Since the adoption of entirely fiat money, the relatively even balance between periods of rising and falling prices has given way to a secular inflationary trend. However, year-on-year inflation in the eurozone actually turned negative in May 2009 and prices continued to fall for six months. The way the eurozone calculates its inflation, mortgage interest repayments are excluded so the figure is all the more remarkable given the absence of one of two main drivers of falling prices at the height of the crisis (the other being collapsing oil prices in early 2009).

In the last few months, though, inflation has re-emerged and the measured price level in the eurozone was 1% higher in January 2010 than a year previously. What is likely to happen inflation over the rest of the year? To get an idea, it’s important to understand what is measured in HICP, the EU’s standardised inflation measure, and what drives it.

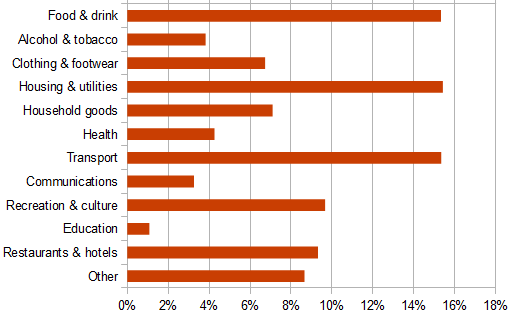

Despite the services-based economy in which we live, goods still play a significant role. Food and drink make up almost 20% of the EU basket of consumption used for calculating inflation. Another 15% comes from utilities, which are energy-intensive. In fact, just under half of the HICP basket comes from goods which ultimately come from commodities. The breakdown of the percentage each type of good contributes to the eurozone basket is given in the graph below.

Therefore the prognosis for inflation over coming months will depend on commodity prices. How this works is essentially a slower and more diluted version of higher oil prices lead to higher petrol prices at the pump. The dilution factor is what proportion of total costs are made up by wages (and other factor payments like rents). (In that sense, commodity prices also affect the price of services, but more indirectly – people who provide services have to pay their electricity bills.)

Some insight on the prices of commodities comes from the World Bank, which compiles a monthly “Pink Sheet” of commodity prices. It is typically used when analysing developing countries who are dependent on particular crops for export revenues. The prices can also shed light into eurozone price movements, though. At the height of economic uncertainty, significantly lower commodity prices in 2009 were a force pushing consumer prices down. For example, energy was over one third cheaper in 2009 than in 2008. Food prices fell by 17%, raw materials by 14% and metals and minerals by 28%. This collapse in prices was very welcome for Central Banks, as it gave them more leeway to cut interest rates. Of course it was not entirely unexpected – prices fell because there was no demand, with the future looking so uncertain.

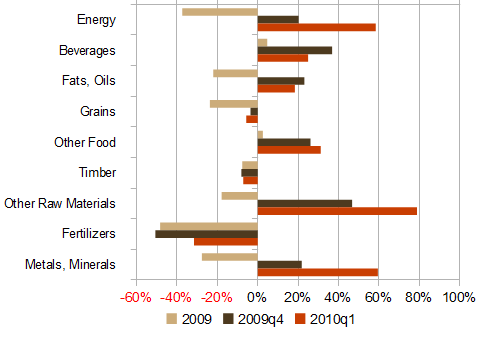

However, since mid-2009, prices have been increasing steadily. The graph below shows the year-on-year change in prices for nine different commodity indices, for example energy (mainly oil and gas), fats and oils, grains and timber. Whereas across the nine headings, the typical rate of inflation in 2009 was -22%, by late 2009 it had already risen to +22%. Figures for January and February this year show that these inflationary pressures if anything have strengthened slightly:

- Prices of metals, minerals and energy are 60% higher than a year ago.

- Rubber and cotton prices are 80% higher.

- With the exception of grain prices, the prices of food and drink commodities are rising strongly – 20-30% year on year.

The point is not to be alarmist. Hyperinflation is not a risk and is one of the few economic phenomena that is well understood: it’s how a country with large debt in its own currency gets out of a fix. But already prices of some foods and raw materials are above their pre-crisis levels. This puts pressure on prices which in turns puts pressure on banks whose mandate is to obsess about inflation (and not economic activity), such as the European Central Bank. Increasing interest rates will negatively affect those with variable-rate debt, including mortgage holders and many businesses.

Pushing up interest rates to counteract inflation has, since the Great Moderation started in the early 1980s, been regarded as the single instrument for bringing about sustainable economic growth. The worry now is that the success of this strategy was based on a benign economic environment which no longer exists and that the current paucity of macroeconomic tools leaves any economic recovery in a fragile state.

For an excellent analysis of the current state of macroeconomics, entirely free of equations and relatively light on jargon, see this recent paper by Olivier Blanchard, Giovanni Dell’Ariccia and Paolo Mauro of the IMF. While the press focused on the suggestion of exploring a 4% inflation target, rather than a 2% one, the entire paper is worth reading.

Joseph ,

It’s not just commodities – plenty of other stuff is going up all the time. I’ve recently renewed (in Ireland) things like motor insurance, tax disc, health insurance, contents and home insurance, TV licence, etc. and they all cost more than last year! Commodities as you point out are a big danger though. I suspect we will see another spike in oil prices this year too. We are only a heartbeat away from a double dip I reckon once stimulus starts to dry up.

Olivier Van Parys ,

Really insightful piece Ronan. Looking forward to your talk in Google. I hope I’ll be able to make it.

Owen Rooney ,

A good post, Ronan. However, it’s worth pointing out that increased eurozone inflation could actually be quite desirable for Ireland at the moment. We’re currently going through a rather difficult, but necessary, period of deflation to regain competitiveness. Our deflationary pressure, though, isn’t for a nominal reduction in costs here, but rather a relative reduction in costs compared to the rest of the eurozone. Hence, for every point increase in inflation elsewhere in the eurozone, we only need to go through one less point of deflation than we otherwise would have here in Ireland.

It would certainly be a worry if inflation increased enough for the ECB to start raising interest rates, but until that happens we should be quite happy with eurozone inflation moving into positive territory.

Pat Donnelly ,

Commodities will continue to increase as a proportion of costs, I think, especially as the fiat currencies devalue. Not a pretty prospect.

The good thing is, as you say elsewhere, that Ireland can increase service earnings, particularly as BHO lowers the boom on tax avoidance, Ireland is likely to gain employment and spin off.