This year, the State will spend approximately €64bn of taxpayers’ money. A little over €7bn of this is capital expenditure, dominated by social housing and new roads. The other €57bn is current expenditure. Tax receipts for 2009 are likely to be in the region of €34bn. This leaves us, therefore, with a €23bn gap to sort out – and that’s assuming that capital expenditure is being spent on projects that deliver enough social good to pay for themselves over time. If cleaning up the banks ends up costing us about €1bn a year for the foreseeable future, and there is indeed some waste in the capital expenditure, it’s fair to say that the true fiscal gap is in the region of €25bn.

With a gap that size and a faltering international economic reputation, Ireland needs more than just a series of harsh budgets. Ireland needs a clear and well communicated overall recovery plan that it can show citizens and investors – of both the bond and FDI kind. Prospective bond buyers will demand less of a risk premium if they see Ireland has a well thought out plan for its recovery, so even announcing the plan itself could reduce the cost of the national debt in terms of servicing.

What should Ireland’s plan be? The general tenor of opinion is that public sector expenditure has to be drastically reduced, while the tax system needs to be rebalanced to provide a sustainable base for income. €42bn seems like a good target – both for tax receipts and for current public sector expenditure. Elsewhere, I’ve discussed some options to get our tax receipts up to €42bn. What elements of current expenditure must we look at, though, to reduce the Government’s outgoings by about one quarter?

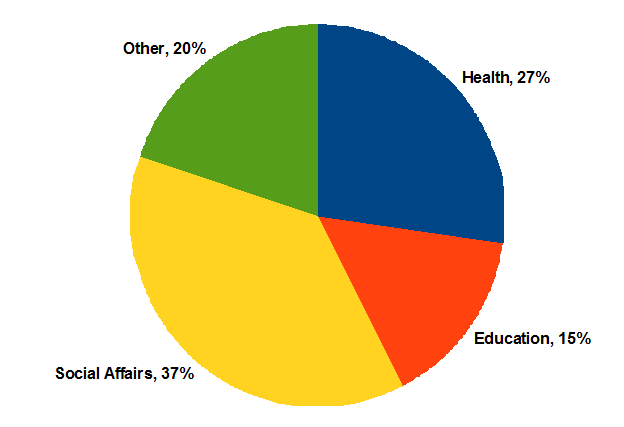

The graph below shows three likely candidates: social affairs, health and education. These three areas alone account for €45bn, or four fifths of gross public expenditure. If €15bn is to be saved, these areas will have to contribute the lion’s share. As the first of hopefully a series of posts on how we can get public sector expenditure back into line, here’s a high-level look at how to save a few billion, without changing the overal structure of the public services…

Social Affairs

The Irish taxpayer will spend €11bn in 2009 on ‘Social Assistance’, and a further €10bn on ‘Benefits’. In ‘Social Assistance’, the two biggest ticket items are child benefit (€2.5bn) and job seekers’ allowance (€2.2bn). Other items costing in the region of one billion euro each include the State pension, the one-parent family allowance and the disability allowance. Various supplementary welfare allowances, such as rent, mortgage interest relief and back-to-school clothing cost a further €1bn in total, while all the other Assistance schemes (such as the Carer’s Allowance, Free Schemes, etc) come to a further €2bn. To this must be added money spent under the ‘Benefits’ heading. The biggest items here are €3.3bn spent on State pensions, €2.4bn on Jobseekers’ Benefit, and a further €1.4bn on widow(er)s pension. About €1.5bn is spent on illness and invalidity.

Some awkward questions:

- Why is Ireland’s job-seekers allowance/benefit so generous compared to other countries? Particularly when one bears in mind that rent allowances are separate and cost the taxpayer a further €500m.

- Why should payments to job seekers not be index-linked both ways? Should these payments not be going down in line with price levels generally, just as they went up in inflationary times?

- Why is child benefit not means-tested? €2.5bn is an awful lot of money – is there any evidence to suggest that it has contributed to Ireland’s higher birth rate?

- Why on earth is mortgage interest relief, which admittedly is only costing €40m in 2009, considered social assistance?

- Why do one-parent families receive special assistance? Is this a blunt instrument targeting one-parent families in certain socio-economic circumstances? If it is, should it not be better honed for this end?

- Is everyone on disability allowance really in need of it?

- Likewise widow’s allowance… Without wanting to sound like Homer Simpson (who grumbles about “mooching war widows“), Ireland pays about as much on widow’s allowance as it does on civil service pay! What is the goal associated with this policy tool? Why do we have something in the region of 100,000 widows being paid €200 a week? One simple interim solution would be requiring the widow in question to sign on to receive the money, rather than pay it directly into their account – that would hopefully eliminate some of those who just don’t need it.

Overall, expenditure on Social Affairs will increase by €3.5bn this year, with 60% of this increase due to greater jobseeker payments. This should at least in part be regarded as cyclical (say €1.5bn), meaning the base from which to start trimming is €20bn. It should definitely be possible to reduce expenditure in this area to €17bn or so, by ‘better targeting the vulnerable’, as the IMF put it in their recent report.

In addition, reducing jobseekers payments by 5% would save in the region of €250m, while a similar amount could be raised from reducing the State pension for those with other sources of income in retirement. Restricting payments such as child benefit, disability, widow and one-parent allowances to those that need it makes a savings target of €3.5bn more than achievable.

Health

The Department of Health and Children will spend €15.5bn on current expenditure this year. Within this, the HSE is the chief money-spender, spending €11.6bn in 2009. On the face of it, this represents a saving of €1bn on 2008. However, these figures include income, such as money given to this particular budget line from the public sector pensions levy: actual gross spending will be €15bn – up 1% on 2008, not down.

€7bn is spent directly on the HSE regions – the vast majority of this, €5.5bn, is core pay. A further €2.5bn is spent on grants to hospitals. Most of the remaining money is spent on schemes, in particular the €2.75bn spent on medical cards and the €1bn spent on long-term residential care.

No matter which way one looks at the numbers, one cannot ignore the fact that, along with those on a HSE pension, the 136,000 people employed by the HSE will be paid over €8bn. The HSE regions will together spend 3.5% more on pay this year than last, while non-pay costs will go down by 15%. If only that sort of flexibility were possible on the pay side: a 15% reduction in pay costs, rather than a 3.5% increase, would have saved the Irish taxpayer €1bn this year.

Ultimately, Ireland needs to consider its health model. I would love to see policymakers explore a Singapore-style model of a mandatory personal health savings account, similar to a pensions account, taken out of tax paid and stored as an investment account, to be used for general medical expenses. In the meantime, though, further savings of about €1bn could be achieved through reform of the medical card scheme, long-term residential care and in particular the block grants given to hospitals.

Education

The Irish taxpayer will spend €9.5bn on education this year, the vast bulk of which is current expenditure. Primary and secondary education will consume about €3bn each, while tertiary will cost just over €1.8bn. In relation to primary and secondary education, my primary concern is well known: Ireland’s primary and second school teachers will cost the taxpayer €3.5bn this year – that’s an average cost per teacher of €70,000. This excludes superannuation, which costs a further €700m.

The VECs constitute a further €1bn in spending, €770m of which is pay, while a further €1bn is spent by the taxpayer on college grants towards current expenditure. If this is like other parts of the education system, this is likely to be about 75% pay. Flexibility in pay costs from primary right through to tertiary, similar to that suggested above for healthcare workers – and similar to the upward flexibility previously shown by education workers in benchmarking – could save the taxpayer in the region of €1bn.

Incidentally, there is relatively frequently a hullabullo in the media about free fees. This initiative is hardly spare change, but in comparison with the items listed so far, its costs are actually relatively small – just €330m. That is not to say, of course, that the free fees initiative should not be re-examined for efficacy – is it just another blunt tool to particular aims in relation to specific cohorts of the population?

Where does that leave us?

Even a quick look at the numbers shows that with 65% of taxpayers’ money being spent on pay costs, the solution to Ireland’s fiscal woes is definitely going to have to involve cutting the public sector payroll. I don’t think necessarily that this should come from cutting the numbers at work, particularly at a time of high unemployment. I think it should come instead from a competitive readjustment of public sector wages – perhaps a further benchmarking exercise, only this time open and transparent, could be used for this purpose.

When the public sector wants to, it can certainly cut costs. It can be ruthless even when it comes to someone’s wages. For example, €77m was spent by the civil service on consultants in 2008 – this is being cut to €53m in 2009. That’s a very commendable 30% reduction! I’m not sure why, when you multiply those numbers by 100 and replace “consultants” with “public sector workers”, the same principle doesn’t hold. The maths above shows that, even without making any major reforms to the public sector, better use of taxpayers money could save about €6bn across social affairs, health and education.

Kevin Denny ,

Re child benefit: “..is there any evidence to suggest that it has contributed to Ireland’s higher birth rate?” As Homer would say “D’oh” : that’s not its purpose. Child benefit is a very effective way of getting money into low income parents’ pockets. Sure, some is wasted by giving it to rich parents too. But what is the alternative? Means testing is not the no-brainer many people think because it ignores non-take up. If you means-test a benefit, a significant number of people will not take them up even though they are entitled to it. I have seen estimates of non-take up for other countries of the order of 30% or even 50%. This may be something to do with stigma attached to such benefits. Making them taxable may be a smarter alternative though there are clearly practical issues about implementing this.

Your post raises legitimate concerns about various items of public expenditure. How come we lack decent evaluations of most of these? And shouldn’t we always be concerned about evaluation of expenditure not just when money’s too tight to mention? I am not aware of many serious evaluations of the effects of the numerous expenditure programs in education, training etc.

Ronan Lyons ,

Hi Kevin,

Thanks for the comment – your point on child benefit ties to an overall message you raise yourself: what are the specific goals of all these policy initiatives and are they being achieved? €2.5bn on every child seems like an indiscriminate way to support those children in poverty. One area I would increase public expenditure without hesitation is the evaluation of policy through cost-benefit analysis (provided that unit itself, of course, passed the CBA!).

R

Kevin Denny ,

Some of the people in the ESRI may have looked at the distributional consequences of child benefit using their tax benefit model. My hunch is that if the objective is “get money to low income parents/kids” then its probably not too bad but it could probably be improved. Anyway €2.5bn should be spent, not on the basis of hunches, but on careful evaluation. CBA has something of a bad reputation in economics since often there is a quite a bit of uncertainty about certain parameters so it be easily rigged to get the result you want. An independent body like the UK’s Audit Commission would be a start however.

Colm Green ,

[i]Ireland’s job-seekers allowance/benefit so generous compared to other countries? Particularly when one bears in mind that rent allowances are separate and cost the taxpayer a further €500m.[/i]

Hmm, there are two parts to this, firstly it’s because it is a lot more expensive to live on restricted income in the republic than it is in the north, or england.

Secondly Rent allowance is so big because the Public sector provision of accommodation has fallen so far behind need over the last 20 odd years. It’s the inevitable consequence of the government prioritizing private sector landlords over tenants.

Ronan Lyons ,

Hi Colm, thanks for the comment. It is my understanding the difference in allowances far exceeds the much smaller differences in the cost of living – but I guess that’s a blog post in itself!

Daniel Sullivan ,

Kevin, “Child benefit is a very effective way of getting money into low income parents’ pockets.” I’m not sure that is true, at least to some extent that is really viewed as “Child benefit is a very effective way of getting money into low income mothers’ pockets.” If we are providing a benefit then by all means we should ensure it goes to those intended but if in 2009 we are operating on the basis that low income fathers/husbands can’t be trusted with the child benefit then we should be honest about it and reconsider going for more direct welfare provision a la the US food stamps model rather than pure hard cash all the time.

Also, this issue with means testing is odd. If people are on social welfare then they are automatically going to receive a new means tested child benefit anyway.

We run a form of gross means testing on all citizens already in the form of the tax net, how is that this becomes magically expensive when it is suggested for any benefits that are currently universal.

Colm Green ,

I wouldn’t be so sure about that. if you don’t have a car your shopping options are extremely limited to very expensive convenience shops. Shopping in aldi goes some way to reducing your food bill, but where I live (just off pearse st) is the guts of 2 miles from the aldi on parnell st, and there is no connecting bus.

Indeed the cheapest super market available to anyone living as far down as ringsend is either the unspeakably shit, and expensive tesco on baggot st, or Dunnes on George’s st, and even then many of their vegetables are priced at levels equal to or above Fallon and Byrne’s who sell only the finest vegetables, watered by linda mcCartney’s bounteous spirit, and hand-picked by people with Ph.D’s in horticulture.

This is a very difficult country to live in if cheaply if you don’t have a car, which is beyond anyone on social welfare.

Daniel Sullivan ,

Colm, does the no.3 not head down Pearse st. anymore? I live in Limerick and the nearest Aldi is about 2/3km away but I load up with the rucksack and head over. It’s a walk and a workout in one!

Jaedi ,

No matter how many times I see the figures, the scale of the projected deficit truly astonishes me. Saving a billion is a huge feat, yet that would be a mere drop in the ocean.

I agree that child benefit should be means tested and I also suspect that there is widespread abuse of the likes of disability allowance. I had pondered the inconsistencies of index linking before. I also cannot understand why the mechanism only works upwards following inflation without considering deflation. Some frivolous expenditure on areas such as consultancy could and should be slashed, however, that would only have a relativly small impact.

Unfortunately, these easy targets amount to minor adjustments for cumulative, long term stability rather than the short term dose of hard action that is required. The only way to turn around state finances is for a politician to truly lead rather than take the path of least resistance.

What about suggesting a taboo such as the introduction of legislation to allow surplus civil servants to be made redundant? There is a layer of middle management fat in the HSE that serves no purpose other than defending their own interests. I’d be reluctant to touch the eduction budget considering its importance to the long term productivity of workforce.

By introducing a (public sector) levy rather than real pay cuts suggests that it can be removed as easily as it has been introduced. I see no reason why such a protected class of worker should be paid more than their peers in the private sector, or civil servants in other European countries for that matter. Medium to high earning civil servants should at least be subject to an real additional pay cut of 20% – 30% on some kind of reducing scale to keep a meaningful overall salary structure, and something like 50% for the highest earners. Again, legislation would be required to facilitate this.

Some social unrest would be inevitable, but these tough decisions need to be taken. To make them more palatable, there should be prosecutions or at the very least, any ongoing benefits such as pensions eliminated for the likes of the former Financial Regulator and the top management of the banks. Politicians should be forced to endure much greater cuts to their remuneration.

Such extremes would not have been necessary had the government not blindly issued a blanket guarantee of the majority of the banking sector. If Anglo Irish had been allowed to go under, only the 100k deposit protection would need to be honoured and we would not be left with a black hole hungry for capital from the state. Bond holders should be allowed to suffer the consequences. The resulting financial instability would be weathered by nationalising AIB and BOI until the economy stabilises.

It may be outside the scope of your article, but why was a real value-based property tax not introduced? Are our public servants too lazy to establish the cadastral and procedural framework needed for property records and valuations? We need to widen the tax base after all.

At least we have some sensible independent analysis from articles such as this one. The fact that an outsider such as Dr. Alan Ahearne was chosen as the governments chief economic advisor is another ray of hope, although, his advice should have been followed for the last 10 years, not just 10 months.

kevin denny ,

Daniel: I don’t want to seem a die-hard defender of the status quo. Lets just say of policies we have, universal child benefit is by no means the worst. On the mother/father issue: giving the money to the mother is probably the most sensible option especially for “single parents” (those looking after kids) about 90%+ of whom are female. Children born out of wedlock (not the same as to single parents, I know) is close to 50%, over 50% in Limerick apparently.

Child Benefit (CB) isn’t magically expensive to means test: the evidence is that means testing will discourage genuine applicants: thats bad. What are you going to do?

People who design and implement policies are, in my experience, not stupid,lazy or wicked ‘though they may well be ill-informed or ill-trained. In an imperfect world, faced with the pressing need to help low income families, universal CB is probably pretty good. Claw some back though the tax system if you can.

Ernie Ball ,

Disappointing to see you continuing to put forth the canard that Irish teachers are overpaid relative to their European and OECD counterparts even after it’s been fairly decisively refuted.

Caelen ,

Regarding child benefit.

If our tax system is going to reflect an ethos of ‘those who can afford the most pay the most’ then we are going to have to have some form of child benefit.

Raising children costs money. In fact if both parents work it costs unspeakable amounts (day care until 5.5 years alone costs about €60K per child). If there isn’t some accounting for this cost in the way that either taxes are collected or benefits paid out then we are clearly going not going to meet the above ethos.

My thoughts regarding benefits is that they should be paid to everyone, regardless of their income. These benefits should be added to their income and top bands of income taxation should be adjusted to a gradually increasing scale above our current levels. This would reduce the administration of these benefits (as they are simply paid to everyone) and costs of providing them to everyone would be recovered through income tax.