Sometimes, it’s easy to forget – when you see interest rates of just 2% or so on your savings that the real return on savings can be quite high. Even with zero interest rates – as people often have in their current accounts, it may actually be the case that there’s “never been a better time to save”! Earlier this week the latest CPI figures were released, showing an annual fall in prices of almost 5%, as discussed by Karl Whelan on the Irish Economy blog.

A couple of week ago, I discussed the different inflationary paths across the various sectors of the Irish economy. Among the most interesting trends were that publicly dominated sectors – education and health – had the highest rates of inflation, while other sectors, particularly those exposed to international competition and technological progress such as clothing and communications, had price levels now comparable to the 1980s. The idea, then, that prices always go up slowly and steadily may be true in aggregate but it certainly doesn’t hold true when you scratch away to any level of depth.

More recently, following comments on my stylised rent-or-buy calculations, I asked people to outline whether they thought renting or buying was a good decision at the moment, based on falling house prices/rents/economic confidence, etc. I had originally thought of just two main sets of factors determining house purchases, affordability on the one hand (as per the rent/buy calculations) and confidence on the other. The 60 or so responses to the survey were interesting, as half of those who answered picked deflation, which falls between those two stools. That is, assuming a job – so assuming some level of economic confidence – half would not buy because house prices were falling and therefore would be cheaper down the line.

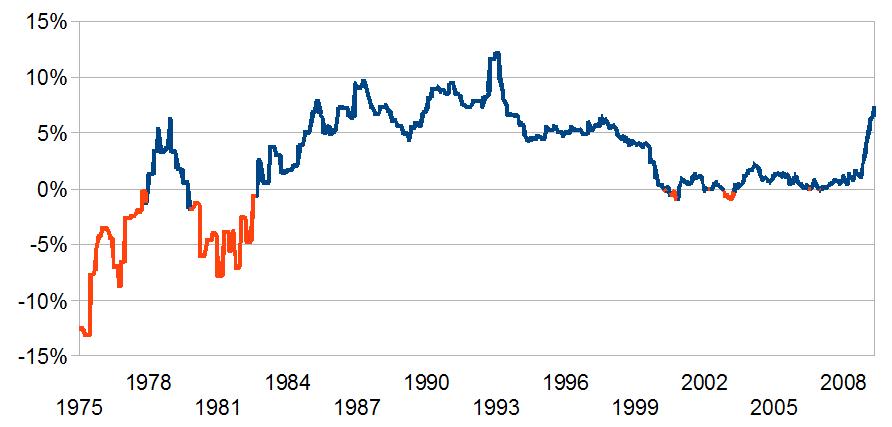

This is of course perfect rational on the part of prospective consumers and one of the reasons policymakers fear deflation so much: why buy now what you can get cheaper in a year’s time? Negative real interest rates incentivize borrowing, while high rates encourage people to save and wait for another day. I thought this was worth investigating further, both in the general economy and also in the property market. The graph below shows real interest rates in Ireland from the late 1970s on – i.e. typical interest rates less the rate of inflation. In the late 1970s and early 1980s, then, borrowing for a mortgage was a no-brainer – provided you could get the money – as inflation would whittle away your debt, just like European government debt after World War 1. (There’s one reason to have less sympathy for people who say things like “In my day, interest rates were 15%”!)

Even in the 2000s, the average real interest has been about 0.5%, no matter what the headline rate, so there has been very little real burden on borrowers. Now, however, real interest rates have soared rapidly since January, reaching about 7% in May. In the late 1990s, real interest rates averaged 5% or so, but the last time real interest rates were as high as they are now was in 1993. There’s never been a better time to save since the start of the Celtic Tiger!

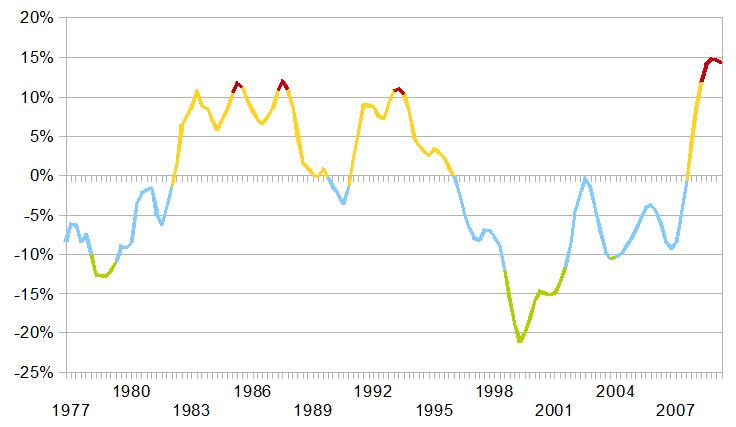

In reality, though, while lots of people borrow smaller amounts for their everyday consumption, the single largest segment of borrowing by households is to buy homes. The response to my quick survey last week suggests that steadily falling prices and a plethora of peak-to-trough scenarios mean that very few people are prepared to try and ‘catch the falling knife’. Dept of the Environment and ESRI figures mean we can construct a quarterly series on house prices from the mid-1970s which, put together with Central Bank figures on typical mortgage rates, mean that real interest rates for the Irish property market can be calculated. The result, taken on a 4-quarter moving average basis, is below.

The green parts are where the real cost of borrowing was not only negative but significantly negative – borrowers were basically being subsidized 10% a year or more to borrow. This occurred in the late 1970s and again from 1998 to 2001. These were the ‘no-brainer’ times to have a mortgage, as real interest rates were whittling them away. In fact, for almost 60% of the last 33 years – and over the whole course of the Celtic Tiger period – real property interest rates were negative, giving perhaps a slightly different perspective on the usual “Why Irish love buying their home” story.

The yellow shows where real interest rates in Irish property were positive, while the red shows where the cost of borrowing in real terms exceeded 10%. With deflation embedded in the Irish property market at the moment, its real interest rate has soared, touching 15% in recent months. The real cost of borrowing for property is higher now than at any point since the figures began in the mid-1970s and shows perhaps that for all the rent/buy arguments out there, prospective buyers are happy to sit, wait and save.

To buy or not to buy… - Smart Taxes Network ,

[…] Sometimes, it’s easy to forget – when you see interest rates of just 2% or so on your savings that the real return on savings can be quite high. Even with zero interest rates – as people often have in their current accounts, it may actually be the case that there’s “never been a better time to save”! Earlier this week the latest CPI figures were released, showing an annual fall in prices of almost 5%, as discussed by Karl Whelan on the Irish Economy blog. Link to article […]