This week’s daft.ie report revealed some intriguing findings in relation to the current state and trajectory of Ireland’s property market. As was discussed yesterday, for example, while east peaked earlier than west, north has fallen further than south since the peak. One of the conclusions of both these findings is that Dublin and its commuter counties have experienced falling prices first and deepest.

This goes somewhat counter to conventional wisdom, although conventional wisdom hasn’t done too well in the last couple of years it must be said! Conventional wisdom would suggest that whatever about the Section 23 wastelands and ‘ghost estates’ of Ireland’s mid-West and elsewhere, the capital – as focal point for Ireland’s public and internationally trading sectors and their upstream and downstream employers – would be alright, at least in relative terms. In an Ireland where prices fell 20% in the crash, Dublin might be 15% or so while “somewhere else” would be worst hit.

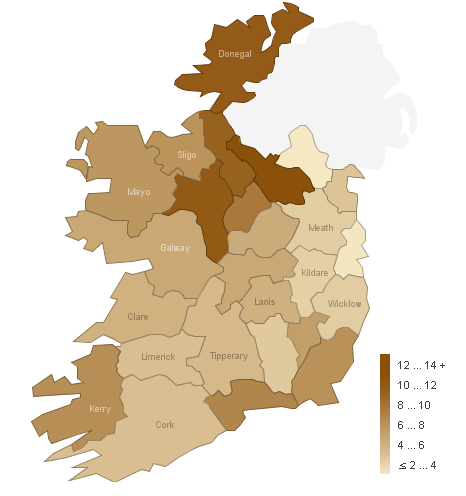

While easy to mock, there is something in this from a long-term perspective. I have argued before on this blog – in December and again in February – that the ‘overhang’ of property looks a lot worse, even with just approximate calculations, in the mid-West than in the capital or indeed any of Ireland’s five cities. With stock falling slightly in the last six months, no harm revisiting the ‘overhang per county’ chart again, with stock levels taken from today.

Again, the message is pretty clear – Cavan, Donegal, Leitrim and Roscommon have significant property ‘overhang’ compared to the likes of Monaghan, Kilkenny and Dublin and its commuter counties. The conclusion that I would draw is as follows: as it is home to the vast majority of Ireland’s top earners, to the extent that Dublin’s property market priced in expected future GDP and wage growth – i.e. confidence – it is to be expected that prices will fall most there, as confidence collapses from a high in late 2006 to a low in 2009. (The implication is that prices would be more likely to turn around faster, were confidence to somehow rematerialize.)

Taking a longer term perspective, though, unless prices adjust faster in places like Donegal, they face the prospect of longer peak-to-trough. Indeed already, some on theproperty.com are fretting about the future of places like Roscommon. On a thread entitled “Rents getting very cheap in the west“, mikewest’s message makes glum reading for property holders in Roscommon:

The house prices down here are still utterly crazy because something the developers never noticed is that there is shag all work in Co. Roscommon and if you dont have work then nobody wants to live there. People talk about the ghost estates in Longford and Leitrim but they don’t hold a candle to Roscommon. Every village and town has empty or virtually empty estates and / or apartment blocks…

There is another teeny tiny problem in the west. There are one or two houses too many in some towns right now so asking prices for rents are really more aspirational than actual but not quite as aspirational as asking prices for houses.

Joe Murray ,

I have three methods of calculating the value of the standard 3 bed Semi in Dublin, the three methods are unconnected but actually give roughly the same answer.

——————————————————————————–

Method 1 , Houses as an investment

If a Dublin-3-Bed-Simi was an investment the income would be rent, the current rents are about 1,050 per month. To give an investor 1,050 a month at 8% the house would have to valued at 160,000.00.

This is the normally accepted international return.

——————————————————————————–

Method 2 , History of Price falls. (Morgan Kelly, UCD)

He says that on average in a bust house prices lose 70% of what they gained in the boom resulting in a drop in house prices of c50%. However Ireland has the potential to be worse.

Deciding when the boom started is not that easy. But if a house was worth 100k before the boom started,increased to 350k at the peak then c70% of the gain of 250k is expected to be lost i.e 175k. This would bring the 350k down to c175k. This is broad and complex but the figure is directionally in line with other estimates. This takes inflation etc into account.

This takes into account 48 boom/bust cycles in Europe in the pas 50 years. This puts the average value of the Dublin-3-Bed-Simi at 175,000.00 (best, may be lower)

——————————————————————————–

Method 3 , Used for 70 years, tried and trused , based on income.

The price limit used by all mortguage lenders up to 1990 was value of home = ((Main-Wage*2.5)/0.80). That is a, home should never exceed 80% of the main wage multplied by 2.5.

The average wage taken was that of a Civil Servant/Teacher on mid-scale wage 52,000 pa. This pegs the value of Dublin-3-Bed-Simi at (52,000*2.5)/0.8 = 162,000.00

——————————————————————————–

The average and therefore the value of Dublin-3-Bed-Simi today is 165,000.00 Euro (best possible value)

Until this number is accepted we cannot move on. This number is absolute and cannot be otherwise. It’s a best possible figure and may be lower.