. And even being clear on which I use, the mathematical subtleties would not be apparent to most.

On (2), I’ve actually used the last 4/5 quarters, exactly as you asked, to base my projections forward, so hopefully that allays your fear there. As you point out, one quarter is simply not enough to go a-forecasting!

Ronan Lyons ,

Hi Rory, great suggestion. I’ll have a look and see if our system has that kind of information and if the sample are meaningful enough to start taking out lessons.

Thanks,

Ronan.

Ulrik Andersen ,

Hi Ronan,

I am wondering if looking at the Draft numbers is a bit like looking at selling numbers and prices in a monopoly alike market dominated by a dominant seller, in this case the Irish Government?

Because in reality the Irish Government controls almost all the banks in Ireland and also NEMA, and through this they control perhaps as many as – who knows perhaps 50% – of the properties that really and urgently needs to be sold now? Well I don’t know, so I ask?

As I see it the dwellings on which owners are defaulting their mortgages does not come on to the market. They are not reprocessed or made to sell. I suspect that the real reason for this decision by the government is to keep these properties of the market to avoid further asset deterioration coming through to the banks etc. Read that they are by these means artificially holding up the property prices.

The story seems to be the same for the properties transferred to NEMA. As I see it they are also not coming on to the market at any trustworthy speed. Thus, by also holding these properties of the market the government controlled market dominance is supporting the property prices artificially. Perhaps one could say that there is no longer any free property market, as the current market is only a fraction of the real market for properties.

Do you have any information about when these properties are likely to come on to the market? How many properties it might be and what will happen to property prices when this happens? Sorry if I’m asking you too much.

I am seeing this from the outside as I am living I Copenhagen with my Irish wife. We are potential buyers of property in Ireland, but I am currently concerned about this big and grooving stock of unsold property in effect controlled solely by the Irish Government. I can understand that the government could want to support property assets by dominating the property market. But for me as a potential buyer, this is poison and it will keep me away.

Any comments appreciated and thank your for your great articles!

Ronan Lyons ,

Hi Ulrik,

Thanks for the comment and kind words. I was discussing this yesterday with someone. NAMA will have a dominant market position in Irish residential (the new homes segment) and commercial property over the next 10 years, in addition to being effectively the entire supply side of the market for Irish land during the same period. Mortgage debt in Ireland is about €120bn and assuming about half of this dates from the last 10 years, then it seems the entire residential market is worth about €6bn a year and thus new developments perhaps €3bn a year. (These are “back-of-the-envelope” figures, more to give an indication of scale.)

NAMA has somewhere close to €10bn in residential property/new developments (perhaps NAMAwinelake has better info). So it will be looking to offload in the region of €1bn a year over the next decade. This makes it not a monopolist per se but certainly the single biggest player in new developments and therefore it will have an impact on price. As NAMA is set up, it is its job to ensure that this stock of property is eased back on to the market, not flooded on to the market.

With yields on Irish property so low, you may be safer renting in Ireland until the picture becomes clearer over the coming 24 months.

Thanks again for the comment,

Ronan.

robert ,

yes almost interesting ou guys oubut where were all you people before the bubble burst ,

there were no predections or certainly very few that all these credit card handymen were on the titanic ,where were the so called handyman academic professionals ahem, i saw the arogance and the endeless gutting making pigs of themselves , im glad it happened long may it last what would you expect in a place ruled by school teachers who never lived in the real world and a PACK OF LIES

Home thoughts to abroad: Three things the Irish election has made clear | Ronan Lyons ,

[…] are hardly better for Ireland’s 30-somethings. At least 200,000 households – and maybe as many as 300,000 – are in negative equity. This is out of a total of 800,000 households with a mortgage. […]

Good Report by Ronan Lyons on Irish election Results – Smart Taxes Network ,

[…] are hardly better for Ireland’s 30-somethings. At least 200,000 households – and maybe as many as 300,000 – are in negative equity. This is out of a total of 800,000 households with a mortgage. Just […]

Mark Molloy ,

@ Ulrik anderson – you seem to have answered your own question with your very valid concerns. The fact that NAMA is holding (at the taxpayers expense) so much property (I am not sure of the usefulness of discriminating commercial and residential) from the market indicates that the market has further to fall. In essence, the entire NAMA exercise is in order to ‘game’ the market, to prevent it from rebalancing at a natural equilibrium. The reason for this is clear – since the gov. is the defacto holder of the mortgage assets,through nationalisation of banks and assumption of debt through guarantees, preventing asset price correction (downwards), is essentially an accounting fudge. It keeps the lower real price of real estate assets off book, for now. Take away NAMA and you would have lower real estate assets values and more insolvent banks. Ronan is quite correct in asserting the importance of yields – it makes no sense at all to purchase real estate in Ireland in the coming years. Far better to rent!