Housing and Ireland’s competitiveness jigsaw

Housing should always be primarily a social issue. If the country cannot house its own citizens, this should be disturbing enough for remedial action. However, most people would acknowledge that, with everything the last five years have revealed, when housing is only an issue of social justice, it doesn’t feature high enough on the agenda. What needed to happen was for housing to become an issue of international competitiveness. Unfortunately, this has now happened – but fortunately, this means that it is far more likely to feature on the radar of key Ministers, policymakers and the Cabinet.

Housing has traditionally been regarded as domestic issue. Just as firms based in Britain typically ignored EU bashing in the media, as they didn’t want to meddle in a local issue, so firms based in Ireland typically focused on more obvious inputs to competitiveness, such as corporate tax rates and membership of the European single market. No firm wants to get a reputation for meddling in domestic affairs. However, firms based in both countries have realised that ignoring a political issue can be precisely the worst course of action. In the UK, firms are now scrambling to respond to the referendum result on EU membership last year. The powerhouse of the entire British economy – the hub of financial services centred in the City of London – could have its foundations taken away in coming years.

And in Ireland, large employers here have become increasingly noisy on the issue of accommodation. To see why, you need look no further than the National Competitiveness Council’s ‘Cost of Doing Business’ profiles. The standard FDI project coming to Ireland now is a services, or perhaps R&D, facility and for such projects, labour costs make up three quarters of their overall costs. This is a sea change from the 1980s and 1990s, when the IDA’s main targets were large manufacturing facilities, where half of all costs were imported inputs.

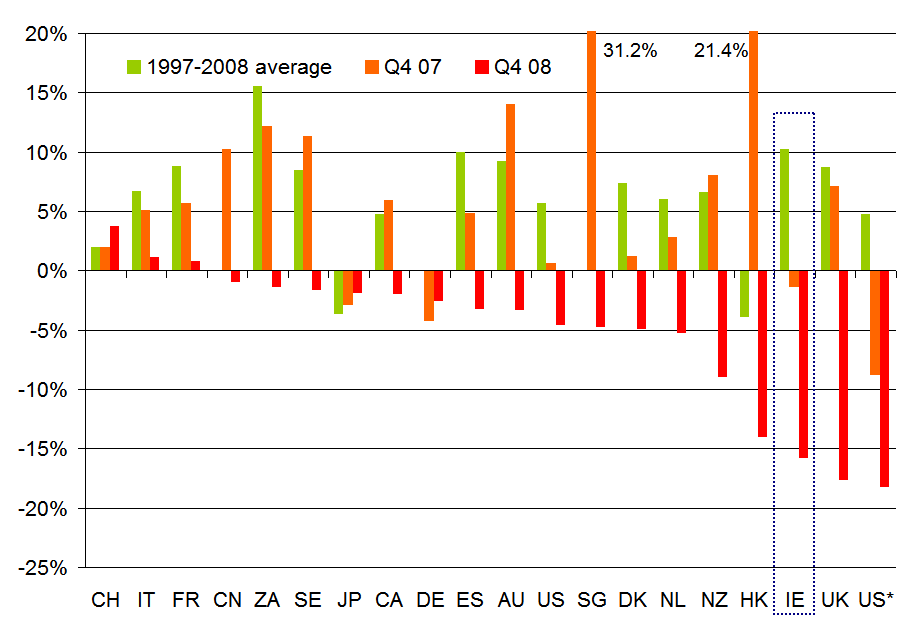

And the single most important item of spending is housing, which typically makes up one third of disposable income in cities. So of the three quarters that relates to wages, one third is down to housing. This means, simply put, that housing is one quarter of Ireland’s competitiveness. Therefore, when rental prices in Dublin rise by 65% in less than six years – or sale prices rise by almost 50% in less than five years – this does not just put pressure on those on lower incomes. It also erodes a key source of wealth for this country: jobs serving foreign customers.

When Irish-based subsidiaries of foreign-owned firms have to take unusual steps, such as offering bonuses to existing employees to temporarily house new ones, while they find their own homes, it is only a matter of time before HQ finds out that Ireland has a problem. In a world where capital is chasing skilled labour, and where skilled labour wants to enjoy all the amenities offered by a vibrant city, it is the cities that can house growth which will win. Irish cities are hopeless at accommodating growth currently. Dublin has now been allowed to grow up and so, since the 1980s, has started to sprawl. Commuting, though, is consistently ranked as people’s least favourite use of time and is not a viable long-term way of life.

But it is not just Dublin that is suffering. Cork and Galway are home to very large employers, with thousands of workers, in particular in pharmaceuticals in Cork and in medical devices in Galway. But both cities are struggling to accommodate the growth. One home was completed in Galway City Council in May last year… and while this is an extreme example, only 52 new homes were started in the city in 2016. In a rapidly growing city of 80,000 people, it should be adding closer to 800 a year – over 15 times the current level of activity. In Cork, just 310 new homes were started. In a city with a population of 200,000 people, it should be adding 2,000 new homes per annum.

And the problem is not limited simply to the building of homes, although it is clearly at the heart of the issues. Access to schooling, childcare, public transport and infrastructure are all related to the decision of where to live and work. Back in Galway, traffic has become such an issue that there are stories of three-hour commutes after work from the east of the city, where most of the business parks are, to the west of city, where much of the housing is. Three hours to cover ten kilometres is not sustainable.

Housing is and always will be first and foremost an issue of human rights. In a modern, high-income country, access to housing should be guaranteed by a system of subsidies that top up a family’s means to meet their need, where appropriate. But housing is also a competitiveness issue. If we don’t figure out how to build enough homes quickly, it will start costing the country jobs.