The latest Daft Report was released yesterday – all the materials are available from the usual place, including a commentary by John Logue, the new president of the Union of Students in Ireland, and the full report itself (PDF), which includes the annual “Student Special” of rates close to all Ireland’s major higher education institutions. There are two main headlines, at least by my reading: one in relation to rental trends and the other in relation to the number of properties on the market.

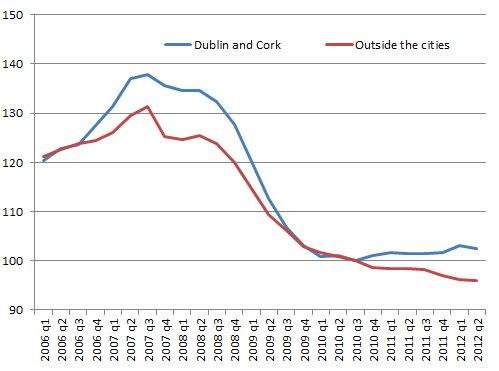

In relation to average rents, it remains hard to describe the national rental market with just one statistic. Rents have been higher (in year-on-year terms) in Dublin and Cork every quarter since the start of 2011 (the last six quarters). On the other hand, outside Ireland’s cities, rents have been falling consistently in year-on-year terms since early 2008.

It should be noted that the rate of change in both cases is small – up typically less than 2% in Dublin and Cork, down roughly 3% outside the cities. Nonetheless, as each quarter adds to the last, the split becomes more and more apparent and something a few of us predicted would happen in late 2009/early 2010 looks to have come to pass. (For those wondering about Ireland’s other three cities, Galway city is a bit of intermediate case – rents have effectively been static the last six quarters. Limerick and Waterford are closer to the non-city areas than to Dublin and Cork in their performance.)

Rental supply

In relation to the supply of rental properties, the number of rental properties on the market continues to fall – and this is again driven by Dublin. On August 1st 2012, there were 16,500 properties on the market available to rent, down from almost 19,000 on the same day in 2011 and over 23,000 in 2009. While this is still well above the 7,000 or so rental properties on the daft.ie site in mid-2007, I think comparisons with 2007 miss two important facts: the rental market outside cities was much more limited while there were free capital gains to be had in real estate; and secondly, the delay in people buying property means that there are more renters than a “business as usual” scenario.

In Dublin, there were 4,200 rental properties on the market at the start of August this compared to 5,400 last year and 6,500 two years ago. As someone who was actively on the market last summer, the market was by no means over-stocked then – so market conditions will be tight for those looking to rent in prime locations, even as conditions remain firmly pro-tenant in many counties. There is less than one month’s supply on the market at any one time in Dublin now, compared to two months in Connacht-Ulster.

A case of urban economics

Returning to the first point, though, the difference between Dublin and Cork in particular on the one hand and the non-urban areas of the country on the other is increasingly striking. The graph below shows the performance of the two segments over the last two years (since 2010-Q3) as well as giving the context of what happened 2006-2010.

The fall from the peak to 2010-Q3 was certainly larger in Dublin and Cork… but the falls elsewhere since then reverse this conclusion. Rents in Cork and Dublin are now on average 25.5% below their 2007/08 peak, while the falls in the “Rest-of-Country” segment (i.e. outside the five main cities) is now 27%.

This is probably mostly a case of common sense: people move to cities because they are the best job creators. The “labour market amenity”, as urban economists such as myself might call it, has perhaps strongest appeal when jobs are tight. Given no significant oversupply of rental properties in either of Ireland’s main cities, and given willingness-to-move to the cities from elsewhere in the country by Ireland’s young workers, it’s unlikely there’ll be any reversal of the trend any time soon.

Leave a comment