The latest Daft Rental report is out this morning. Its at-first-glance unexciting headline is that rents are stable: not only quarter-on-quarter but also year-on-year: the national average rent is just below €825 and has been there solidly since about this time last year.

Is that all there is to it, then? We’ve reach equilibrium in the rental market and – once we find out the “right” yield, or relationship between rents and house prices – we’ll know where equilibrium in the sales market is too?

It’s unlikely to be that simple. For one thing, rents in the three main cities are actually up year-on-year, and are offset by rents elsewhere being about 3% lower year-on-year. Rents in Cork are actually almost 5% higher now than a year ago.

What up with the People’s Republic?

Some might suggest that perhaps the spike in Cork rents is because of the flooding at the end of March and start of April. The damage to homes may have brought about a shortage of rental accommodation, as some homes are rebuilt and restored. It’s an interesting suggestion, showing the susceptibility of the rental market to random shocks.

But at least this time around, it’s definitely not the case. The number of properties available to rent in Cork increased from an average of just over 600 in the first quarter of the year to over 1,000 in the last three months. In fact, all across the five major cities, there has been a substantial increase in the number of properties sitting on the market, typically by one third, in a few short months.

So we may be seeing the rental price interact with the supply on the market. Suppose developers or others have urban properties they have been trying to sell, without success. Nine months of a stable rental market convince them to try their chances renting the properties instead.

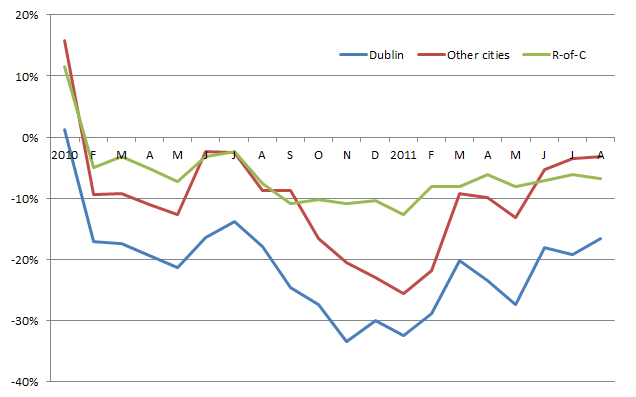

This sounds plausible and leads to an obvious follow-on question: does the increase in supply mean that rents are due to head south in coming months, as the impact of the fresh supply is felt? Perhaps not. The graph above shows the annual change in the number of properties sitting on various rental markets from the start of 2010 until August 1st this year. What’s of note is that the rush of properties this summer season is actually smaller than the rush last year.

In June and July 2010, there was an average of 2,750 properties available to rent at any one time across Ireland’s four cities outside Dublin (Cork, Galway, Limerick and Waterford). In June and July this year, it was below 2,650. Not a huge fall certainly, but definitely not a fresh rush on to the market. All in all, the trend in the stock on the market is downwards.

What is the current return on real estate?

If rents do actually stabilise, at least in the cities, one thing we will be able to do is figure out what the “long-term economic value” of any given property is (NAMA take note!). This is because ultimately a property is an asset, one that gives you income (if you’re an investor) or saves you outgoings (if you’re an owner-occupier).

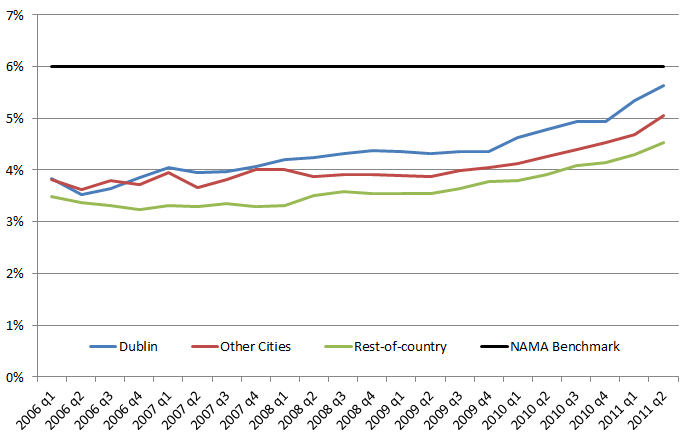

The second graph, below, shows the annual rental income for the average property in three regions of the country, from 2006 (i.e. 2006 rental income compared to 2006 prices) until the second quarter of this year. Particularly since late 2009, when rents have levelled off (and as house prices have continued falling), the yield has improved considerably and now in Dublin is not too far off the NAMA benchmark yield of 6%.

For the yield in the “rest-of-country” outside the cities to correct to an average of 6% from its current level of 4.5%, a swing of one third is needed. That means either static house prices, if and only if rents were to increase by 33%, or if rents stabilise then prices need to fall another 33%.

The average asking price in the rest-of-country is currently €180,000 and a 33% fall would push that down to €120,000. This would be a fall of just over 60% from the peak, something that seems a reasonable estimate peak to trough fall (particularly with Dublin asking prices already down 50% but not yet stabilised and with firesale prices at 65-70% below the peak).

While 6% is a nice round “target”, it’s at the end of the day an arbitrarily chosen round number. What actually determines the yield on a particular property – in particular why yields on smaller properties (one- and two-beds) are higher than those on larger properties (4/5 beds) – is to my knowledge unknown. (And the topic of some of my research at Oxford and my presentation at the ISNE 2011 Conference later this week!)

Sporthog ,

Perhaps rents are rising as landlords are facing increasing costs i.e. insurance etc.

In addition taxation on a loss is pushing landlords into a difficult corner, the only solution is to push up rents. This increases pressure on tennents, most undesirable during these times.

While the Gross rental yield is a convienient metric when talking about property, for the property investor/landlord this metric is very misleading. Rising interest rates, some now around 6%, and a reduction in the number of costs which can be offset against profit means most landlords are barely surviving.

A NET yield of maybe 1.5% would be a more realistic figure, if you are lucky.

You would make more money on deposit and have less work and be on the hook for a lot less risk as well.

News 16/8/11 – Collapso – Tracking Irish property prices ,

[…] BOI to increases mortgage rate Bad Idea from NAMA Agents differ on Dr Doom’s dire warnings Sale of council homes down 90% Will the surge of properties push rents down? […]

Ronan Lyons ,

Hi Sporthog,

Thanks for that comment. I take your point about gross versus net yield – in fact, the reason I presented gross is precisely because one person’s net is not the same as another’s. In particular, when we talk about whether the property market is in equilibrium (as an asset market), the gross yield is the metric used because it is compared to things like mortgage borrowing rates and deposit savings rates, and whether there is a sufficient risk premium over those rates.

Ronan.

John Mack ,

Sporthog makes an excellent comment.

There’s no point in renting – with the increased costs – if you cannot make a fair return. If that is the case, and it continues, many larger single family homes will be turned into smaller to quite small multi-unit rentals, as has happened in the pas when economies and neighborhoods collapse. Converting to small multi-units tends to turn neighborhoods into slums, with poorly maintained properties.

Sporthog ,

Ronan,

Your point about using a common metric to compare assets of different classes is well made. In addition your point about different investors having different costs is understood as well.

What I find annoying is the disparity between theory and reality in this upside down economy.

If a house in Firhouse was priced at 400K in 2006, a 80% drop in peak to trough would mean that house is worth 80K today.

Does anybody seriously believe that they could buy a plot of land in Firhouse, build a 3 / 4 bedroom house (1300 sq foot) on it, and turn a profit for 80K? A double oven alone would nearly cost 800E.

When Dublins first million punt house went on the market in 1998, a builder was asked is there really 1 million worth of materials in the building. The answer of course was no.

Just as the price of property bore no relation to its actual material value during the boom, it also appears to be the case during the bust.

Some properties now must be selling below cost to build them.

Yields or Bust ,

@Sporthog

Your point above in relation to the house ‘price’ in Firhouse is interesting and goes to prove why the property market is not a real market in the sense that it is primarily driven by the availability of credit. Without leverage/credit prices should in theory fall to where cash only buyers would be willing to buy and that

price would make yield comparisons a lot more relevant than is currently perceived by the market and the lending banks.

I have said it many times before but 98% of housing transactions would simply not occur without the aid of a lending bank. It is therefore the case that banks in fact largely price property because by their lending polices against them as security they say yeah or nah to the deal based on their own pricing metrics (most of which I believe are wrong). Those in control of the leverage in a leverage driven market control the prices.

Given that the minimum falls one is likely to see in the current envirnoment is 66% from top to bottom its fair to say the banks have mispriced the asset class (their models have failed )when we know falls will in many parts of the country be significantly larger than 66%.

Given this mispricing error why is there such an outcry obout debt forgiveness? The banks mis priced the asset class for a decade i.e. failed miserably to do their job and financed thousands upon thousands of additional properties which lie idle on the market ensuring prices have no prospect of revovery because 1. There simply is not enough cash only buyers 2. The banks cannot afford to lend because the crazy capital restrictions imposed upon them 3. Economic prospects are highly uncertain.

In simple terms all whats required for the normal fuctioning housing market (odd as it is) is missing.

Given this situation quite what the true cost of a house is, is really anyones guess. If the market has stopped and their is no demand then in theory no price is low enough so comparisons to land,material and labour costs are largely an academic exercise. The market doesn’t want additional supply no matter what the price – for now.