Perhaps you’ve seen it on Twitter or had it emailed to you, the New York Times’ fancy chart outlining “Europe’s Web of Debt”. Writing in the April 30 New York Times, before the EU had outlined its almost $1 trillion financial security package, Nelson Schwartz attempted to set out the relationship between the future of the euro and the Greece/PIIGS situation, using cross-border debt statistics. Complete with now-viral graphic by Bill Marsh, the point of the article was that the financial systems of all EU member states are so intertwined, that Greece’s fall would herald the likely collapse of the entire eurozone.

While an interesting use of data visualization, the problem with the graph is that it uses the wrong figures! It looks at all debt, no matter who took the debt out. (And even then, some of the figures aren’t that impressive: total lending by Greece to other PIIGS countries? $2bn.) For example, Nelson and Bill should have been concerned that their graphic showed Irish debt at almost the same level as Spain, a country ten times its size. If they’d divided the debt by population, they might have been a little suspicious to read that Ireland’s citizens apparently owe an average of over $500,000 each! Trust me, if the Irish government had debts of the guts of a trillion dollars, I’d be the first to be proclaiming the end times.

Because they didn’t look behind their statistics, however, the graphic is about as informative as CNBC’s now infamous unveiling of Ireland as the world’s most indebted country, with debts worth 1300% of GDP! The point that both miss is that you can’t look at debt liabilities without looking at corresponding assets.

That is why the markets are worried not about all debt. They are worried particularly about government debt, because typically there is no corresponding asset. And it turns out that there is a difference in scale between all debt and government debt – a huge difference in some cases. It turns out that, in the case of Greece and Italy, only about half of all debt is government debt. For Portugal and Spain, it’s only one fifth of all debt. In the case of Ireland, just five percent of all its debt is general government debt.

The reason is hardly a secret: Ireland is a major international financial services centre. The international financial services sector plays such a large role in the Irish economy that it even gets its own set of statistics from the Central Statistics Office. At the end of 2008, the sector had debts of almost €1,650bn. Don’t worry though – it also had assets worth about €1,660bn.

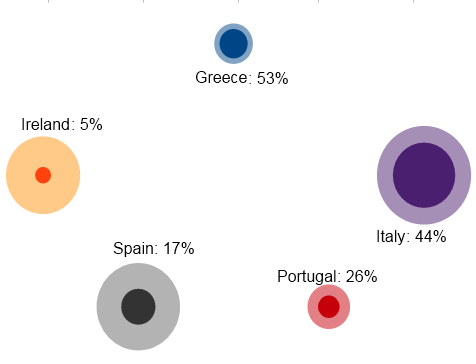

So, what might a revised “Web of Debt” look like? Taking the totals that the NYT used, attributed to the Bank for International Settlements, the graph below corrects them using the percentage of external debt that is government debt, according to the World Bank/BIS Quarterly external debt database. (Incidentally, a good indication of how inexact debt figures are is given by the fact that the World Bank/BIS figures give very different totals than the ones used by the NYT.) The partly-transparent larger circles are the NYT figures, the smaller circles are those figures scaled down to just public debt.

As you can see, the total debt figures exaggerate the situation for all countries, in particular Spain and Ireland, which have sizeable international finance sectors. A more useful statistic would have been to look at total government debt – or better yet total government debt per citizen. This ranges from $10,000 per head in Spain to $27,500 in Greece. Or – better still – take account of how the per capita debt compares to average output. Based on these figures, the ratio of (per capita) public debt to GDP in late 2009 was about 50% in Ireland and Italy, as low as 30% in Spain and above 90% in Greece.

The NY Times graphic was basically trying to be too clever. By looking for the smoking gun in the debt statistics across eurozone countries, it misses the much more obvious smoking gun: these countries are worried because they share a currency. And by trying to explain the UK’s concern at current developments through looking at its lending, the New York Times has missed the more obvious point that the UK is concerned not about its lending, but about its borrowing!

Joseph ,

I wonder which graphics were shown to the EU leaders at the weekend?! There would have been some presentations. I would love to get my hands on them.

Jagdip Singh ,

Ronan,

Did you ever see the UK Channel 4 comedy “The Day Today” where spoof business correspondent, Collately Sisters, reels off the make-believe day’s business news in a very confident but utterly ignorant way. And then employs grahics like “The Currency Cat” to simplistically explain currency movement which just confuses the nonsense. Favourites included the make-believe report that Italy and France swap currencies but the reports were always peppered with utterly meaningless statistics and commentary.

I guess the comedy was parodying confident, graphic heavy business reporting and the use of huge yet undefined numbers – well worth a look, if you can see it on youtube.

Thank you for doing what any decent (nay, responsible) finance or economics reporting should do and that is place numbers in a context that is relevant to the audience and explains that context. That CNBC chart did so much harm to our State at a social level and possibly in an economic way, all for the sake of a cheap marvel that Ireland has a huge gross debt level without placing it in the context of assets or sector.

Looking at your graph above, we don’t look too bad in total terms though as you say once you put our 4.5m souls against Spains 40m the per capita is worrying.

Ronan Lyons ,

Joseph and Jagdip, thanks for the comments – will search for that video clip, sounds good!

For those interested, this got picked up first by the Financial Times Alphaville blog, http://ftalphaville.ft.com/blog/2010/05/11/226991/dude-wheres-my-web-of-debt/ and then by Felix Salmon at Reuters:

http://blogs.reuters.com/felix-salmon/2010/05/11/europe-its-more-than-just-government-debt/

The latter was less convinced by my graphic, so I might take the opportunity to respond to a couple of comments.

Felix writes: “But we’re still a long way from the point at which markets are more worried about government debt than about corporate debt, at least if you’re measuring such things using credit spreads. Investors still believe in the concept of the “sovereign ceiling”, and it’s still extremely rare for any corporate, including a bank, to be able to borrow more cheaply than the government of the country it’s in.”

There’s certainly merit in this point, but I would add two things:

(1) that sovereign debt markets, e.g. for the UK, are more worried at the first-round effects of the current future stream of sovereign liabilities at the moment than any contingent liabilities via bailing out of UK lenders to Greek defaults; and

(2) that the last point – the sovereign ceiling – applies certainly to domestic banks but recent experience suggests that it doesn’t seem to have applied to internationally trading financial houses, at least if Irish experience is anything to go by. Hence the necessary and ongoing bailout of the Irish domestic banks, while their significantly larger (in terms of assets) foreign-owned counterparts around the corner in the docks survived. Indeed, banks such as Depfa, Fidelity and StateStreet would probably cast a wry smile at the suggestion that Ireland would ever be in a position to be their lifeguard!

The “Don’t worry” in the article above is to be read in that light (where’s the sark mark when you need it!).

stephen nally ,

Does your figure for Irish Govt debt take into account the money required to bail out the banks? This will be 50 to 80 billion euros and is a lot more than 5% of GDP.

John ,

Greetings from Greece,

Im a local equities broker/investor and i was impressed by your analysis. You are already semi-famous in the investment blogs here…

I was wondering where can i get the figure of total assets in Greece, like you found the equivalent Irish one ??? You see we are trying to convince some foreign investors about the relatively bigger wealth of Greeks compared to other indebted Europeans, as a result of high real estate ownership, low credit expansion and off the records economy…

Thanks in advance and if you find something relevant please dont hesitate to email me or post a link here.

Best Regards

John

Ronan Lyons ,

@Stephen

They’re not my figures, they’re from the BIS/World Bank! (Which is a no, as you’re talking about likely future debt, while the WB/BIS only measure realised debt liabilities.) Incidentally, those will be liabilities with assets, unlike the general government deficit. Getting peak-€80bn property for €40bn might not be the safest bet in the world, but it’s certainly not guaranteed to lose money either!

Just a quick clarification, the 5% is not 5% of GDP, it’s 5% of the total liabilities in the country which are state-owned.

@John

Honestly, flattery will get you everywhere! The Irish figures are compiled by the Central Statistics Office here – so perhaps it’s worth checking with your equivalent. More generally, your Balance of Payments may have capital accounts details, which could have some of these statistics too. The European Commission also has some stats, for example: http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/Household_financial_assets_and_liabilities. Overall, though, the full extent of the point you’d like to make is probably the preserve of a local research institute, as backing out wealth from the black market takes a range of techniques (e.g. using electricity consumption per capita).

John ,

great thanx a lot mate

Ben ,

Hi Ronan,

Enjoyable as ever.

Though could they not be raising two issues (perhaps without realising it):

1. Contagion effect. The “web of debt” highlights that Europe is interconnected through private/public debt, and a default could ripple through the EU through the banking system. The point being that any Greek default could cause a solvency crisis within the EU’s banks, or could at least hinder Europe’s recovery by limiting their banks ability to lend by eating up their “capital”.

2. A liquidity point. I doubt that countries have matched maturity profiles on their balance sheet – so if there assets are long term, and their liabilities short term they could get in a squeeze? So a spike in short term funding rates could push them insolvent.

Just one final clarification: my understanding of the BIS figures is that they measured cross-boarder activity so do not capture any domestic figures. So Ireland bailing out the banks would not appear in the figures unless the Government was unable to raise the sums domestically.

Best,

Ben

stephen nally ,

Hi Ronan,

“They are worried particularly about government debt, because typically there is no corresponding asset”.

Of course in the case of government debt, the corresponding asset is the population of the country. (I’m joking, but it’s sort of true).

Thanks for the previous clarification.

Ronan Lyons ,

Seems I’m not the only one not fully impressed by the chart:

http://junkcharts.typepad.com/junk_charts/2010/05/untangling-europes-debt-web.html

Noli Irritare Leones » Blog Archive » Another round up on Greek debt and the future of the euro zone ,

[…] troubling is Ronan Lyons’ argument for why Ireland isn’t Greece; Ireland’s debt lies far more in the private sector and less in the public sector. Lyons […]

How much trade has been lost in the Great Recession? | Ronan Lyons ,

[…] Browse in World Economy « Untangling Europe’s “web of debt” […]

Credit Card Tips ,

I wonder which graphics were shown to the EU leaders at the weekend?! There would have been some presentations. I would love to get my hands on them.

daizy

AndyC ,

Ronan

How much are these 1.6 trillion in “assets” actually worth?

Whoops…..

AndyC ,

Ronan

Do government debts also appear on the asset side of the ledger?

If so, hey it all comes out to 0, so whats to worry about.

🙂

Visualizing the news, literally « the maniblog ,

[…] reactions to the case studies: http://www.ronanlyons.com/2010/05/11/untangling-europes-web-of-debt/ http://ftalphaville.ft.com/blog/2010/05/11/226991/dude-wheres-my-web-of-debt/ […]