Property prices rising?! Thoughts on the latest firesale auction

Ireland saw its first “fire sale” auction in April 2011 and over the months since then they have become an regular feature, with at least six auctions held by Allsop/Space in Dublin in that period. Last Autumn, I analysed the results of the first three auctions and concluded that, comparing the September auction to the April one, the price level had fallen.

To do this, I constructed a peak price for each property. I did this by using the “hedonic” model that underpins the Daft.ie Report, which effectively breaks every property’s value down into certain components, such as number of bedrooms, type of property, location and what quarter the property was listed.

Falling prices – so what?

In one sense, you may say: property prices were falling in Ireland last year, so what? Didn’t we all know that? The reason it concerned me at the time was that swings in property prices are typically driven by credit conditions and – at a macro level – the number of buyers relative to the number of properties being sold. In an auction setting, the number of properties being sold is fixed (there are about 60 residential properties sold in each fire-sale auction) and in a country of 4.5 million people, it should not be a struggle to find at least sixty buyers. More importantly, though, the buyers are mostly cash buyers, so their price level should not really change from auction to auction: if it was two thirds below the peak in April 2011, everything else being equal it should be roughly the same six months later.

The conclusion last September, however, was that the cash price level in the market was quite a bit lower in July/September (about 71% below peak) than it was in April (about 66% below peak). It’s important to remember that each additional percentage fall from the peak is proportionately greater at the time. So if a property valued at €500,000 at the peak falls 65%, it is worth €175,000. If it were to ultimately fall by 75% from the peak (to €125,000), that fall from €175,000 to €125,000 is not “just another 10%”, it’s a fall of almost 30%. For this reason, the fall from April to July/September was noteworthy.

So, halfway between the May and July auctions, what does the May 2012 auction tell us?

The latest fire-sale stats

As before, I’ve analysed each of the sixty-two residential lots sold in the May Allsop/Space fire-sale auction. For each one, I’ve jotted down the type, number of bedrooms and bathrooms and plugged its location into the model of the Irish property market to construct our best estimate of what it would have sold at, at the peak. Where rental information is given, I’ve noted this too as the ratio of annual rent to the price is – as established readers are probably sick of hearing – the single most important indicator in the property market.

Thus for the sample as a whole, there are two important metrics: the average yield (rent to price ratio) and the estimated typical fall from the peak (not an important measure in theory but one which everyone understands). Not only that, the sample can be divided into two groups: Dublin and the rest of the country. (This doesn’t quite do justice to the non-Dublin cities, which in my opinion are closer to Dublin in their supply and demand dynamics than they are to, say, the Upper Shannon region but a sample that size has its limits.)

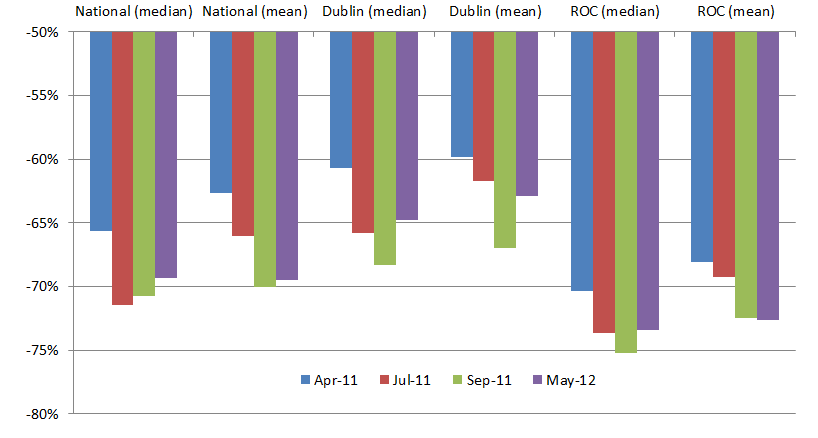

The key stat from the May 2012 auction is that the estimated typical fall from the peak was 69%. As is shown in the graph below, this marks a sort of inching upward of auction prices from their July 2011 level – at least when measured by the median. The difference between mean and median shows the limitations of the small sample size – a few outliers can skew conclusions.

Prices not falling? What?

What is interesting is how the extent to which Dublin prices are down from the peak has changed since September. Last April, the typical Dublin lot sold for 61% below its estimated peak price. By July, the discount was 66% while by September it was 68%. The May 2012 lots sold for an estimated 65% discount from peak prices. Whisper it, maybe, but Dublin cash prices may be creeping up. (Using the mean, rather than the median, doesn’t change the conclusion.)

Elsewhere in the country, though, the discount from the peak remains significantly larger: 73% in May 2012, compared to 74-75% in the July and September 2011 auctions. The evidence that Dublin is decoupling from the “rest-of-country” property market is beginning to stack up.

What about yields? The earlier auctions suggested something of a paradox: the desired yield was higher in Dublin than elsewhere in the country, despite people reasonably assuming that to get people to buy outside the largest markets you would need to offer them a risk premium in the form of a higher yield. The May 2012 figures, however, confirm what was suggested by the September 2011 figures: there is a significant risk premium emerging for properties outside Dublin. While the typical Dublin yield is between 8% and 8.5%, the yield elsewhere in the country is above 9.5%. The slight fall in yields in both Dublin and elsewhere is consistent with the price level at the fire-sale auctions rising slightly.

One shouldn’t forget that a large chunk of the residential transactions at the fire-sale auctions so far (perhaps 50 out of 400) have been from one development, Castleforbes Square near the O2 in the IFSC. This adds a further asterisk to the results so far (Dublin vs. rest of country comparisons are at least in some way Dublin city centre vs. rest of country comparisons) – but also creates an opportunity to compare like with like over time – something I’ll be doing anon.

In the meantime, though, it will be interesting to see what future fire-sale auctions throw and whether prices level off, rise or fall and how this continues to vary across the country.

—

PS. The full database of results from the firesale auctions is now up on the Allsop site here.