Recently, reading the Irish Independent has been a bit of a rollercoaster for me – one day I’m practically doing the government’s job for it for free, the next I’m guilty of elder abuse. By way of context, in late January, I presented at the Dublin Economics Workshop Conference on Irish Economic Policy. Specifically, I presented on how a Site Value Tax might be introduced in this country, both on an interim basis and on a full-time basis – a podcast of the entire property market session is over on the irisheconomy.ie website.

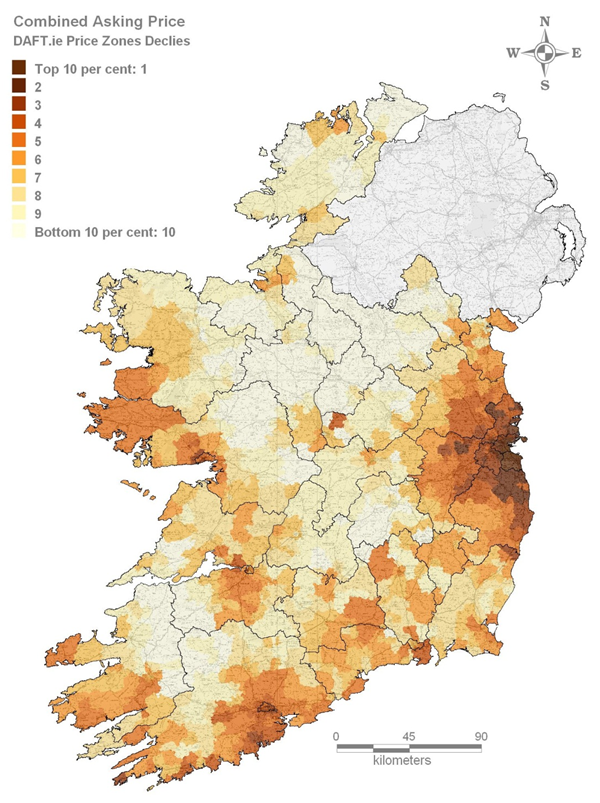

My proposal – full report here – was relatively straightforward: use the best information we have currently (1.3 million sales and lettings ads posted on daft.ie between 2006 and 2011), and the best methods available for establishing the components of house prices (hedonic price regressions) to implement the best known form of taxation (Site Value Tax) on an interim basis, in an area where Ireland desperately needs new revenues: residential property. And when better information becomes available – in particular the Revenue Commissioners register of transactions – then that can be used for a full Site Value Tax. My map outlining relative land values in 4,500 districts across the country is reproduced below.

SVT: the sales pitch

A Site Value Tax (SVT) is an annual tax that is paid on the value of the land that you own. If you own a four-bed semi-detached in suburban Dublin worth €400,000, you can think of that €400,000 as being the value of the building (say €300,000) added to the value of the land (say €100,000). Your tax bill would be something like 2% of the €100,000.

Why do I say SVT is the best known form of taxation? Ultimately, because it’s fair and efficient. It’s that rarest of taxes, popular with not only both left- and right-wings but also with environmentalists. Left-wingers like Site Value Tax because ultimately real estate is the single biggest form of wealth – and what left-winger worth their salt doesn’t like a wealth tax? Right-wingers like Site Value Tax because it does not distort economic outcomes: land can’t go anywhere, unlike pretty much every other input you can think of, so just because it’s taxed doesn’t mean that rents have to go up or that business has to move elsewhere. And environmentalists like Site Value Tax because it encourages the best use of land, which is a scarce resource. Why would you keep a site derelict if you’re getting taxed as much as the same the guy next door making that land work?

A Site Value Tax is particularly appealing when viewed in the context of local government. Think back to why any land you own is worth more than agricultural land. It’s because of a range of amenities to which your land offers access – from public services like education, health and public safety, through environmental amenities like urban green space, coastline or lakes, to more intangible services, such as access to thick labour or consumer markets. Unlike, say, the value associated with shares in a firm, no one person or group of people creates the value associated with land – society does and thus SVT is the return that society gets for creating the amenities we enjoy.

SVT: glitches and hitches

The Irish property-owner, however, may not be as impressed with such lofty talk. What about those who bought in the boom and who are now stuck in negative equity? What about those, such as elderly couples, who are land-rich but cash-poor? What about those who live on rural sites that might be ten, fifty or even a hundred times the size of those in urban homes?

A Site Value Tax fundamentalist would say that none of this matters. Those who bought during the boom are not going to un-buy because this tax is brought in and besides the SVT reflects current land values, not bubble-era values. They would argue that those who are land-rich but cash-poor should be encouraged to move on, as a country where every set of parents who refuse to downsize on retirement push their own children’s homes further out. And a country of large rural sites imposes greater costs on urban dwellers subsidising their scattered neighbours – thus a site value tax should – and would – reflect this, they would argue.

A Site Value Tax realist knows that these things matter. Hence I prepared a series of FAQs in the full report prepared for Smart Taxes and the Department of the Environment, available here. Bubble-era buyers, for example, could be given a graduated tax credit from introduction of SVT for a five-year period (similar to mortgage interest relief). After this, 2004-2008 buyers would be liable for the same amount of tax as their neighbours on similar plots.

Those with large plots of land but little income – in particular pensioners – could easily be accommodated with the use of lien on the property, where the tax bill is postponed until the property is ultimately sold. And rural dwellers will almost certainly pay less than their urban counterparts anyway, with such a large differential between urban land values and residential ones. Allowing rural landowners to decide once and for all which of their land is residential and which agricultural would also assuage fears that rural life would be irrevocably destroyed.

In truth, any lobby group can be accommodated – we just need to be clear that this is what we’re doing. We’re shifting the burden from one group on to the rest of society. We may have good reasons for doing this but we shouldn’t fall for emotive arguments that try and disguise that.

One lobby group I think we should pander to is people, as opposed to empty land. What do I mean by this? Suppose we have two adjacent 1-acre city centre site. One owner leaves theirs empty (Case A) while the other builds 100 apartments, each worth €200,000, and rents them out (Case B). In case A, the site is worth €5m and in case B the block is worth €20m, of which the site is worth €5m.

Under a full property value tax, the empty site has a liability of €25,000 while the apartment block pays €100,000. It seems very unfair, though, that the site being used productively, from society’s point of view, has to pay the burden of the tax. Under a 1% SVT, both sites would pay a tax of €50,000 – already the person leaving their site empty is being encouraged to use their site to generate a return.

Now, suppose there were a 2% site value tax but with a per-person “green space” tax credit of €250 (roughly 1% of an acre per person, at a nationwide average per-acre value of €25,000). If the 100 apartments housed 250 people, that would mean the apartment block receives tax credits of €62,500, off their bill of €100,000, while the empty site is hit with a full tax bill €100,000. This modified SVT would shift the burden of taxation on to zoned-but-undeveloped land.

SVT: making us rich?

How much could SVT raise? The tax I proposed worked off an assumption that the Goverment would like to emulate best practice in this area and generate about €2bn in residential property tax annually – this is where the €625 per household figure from the press came from. If applied to commercial property also, a full SVT which replaced commercial rates, stamp duties and the 80% windfall tax, would constitute about €1bn in new revenue streams.

The natural response of anyone to the suggestion of a new taxation averaging €625 a year is “No thanks” (or possibly worse). To argue this, though, is effectively an argument for higher income tax and higher VAT. This is because everyone agrees that Ireland needs to raise about €4.5bn in new tax revenues over the coming years (€4.65bn by 2015, according to the 2011 Medium-Term Fiscal Statement) and even if organic growth delivers, as the Department of Finance expects, €1.4bn, that’s €3.25bn needed through fresh taxation measures.

Ultimately, there are only three types of taxes: those on incomes (which hurt competitiveness), those on consumption (which are bad for equity) and those on wealth, including property. So those who argue out of hand against a property tax such as SVT are arguing for the €3.3bn in new revenue streams to come entirely from some combination of income taxes or consumption taxes, both of which hurt jobs. And with Ireland’s VAT rate the highest in the world outside the Nordic countries and Ireland’s income tax rates among the highest in the world, the scope in these areas is limited.

For me, the key point is that when a full property tax is proposed, it needs to be done as part of an array of alternatives. The Minister cannot simply say, in the context of needing to raise €2bn: “Here’s our idea for a property tax. Do you like it?” No matter how nice the tax is on paper, the answer is going to be overwhelmingly “NO!”. Any property tax needs to be proposed as one of two (or three) options: “We can either introduce this property tax, or else we will need to raise the lower rate of income tax from 20% to 25%. Both harm disposable incomes but only one harms the creation of jobs. Which one do you want?”

A bold postcript

Note that the €625 average figure above was an input of the research (we need this to raise €2bn), not an outcome. The tax could be introduced at any level. At €100 a household, it could merely replace the household charge – but that’s not going to fund too many local amenities.

Alternatively, and much more boldly, the introduction of a 10% SVT on residential and commercial property – which would raise perhaps close to €10bn – could be done in conjunction with a reduction in VAT and a reduction in income taxes. This would help close the deficit, boost Ireland’s competitiveness, improve the fairness of the tax system and encourage efficient use of land. What’s not to like?

David O'Connor ,

Firstly, could I suggest it might be more straight-forward to call this a “Property Value Tax” since “site” usually refers to the plot area on which development may or may not sit?

Secondly, I’d be very concerned that site or property value is inherently and utterly contestable. Presumably you are supposing that estimated current market values would be used (based on DAFT or whatever). But even from street to street within neighbourhoods, values differ greatly. The unintended consequence of PVT/SVT, in fact, could be to disincentivise good property maintenance and damage the national housing stock.

My simple suggestion, to be constructive here, is €1 per sq.m. House sizes are utterly incontestable and can be ascertained from sales information and planning files. Self declaration may even be possible with non-compliance policed by fines, incomplete title transfers, planning retention orders and such like. But to copper-fasten it, it doesn’t take long for a valuer, estate agent or surveyor to go out and measure up a house’s gross floor area.

€1 per sq.m has the virtue of being truly socially, economically AND environmentally progressive. The more modest abodes would be taxed the least; more efficient building and residential layout designs would be encouraged, and people would be incentivised to live closer to towns in more compact settlements.

And, since we’ve about 2m houses, and if we assume an average house size of 120sq.m. such a Property Gross Floor Area Tax (PGFAT) would raise about €0.25bn. Not enough? Well then it becomes €2 / sq.m. Or whatever. At least it would be fair and its unintended consequence, since every tax has one, might be to promote better, more sustainable, more compact and even friendlier neighbourhoods.

Ronan Lyons ,

Hi David,

Thanks for the comment but I’m not sure if you’ve read the proposal fully. This is most certainly not a “Property Value Tax” – the example of the two sites in the city centre should have made that clear. This is very much a site/plot/land value tax – you pay on the land you own (not the buildings). Given your interest in the area, I’d recommend reading the report in full, which explains how to take account of variation within districts, as well as between the 4,500 districts analysed. Certainly for an interim SVT, though, those 4,500 districts would be more than detailed enough.

The point is taken on contestability. The key to a tax such as this is getting the right trade-off between simplicity and robustness. However, I must strongly reject the idea that a charge per square metre regardless of location would be “truly socially, economically AND environmentally progressive”. Imagine such a scheme applied to Ireland now:

– on social progressiveness, rural areas would bear the overwhelming burden of the taxation and these are the areas with lowest incomes and poorest public services. Site Value Tax is at least in some senses a wealth tax, as the bulk of wealth is tied up in real estate. This is a space tax, which has little or no correlation with wealth. Those who buy space where it is cheap (and cheap for good reason) get punished.

– on economic progressiveness, this system sends out all the wrong signals. Go back to the example above of the two adjacent site centre sites. Whereas a property value tax would somewhat skew the incentives and make it more attractive to keep useful land barren, this would completely shift the burden from useful but unused land on to people. Without being truly perverse, it’s hard to think of a property tax that sends out the wrong signals more than a square metre tax. Don’t forget: society actually wants people to build!

– on environmental progressiveness, this would effectively encourage sprawl. Why live efficiently when there is no reward for doing so? The system effectively says: let’s all have huge gardens. Given that we can’t afford that where land is expensive, let’s spread out. When all of these large plots are put together, they incur on society far greater costs on the provision of amenities and social services than if people are reminded via the tax system that land and its value are scarce resources that must be used well. Under this scheme, rural, urban… it doesn’t really matter – let’s sprawl.

haroldscross ,

Thanks Ronan, your proposal is smart and appears fair. The political economy bit will always tricky. The mobilisation over the kiteflying 100 euro charge gives some measure of the resistance to a ‘proper’ property tax that would levy 1000 euro pa on a nice suburban Dublin house. Your suggestion that politicians frame these issues in terms of rival unpleasantnesses one of which must be implemented is spot on.

Gavin ,

Brilliant work Ronan!

Bob ,

If you set a 2% rate for the whole country but disturbed the tax to local coffers would this not leave Dublin with more money than it had before and Leitrim with much less.

Would individual local areas not need the power to set their own rate based on their wants/needs.

If that is the case would you not also need a more detailed analysis of Dublin rather than just saying it is all band 1 or 2 relative to the rest of the country. Would you not instead need 10 bands for Dublin itself to make the tax progressive.

Mike Hawes ,

It was good to see your article in support of SVT, but I would like to raise some fundamental issues.

First of all you say that ‘the SVT reflects current land value, not bubble-era values.’ Correct. So why, in the next paragraph do you suggest that ‘Bubble-era buyers’ could be given a tax credit? There is no need to do so.

And you also say that ‘Those with large plots of land but little income …’ SVT is not based on the size of a plot but on the annual rental value of the site. So a small site in the centre of Dublin will have a very high value whereas a large plot on the outskirts will have a much smaller – perhaps even marginal value. Under SVT marginal land will be exempt.

In the first paragraph you make it absolutely clear that SVT excludes the bricks and mortar structure and will be levied on the land value only. But then in your Case A / B examples you say that both sites have a value of £5m but the site with 100 apartments will pay a much higher tax than the vacant site. NO, NO, NO! SVT is on the land value – excluding all improvements. We want the owner of the vacant plot to build the most modern apartments with all modern services and charge the highest going rent. This is the incentive to bring the land into the maximum permitted planning use.

Finally (!) to those not familiar with SVT it is confusing to muddle SVT with property tax. Property is man made – the structure – and we want everyone to have as large a house with the best facilities available. It is the land value that, as you so rightly say, is created by the community that should be returned to the community for public services and infrastructure improvements.

And let us not forget that SVT is intended to replace taxes on wages and production and not be ‘another’ tax.

I will read your Smart Taxes report with interest.

Ronan Lyons ,

Hi Mike,

Thanks for the feedback. Just to be clear, in the Site A vs Site B example, I was contrasting Site Value Tax with a full property value tax. As I hopefully explain clearly enough in the piece, with property tax the well-used site has a higher bill but as you point out with SVT, they pay the same.

The tax credit for bubble-era buyers is for political reasons not economic ones. With so many young families in negative equity and increasingly arrears, it’s unlikely any tax would pass that didn’t give them some recognition of their plight.

Hope that clears things up a little.

Ronan.

Henry Law ,

As a earlier commentator pointed out, land PRICES are contestable and inherently unstable. Land price is nothing more than the capitalisation of anticipated rental income.

Land RENTAL values, on the other hand, are not, and furthermore, for the purposes of a land value tax, the important thing is not that absolute values are correct, but that the values of all sites are in the correct relation to each other.

Since the tax must be paid out of rental income or imputed rental income, a tax levied on a rental value assessment is what is says it is ie that, say, 25% or 45% of the rental value is being collected as tax. Rental value assessment also avoids the absurd situation that the levying of the tax cuts into the tax base eg if 100% of rental value were collected, selling prices would be zero.

Nearly all discussion of LVT focusses on residential land. This is mistaken and gives rise to scare stories. Most land value is on land in productive use. But because the incidence of most taxation (including income tax nominally paid by employees) is actually on business, the value of land in commercial use is much lower than it would be if other taxes were phased out.

The issue of pensioners is a temporary one and easily dealt with through some kind of deferred payment scheme, plus a general rise in pensions. Though there seems to be a movement to push up the age of retirement, which is another way of dealing with the matter.

Ronan Lyons ,

Henry,

Many thanks for taking the time to comment. One rather technical comment I would make in response is that the understanding of imputed rent varies systematically with land type (and location), hence there is a role for land values as well as rental information in determining relativities between districts. (The report actually uses an average of two average “prices”, one from prices and the other from implied rents, to overcome this.)

In particular, among residential properties, capitalization is – for reasons not yet known (but which I’m exploring in my doctorate) – much more aggressive the larger the home. If this reflects some underlying error in the calculation of imputed rent (i.e. if capitalization multiples is actually the same, but the measurement of rental services is wrong), this has significant implications for using market rents to substitute for imputed rents. If instead capitalization by homeowners is done by completely different rules to landlords/investors, this will also have implications for calculation of SVT: which rule do you use?

Regards,

Ronan.

Henry Law ,

We have got a lot of information on valuation eg here

http://www.landvaluetax.org/frequently-asked-questions/how-is-land-valued.html

This in turn links to the Whitstable valuations which can be regarded as a model.

Also this http://www.landvaluetax.org/frequently-asked-questions/how-does-planning-zoning-affect-lvt-valuation.html

and http://www.landvaluetax.org/download-document/152-annual-rental-valuation-by-the-residual-method.html

Land prices can certainly be used as ONE of the means by which evidence of rental value is gathered.

Mike Hawes ,

Ronan – thanks clarification re the site A / B examples. I didn’t look closely enough, and you do say ‘Under a full property tax …’ My apologies!

Would you rather tax gardens or jobs? – Smart Taxes Network ,

[…] good blog by Ronan Lyons whom Smart Taxes commissioned to scope how SVT might be implemented in Ireland in […]

Phoenix Nursing Home Abuse Lawyer ,

Really great and much needed article on the topic of SVT.

Paying tax in Ireland: Where the richest (and poorest) pay | Ronan Lyons ,

[…] but in this Ronan-dictator-for-a-day scenario, this new system would be brought in along with a Site Value Tax that would shift the burden away from economic recovery) but be significantly fairer, with […]

The Irish Economy » Blog Archive » Property tax - understanding cause and effect ,

[…] controls for market conditions over time and for the fact that property types differ by location [more here]. (As before, I’m happy to share for free this and the underlying data with any Government […]

Smart Taxes’s Site Value Tax versus the ESRI’s Property Tax – Smart Taxes Network ,

[…] controls for market conditions over time and for the fact that property types differ by location [more here]. (As before, I’m happy to share for free this and the underlying data with any Government body […]

Mark Wadsworth ,

That’s an excellent article and an even better map 🙂

Property tax – it’s not rocket science! | Ronan Lyons ,

[…] frustration so I’ve decided to continue my crusade for good policymaking in Ireland and post (yet again for long-standing readers) about property […]

Can we have a win-win property tax ? | Brian M. Lucey ,

[…] of these seems to be the ability to value the land-only element of a property. Recent work by Ronan Lyons and Smart Taxes has done that, at a micro level and as yet (6 months later) their methodology is […]

Another fine mess! So you want to value some properties… | Ronan Lyons ,

[…] any sort of property tax, no matter how cleverly designed. But still, there were those of us who argued all year long for a smart tax with a smart design. One that got lots of information into the system, to enable the auditing that means everyone is […]

In Support of a Land Value Tax ,

[…] detailed analysis of the merits of a site value tax please refer to Ronan Lyons’ excellent posts here and […]

Call to reform property tax - Page 5 ,

[…] tax will give revenue back to communities – Independent.ie Pros and cons for site value tax: Would you rather tax gardens or jobs? The Site Value Tax debate | Ronan Lyons What is the difference for taxpayers if the tax is based on the perceived value of the site vs […]