This year, I’m teaching first year undergraduates at Trinity. I’ve a gang of about 400 and they’re mostly students not interested in studying Economics after this course. My job is to try and make them economically literate as they head off into the world. Part of the course is about macroeconomics in their everyday life: how the jobs market works, how the housing market works, that kind of thing.

But the first part of the course is about giving them the grounding to understand the bulk of major headlines at the moment. Unemployment, negative equity, emigration, bailouts, quantitative easing, bondholders, recessions and business cycles… it is hard these days to be an educated citizen without a thorough grasp of what monetary and fiscal policy are and indeed how the modern banking system works.

Back to school for some

Surprisingly hard, it turns out, to be an educated policymaker or politician these days too. Leaders of twenty-five European countries have signed up to a fiscal compact that would, I hope, be soundly trashed by a II.1-standard student if I set this in the summer exam.

Any first year undergrads that have been paying attention to my lectures will know that there is a limited number of tools available to policymakers to smooth out the bumps (recessions) that modern economies face as living standards grow from one generation to the next. Trade policy – using tariffs or quotas to protect domestic producers (at the expense of domestic consumers) – was a classic response but is not an option for members of the World Trade Organisation.

The next most popular instrument has traditionally been monetary policy, in particular a Central Bank setting the interest rate in an economy. The lower the interest rate, the cheaper it is for firms and households to borrow – and thus economic activity (even if it’s just buying homes) should be stimulated. Members of a currency union, however, such as Wales within the UK, Florida within the US or Ireland within the Eurozone, don’t have this option either.

In the middle of a huge recession, it may seem odd that most economies (particularly if you view the US as a collection of cities and states at very different points in the business cycle) have no recourse to either trade policy or monetary policy. But there is clear justification for both: trade policy is all about protecting domestic producers at the expense of domestic consumers (and producers elsewhere). Having your own currency and interest rate exposes you to the vagaries of international exchange rate markets, meaning – as older Irish borrowers know all too well – high and volatile interest rates, which reduce investment.

The importance of fiscal policy

This leaves just one set of tools for policymakers to smooth the ups and downs that modern economies inevitably face: fiscal policy, the government’s taxing and spending decisions. Given that spending has to rise in bad times and fall (at least relatively) in the good times, the watchword is discretion. You need judgement to be exercised, based on context, when thinking about how to use fiscal policy.

Unfortunately, though, the Fiscal Compact has gone the opposite way. It is as though it has been designed by diehard fans of the recent fashion in monetary policy for rules and automatic mechanisms, people who think that what worked so well in one area (by ‘well’, I mean sort of well at least until the Great Recession came along) can be copied and pasted into another area.

Fair enough, you might say, but if the rules are good ones, then what’s the worry? Unfortunately, the rules are populist but economically illiterate. For example, the start of Article 3 of the Compact states the overall aim: “The budgetary position of the general government… shall be balanced or in surplus.” In brief, the EU Fiscal Compact takes the last remaining tool for stabilising the economy away from policymakers.

EU to member states: borrowing to better yourself is bad

This is the country-level equivalent of telling a student that they can’t borrow to go to college so that their future earnings will be higher – instead they have to live within their means. Because countries, unlike households, don’t age and die, there is nothing wrong about having a national debt and not paying it back. In fact, unless there’s an abundance of natural resources, only a silly country would ever attempt the pain of paying back the principal of national debt, rather than simply roll it over and keep on growing until the debt is small.

Countries shouldn’t be just allowed to borrow ad infinitum – provided they are investing in projects that boost growth, they should be practically required to borrow. If a government’s capital spending is consistently boosting the country’s output by 5% a year, the markets are not going to stop that government from borrowing 5% of GDP a year, every year. But now the EU Fiscal Compact will ban such spending.

As long as current spending is in balance and capital spending is based on the boost it gives to future output, markets will lend. The trouble is that government finances have not been organised along these lines. In that vacuum, financial markets have come up with their own measures of sustainability, in particular the “primary surplus”.

Who’s measuring what now?

The primary surplus is government’s balance, excluding interest repayments. It is economically meaningless, with only the veneer of sustainability… “but if we didn’t have all this debt, we’d be fine”. But it is mathematically compelling, because it turns the focus to comparing the interest rate on national debt (say 6% if Ireland returned to the markets) and the economy’s growth rate (say 3% in a benign scenario).

Quite how this tool of necessity on the part of financial analysts, due to dereliction of duty by governments, has become one of the measurement tools of choice by governments is beyond me. But that is the lesser of two evils, when it comes to how bad a job EU governments are doing at putting their finances on a sound footing.

The other key measurement of choice – written throughout the EU Fiscal Compact – is deficit relative to “potential output”. Nobody actually knows what potential output is: technically, it’s the level of GDP that would have happened if the economy were in balance… which of course it never is, so how on earth do we know what it is? This didn’t, of course, stop EU policymakers from putting it front line and centre in the Compact. From the same Article 3: “the [above] rule shall be deemed to be respected if the annual structural balance of the general government is at [no worse than] a structural deficit of 0.5 % of GDP at market prices.”

Potential output and the potential for error

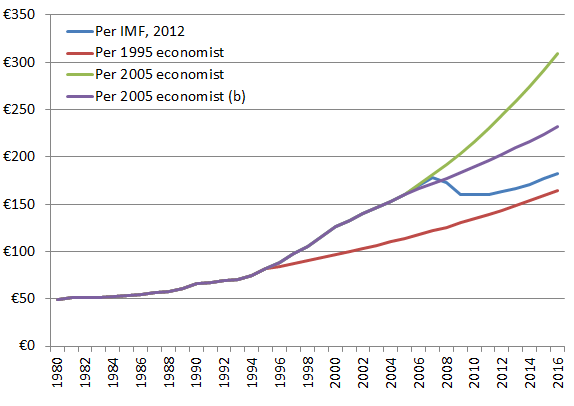

Why might economists say this is crazy? To show this, let’s consider “potential output” in 2016 – shown in the graph above. As of 1995, real growth in Ireland had been an average of 3.4% a year since 1980 so an economist at the time might have thought this a reasonable basis on which to project potential output. By this calculation, output would have been €114bn in 2005 and €164bn in 2016 (the red line in the graph above; I’m setting aside inflation to show that this point holds even in constant prices).

Output was actually €161bn in 2005 (in today’s prices) so our economist would either have to conclude that Ireland was running well ahead of its sustainable potential or that his model was wrong. So let’s say he thinks his model is wrong and that he now knows Ireland’s potential output grows by 6% a year (which is what it had done on average between 1990 and 2005). He now confidently predicts that potential output in Ireland in 2016 will be €309bn (the green line), almost twice his initial projection for 2016.

Well, as of last September, the IMF expected output in 2016 to be €183bn (the blue line). Even a more level-headed economist, as of 2007, might have thought potential output would grow by 3.4% a year (i.e. back at pre-Celtic Tiger rates), in which case potential output would be €232bn in 2016 (the purple line). Either way, the margin for error is huge. We don’t ever actually see “potential output” (heck, even calculating GDP is dodgy enough) so why would we put it in our constitution?!

In a way, though, the whole potential output thing – while attracting a bit of attention – is a bit of a sideshow. There are two main issues with the Fiscal Compact. Firstly, it brings rules to an area where there should be discretion – fiscal policy is not monetary policy and flexibility is key. Yes, governments don’t have a good track record on spending but surely we should tackle the cause rather than the symptom. Secondly, and much more worryingly, it is bringing the wrong rules. By thinking deficits are a bad thing, it will actually prevent the investment that – in the long run – will boost living standards and repay the interest on the very borrowings the EU is worried about.

And yet, despite all this, Irish citizens should vote yes! I’ll explain why next week.

PS. Similar sentiments are expressed by Karl Whelan here. A more benign assessment of the impact of the EU Fiscal Compact is given by Philip Lane.

James ,

I am very disappointed as I have always agreed with the authors general analysis’s.

While the article is good there are some glaring holes it seems to me, in an ideal world his argument is sound, and in the theoretical realm.

Consider the absence of consideration of the irrational markets, unless I am reading him wrong he is arguing that countries should be allowed to borrow unrestricted if they want to maximize growth. This assumes the presence of a market willing to lend to them.

So long as growth rates predicted are achieved then there is not a problem, but if state spending far exceeds income and the growth never materializes…..then the market will disappear and no money will be available.

Then obviously the country will quickly find it does not have the money to meet day to say requirements and a crisis will ensue.

It is a question of balance, balance between risk and reward. And responsibility and irresponsibility.

I will be voting yea for these reasons, and anyone making the argument against regulation following the greatest failure of regulation and it’s obvious effects should be more carefully in there thinking.

P.S. ….one final point…..

Do we want to allow the freedom to peruse maximum growth or protect against maximum collapse?

We need to think about what balance between these two is best for stability, just look where the pursuit of maximum growth during the “boom” brought us.

By we I am referring to Europe as a whole…….I don’t see a future world populated by giant emerging economies being a place we want to be isolated in alone on the outskirts of a Euro-zone.

Ronan Lyons ,

Hi James,

Thanks for commenting. I guess a different way of phrasing what I wrote above is as follows, which hopefully addresses your main point:

If governments everywhere in the developed world stopped being passive in wondering whether markets were willing to lend and actively managed their budgets in such a way that all current spending was balanced and all capital spending was quantifiably growth-oriented, this would remove the markets having to guess about debt sustainability.

I think your weakest point is the following: “anyone making the argument against regulation following the greatest failure of regulation and it’s obvious effects”. Let’s leave aside the point that the problem pre-2007 was not so much a lack of regulation as it was bad regulation. By your very simplistic rule, I could propose any old regulation now and no matter what its consequences – even if it leads to another bubble and crash down the line – we should accept it because more regulation is better than less regulation. What we need now is not plenty of regulation, but solid and efficient regulation – a small body of regulation that creates a level playing field and to the best extent possible minimises the ups and downs of economic cycles. That is a world apart from what you wrote.

R.

James ,

Thanks Ronan, for your considered and excellent reply.

I agree with you, thanks for the fleshing out of the regulation point I made, it was indeed very poorly expressed on my behalf. I too am in favor of balanced well informed and enforced regulation.

Your rephrasing did the trick, it does address my main point, and I agree.

Thanks again, and keep up the good work.

Leo Allen ,

Is it not the case that by putting this into an I/G treaty – which I was of the view specifically allowed for under A20 of TEU (Libson) and no vote needed – is to make the matter actionable at a european level.

The Austerity Games: Ireland’s Fiscal Treaty referendum redux | Ronan Lyons ,

[…] in the casualty list was the concept of opportunity cost: in other words, it’s not how bad or economically illiterate the Fiscal Compact is in and of itself, it’s about how attractive it is relative to the other […]

The Irish Economy » Blog Archive » Austerity games ,

[…] of opportunity cost: in other words, there’s not really much point focusing on how bad or economically illiterate the Fiscal Compact is in and of itself. We need to ask how attractive it is relative to the other […]