Recently, there have been some positive signs – green shoots, one might call them, had that expression not been over-used earlier in the year – regarding global growth. First, stock markets rose steadily, adding trillions to global capitalizations. Then economies around the world – including Germany and France much to the surprise of the Chinese – started registering positive quarter-on-quarter growth.

This has led to speculation that the Irish economy, which is forecast to shrink about 8% this year alone, may be able end its recession by surfing global trends and returning to export-led growth. As usual, however, things are not as simple as they seem.

For a start, Ireland’s economic collapse is not correlated with the global recession. Firstly, Irish exports have proven remarkably resilient over the past 18 months, while other countries have seen their exports collapse by anything up to 50%. Just today, for example, the CSO reported exports for the first five months of the year up 2% compared to the same period last year.

Secondly, what was driving our growth in recent years was domestic consumption and investment, both private and public. This was Phase 2 of a Celtic Tiger that had been driven by export-led growth in its first phase. For example, between 1998 and 2003, when real GDP increased by about €45bn, one quarter of economic growth was due to net exports, i.e. by faster growth in exports than in imports. Since then, though, Ireland has become a domestically-driven economy. Net exports actually detracted from growth in 2005 and 2006 and have contributed just 10% of overall economic growth since 2003.

Perhaps, though, regardless of the history of the last 10 years, we can return to an export-led phase of growth. It is certainly possible, and perhaps likely exports will be one of the few positives in the national accounts this year and next, given the retrenchment in private and public consumption and investment currently taking place. But the level of growth that this will stimulate is a far cry from the kind of growth delivered during a domestic boom fuelled by low interest rates, generous tax breaks and large increases in public expenditure.

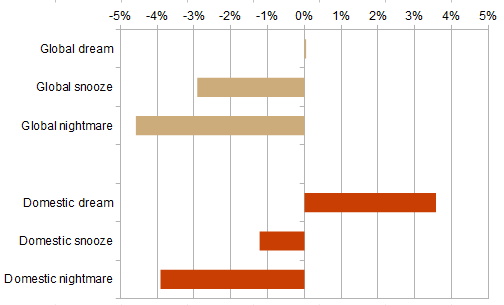

The graph below shows two sets of scenarios, one global and the other domestic. The top half shows three export scenarios for Ireland for 2010. The first is the “dream scenario”, where exports leap 10% over the course of the year. (Ireland has had three years of comparable export growth (8% or 9%) since 2000.) The second is the “snooze scenario”, where exports nudge up slightly as per Ulster Bank’s current forecast, 0.4%, while the third is the “nightmare scenario”, where exports fall 5%.

The most important thing to note is that, an export-led ‘dream scenario’ will have very little noticeable impact on the economy, primarily because exports require a large volume of imports (dragging down net exports) and an 10% increase in exports is unlikely to lead to any substantial reduction in umemployment, as Ireland’s exporting sector is so small in employment terms.

Contrast the global scenarios with the domestic scenarios. Here, the global economy is assumed to be on snooze, and it is domestic consumption that changes. The same percentages are applied, so the dream scenario is where consumption grows 10% (as happened in 1999 and 2000, for example), the snooze scenario is where it grows by just 0.4%, and the nightmare is where it falls by 5% (the fall predicted for 2009 by Ulster Bank is 7.5%).

While the nightmare scenarios look quite similar, i.e. a further contraction of the economy in the region of 4% in 2010, the dream scenarios are very different. In a global recovery, Ireland’s economy just about stands still next year. In a domestic recovery, though, there is noticeable economic growth.

The message is clear: by all means, hope and pray for a global economic rebound which stimulates Irish exports, but don’t be surpised at the pay-off if your prayers are answered!

Leave a comment