A common thread through Government statements recently has been that the severity of Ireland’s recession – described by the IMF last week as the worst in the advanced world – is due to Ireland’s openness and reliance on global trade and investment. On the face of it, this argument has some merit: after all, global data do show some link between openness and the depth of the recession this year.

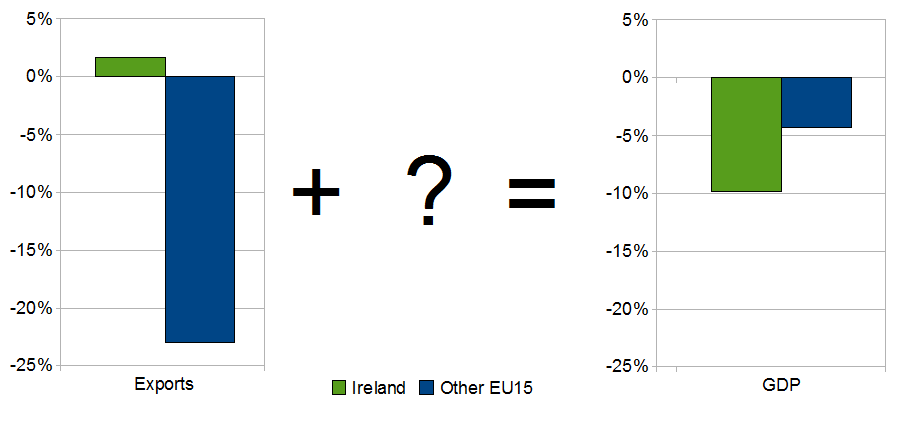

However, last week, the latest export figures came out. They show that Ireland’s exports actually increased in the first quarter of 2009, compared to 2008. Eurostat figures for all other EU economies show that exports fell almost one quarter in the typical EU economy in the same period. Ireland, then, is faced with a recession conundrum, then. If we’re so open that exports are about as large as the value of domestic consumption, investment and government expenditure combined, and they’re increasing, how do we still come out twice as worse as any other EU15 economy in terms of GDP falls?

The answer – in so far as a prediction can be given as an answer – is that the other three components of GDP are shrinking and compare much more poorly with the EU15 counterparts. The chart below shows OECD forecasts for 2009 from their June 2009 Economic Outlook. Consumption and investment are falling by billions of euro, while government is not providing a stimulus – it did that during the boom years and has no capacity to do it now.

Talk of Ireland being hit by a global recession is – certainly at the moment – well wide of the mark. Ireland’s exporters are making things significantly better than would otherwise be the case. If Ireland’s exports were collapsing by 25% this year (or more), as they are across the EU, in the UK, Scandinavia and the Baltics and elsewhere, the fall in 2009 GDP would be much closer to 20%. Blaming global circumstances for local woes only delays a proper understanding of where we’ve gone wrong, and therefore the necessary corrective measures being taken.

John Kennedy ,

I agree with most of your observations here. The exporters are punching above their weight. I would argue that if we hadn’t had such an over-exposure to property and the subsequent fall-out in the construction sector, this country would still be doing well. The conundrum as I see it is we were able to stimulate the property bubble but right now when we need to stimulate growth to replace construction, they have nothing to offer

karl deeter ,

Good post, do you have figures for Germany as opposed to the rest of the EU in one bar?

Does the decrease in investment include (for instance – property investment?) Germany didn’t have a housing bubble the way we did so what I find confounding is that the likes of Germany are having a steep GDP fall as well, they are a strong exporter that traditionally had big surpluses and unlike us they didn’t blow them all, it seems to me they got side-swiped by the more reckless nations driving down the economic road alongside them. any thoughts?

Ronan Lyons ,

Hi Karl,

Germany’s fall in investment is 10%, but that’s driven by non-residential investment (down 15%) rather than by government or residential investment.

http://www.oecd.org/dataoecd/6/49/20209188.pdf

All the German exporters are nervous and hence are not implementing their plans for expansion. So in a way, yes, they got hit by global factors while they themselves were being much more cautious! Spare a thought for the Japanese too – just coming out of their 15 years of hardly any growth and then their one rock of stability – exports – collapses.

Stephen ,

The Irish Misery Index is holding up pretty well though considering how badly the country is doing.

This property “thing” will unfortunitely continue to drag down this country like none other in the EU for the next few years, sadly.

Irish Election » Ronan Lyons on Ireland’s Economic Woes and the Global Downturn ,

[…] Lyons of Daft shows just how unconnected our woes are to the global downturn. It’s even understandable to non-economists. Share and […]

Irish Election » Dan Boyle [Calls for an End to] No Blame, No Shame [Culture] ,

[…] place should be blamed and shamed too? Someone tell me, what’s he up to these days?… Spinning so much the blame won’t stick, that’s what he’s up […]

David Begg on the Devaluation Consensus & responses | Ronan Lyons ,

[…] economic growth. Lane argues that the best possible solution is to minimize unemployment, and – as so many of us have argued before – we had our fiscal stimulus in the good times: If Ireland had run a counter-cyclical fiscal policy during the good years, there may have been […]

Cathal McCann ,

Nice post Ronan, good to hear someone telling the economic truth.

2009 in review and 2010 in preview | Ronan Lyons ,

[…] performances of the domestic and internationally trading sectors of the economy. Astonishingly, Ireland’s exporters have, in aggregate, been largely unaffected by the worst contraction in wo…. This is just the continuation of a long-running trend which has seen domestic income (GNP) grow at […]

Eleven reasons to be cheerful | Ronan Lyons ,

[…] not to experience a sharp fall in exports during the greatest collapse in trade in recent history. (The global recession was just a coincidence for Ireland.) The only downside to this is that exporters here could not expect to have the rebound that many of […]