As with every New Year’s period, the end of 2012 and start of 2013 has brought a significant amount of taking stock, from the global economic outlook down to the prospects for the Irish property market. The “2012 in Review” Daft.ie Report has been released and marks an expansion of the range of information covered in the reports.

In particular, the report includes information from the Property Price Register in a like-for-like manner. As NAMAwinelake has noted, this is the first ever house price index for Ireland that has both the following features: (1) it is hedonic (i.e. compares like with like), (2) it includes both cash and mortgage-based transactions (current indices are based on either listings or just mortgages).

Asking price, closing price

An important question is how closely does it match one based on asking prices? This is important for two reasons. Firstly, the Property Price Register only goes back to 2010, so for example for those who bought in the latter stages of the Celtic Tiger to understand the scale of their negative equity, other sources will be needed to understand what happened up to 2010. Secondly, as explained recently, quantity and quality are highly related when it comes to property market reports, so to have county- or size-specific findings, we will need more voluminous sources than the Residential Property Price Register (RPPR). A comprehensive dataset of listings (such as the daft.ie dataset) is of sufficient size to estimate in a statistically reliable way not just differences in prices over time but also across space.

Falling – but not so fast

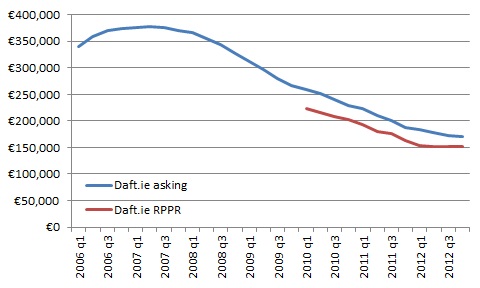

So, how do the two measures compare? The first graph above shows the average house price (using county population weights) according to both the asking and price register datasets. It is clear that the average price from the price register is below the average list price – with the gap 13% on average. (Slight digression: it is not correct to interpret this 13% as the average gap between what someone asks and what someone gets, as transactions and listings do not automatically match up. Transactions from December are associated with listings from earlier in the year.)

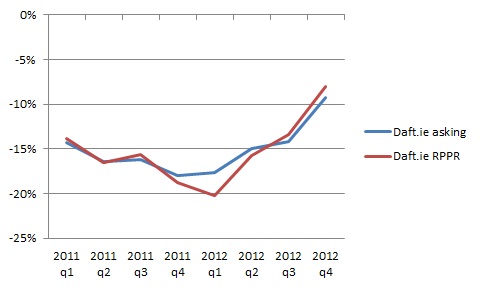

The second graph, below, compares the annual rate of change in house prices, as measured by asking prices and the price register. The key contribution of an index is how it measures changes over time, so this is the key comparison between the two. What is striking is how similar they are (the correlation between the two is over 97%). Both suggest that the year-on-year fall in prices accelerated from 14% in early 2011 to close to 20% by early 2012 – but that by end-2012, the rate of decline was below 10%.

So the conclusion seems to be that asking prices do actually do a very good job in mimicking transaction prices. For a range of purposes, from estimating negative equity to valuation of amenities, this is good news.

Town and country

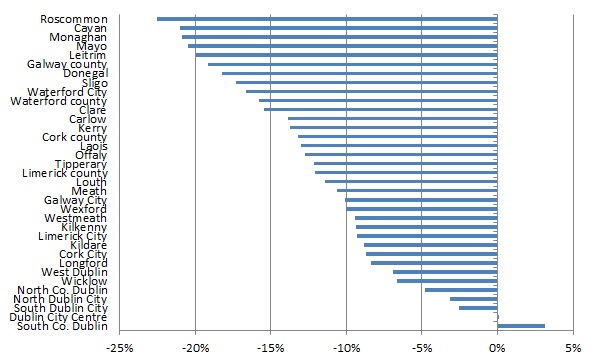

But that is the answer to a relatively specific question. The broader question is what state is the property market in, as 2012 finishes and 2013 starts. The first graph above – particularly the RPPR line – points to a slow-down in price falls. Taking on board the point made above, that asking prices can shed light on regional trends not available form RPPR figures, asking prices tell us that the annual rate of change in prices varies hugely around the country.

This is shown in the third graph, below. In rural property markets of Connacht and Ulster, prices are falling at rates of close to 20%. In Dublin, on the other hand, there are actually some segments – in particular, South County Dublin, which might be regarded as a bellwether (or alternatively, exceptional) – where asking prices are stable or even rising.

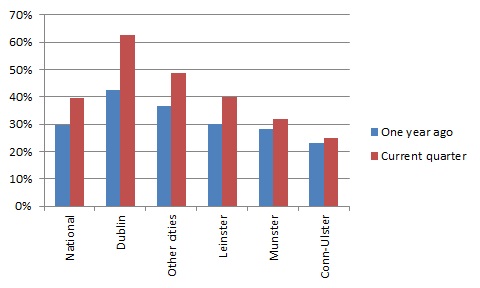

This picture of stabilising prices in the capital is reinforced when one looks at measures of market activity. The fourth and final graph shows the proportion of properties sale agreed (including those subsequently taken off the market) within four months of their original listing. The graph shows the figure currently, compared to the figure from a year ago.

Finding a buyer

While there is an improvement in all regions, that improvement is being driven by Dublin in particular, where almost two thirds of properties find a buyer within four months, and to a lesser extent by the other cities (half find a buyer). In Munster, Connacht and Ulster (outside urban areas), between two thirds and three quarters of properties are still on the market after four months, a proportion that has not fallen significantly in the last twelve months.

So on the face of it, the signs from Dublin are unambiguous – and one may conclude that 2013 will be a new dawn. The fly in the ointment is the extent to which the Government removing itself from fiddling around with the property market had the effect of fiddling with the market one last time.

Until the end of December, first-time buyers were entitled to generous income tax rebates on their mortgage interest relief. The removal of this very generous subsidy may have had the effect of taking some of the demand from 2013 and cramming it into 2012. The result may be that even the Dublin market finds it tough in the first half of 2013 and maybe even beyond, as would-be buyers also factor in a new annual property tax.

2013 might yet turn out to be not a new dawn, but the morning after the night before, a hangover (albeit on a much smaller scale) following the end of the (interest relief) party. My sense is that, for the major cities at least, this will not prove to be the case. But who knows?

Happy new year!

News 4 Jan – Collapso – Tracking Irish property prices ,

[…] house prices drop by up to 10pc A new dawn or the morning after the night before? Swing in interest rates will torpedo Trackerville Investment in property back on the cards this […]

patrick ,

i have a 3 bed house in wexford would it be agood idea to hold onto it untill i retire in 20 years time