The Daft.ie Rental Report out earlier this week found that rents are still rising at double-digit rates around the country. Both nationally and in Dublin, this is the sixth quarter in a row that rents have been at least 10% higher than a year previously.

Outside Dublin, rents are now roughly one half higher than their lowest point, which was in early 2012. In Dublin, the increase has been even greater – rents have risen by three quarters from their lowest point in late 2010.

While South County Dublin, and Dublin 14 and 16, have seen rent increases of about two thirds, in Dublin 8, rents have increase by more than 90% from their lowest point. It is likely that within the next six months, one of the Dublin postcode – possible Dublin 1, 7 or 8 – will have seen rents double within eight years.

A natural reaction for many to this is to demand limits on rent increases. This is akin to a Minster for Health banning people from having high temperatures. High rents, like high temperatures, are not the problem – they are the symptom of the problem.

Fair enough, you might think, but I’ll still take a paracetamol when the need arises, thank you very much. And if that’s all that controls on rent increases did, then there would little to worry about.

The problem is that controls on rent increases turn the market into a system with insiders pitted against outsiders. Those who have a lease keep it. Those who have to move, either into the city or to somewhere new because circumstances change, lose out. To extend the paracetamol analogy, would you take one if it meant that your headache would go off and afflict someone poorer than you instead?

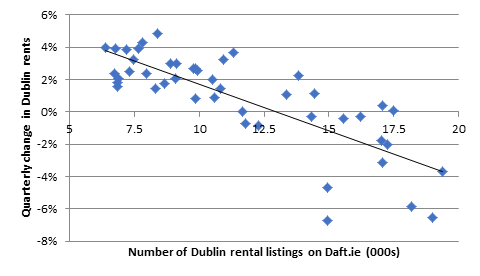

To solve the underlying problem, rather than just the symptom, the whole country – but Dublin in particular – needs significantly more supply of rental homes. The last time rents rose rapidly, in 2006 and early 2007, there were an average of 10,000 rental homes in Dublin posted on daft.ie each quarter.

Over the following five years, there were a variety of different totals posted each quarter and taking the picture as a whole, it reveals that, when roughly 14,000 Dublin homes were listed in a three-month period, rents were stable. More than 14,000 meant that rents fell (2008-2010 in particular), while less than that total meant rents rose.

In late 2012, the total number of listings in a three-month period fell below 14,000 and it has continued to fall since. Since the start of 2014, there has been an average of just 7,500 Dublin homes posted for rent every three months. It is therefore completely unsurprising that rents have risen consistently over that period.

Given that the rental sector in Dublin is roughly 50% larger now than a decade ago, it is realistic to think that rents will not start to fall until the number of listings in the capital exceeds 15,000 in a three-month period.

But where will these extra 2,500 rental homes every month come from? They won’t come from the stock of owner-occupied homes – those are also in short enough supply. There are some quick wins dotted around the capital in the form of vacant homes and there is also potential for over-the-shop conversions.

But in each case, this will take time and the potential should not be overstated. Even the most optimistic estimates of over-the-shop space puts the total number of new homes at perhaps 5,000 or 6,000 – roughly two months supply. Similarly, even a halving of the vacancy rate in County Dublin would only bring a few months on to the market.

Obviously, either or both of these would certainly be welcome. But there are reasons that these haven’t happened already, despite an almost-doubling of rents in the capital. The poor utilization of our built stock stems from a heady cocktail that includes – but is not limited to – low property taxes, incomplete registry of title, conflicting regulations and weak local authorities.

Tackling any one of those issues would take years, let alone all. Thus, while local authorities and the national policymakers should not ignore vacancy, the real solution lies in building new homes. With an average lease length of roughly 3 years, this means that the city needs about 800 homes a month – or an apartment block of 200 homes opening every week.

With only a tiny fraction of that currently being built, the challenge for policymakers is to transform the city’s construction sector into one of the best in the world at building apartments.

==

An edited version of this post was originally published in my column in the Sunday Independent.

Leave a comment