There is much talk currently of changing the global economic order and the growth of new economic powers. Since 2008, for example, the G20 has effectively replaced the G7 as the primary global interface for the world’s major political and economic powers. The IMF and the World Bank are also under pressure to change and in the last few days, there has been much talk about the future leadership of the IMF and whether it should come from Europe or somewhere different. It’s worth bearing in mind, as these conversations take place, what history tells us about the future of the changing importance of regions like Europe and Asia.

According to the best estimates of economic history, in the year 1AD, Asia constituted almost three quarters of the world economy. Most of the rest of the world economy was in the sphere of the Roman Empire. Fast forward to 1500 AD, and Portugal, Spain and other European countries were beginning to fill the vacuum on the global sea-routes left by China’s sudden introspection. Medieval Europe had been developing for almost half a millennium by this point, but still half the world economy was in China and India alone, with just one quarter coming from Europe – now expanding across Russia and over the seas.

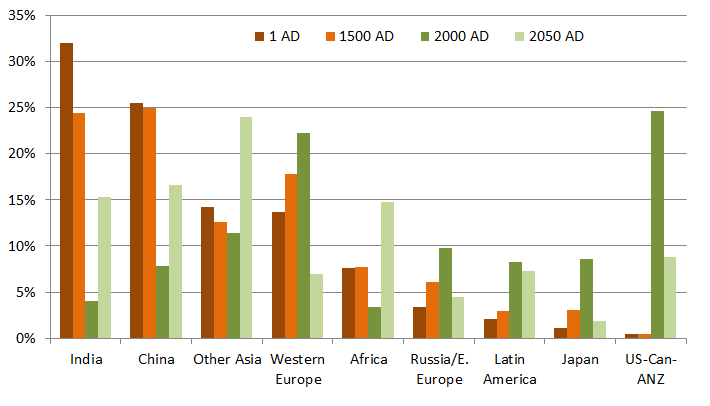

The following 500 years have been ones of turmoil to the traditional economic pecking order. Known as the “Great Divergence”, Western European and its offshoots in North America and Oceania have seen small populations become extraordinarily wealthy. By 2000, those small parts of the planet had come to account for not 15% of the world economy – as they had done for the bulk of human history – but almost 50%. Eastern Europe, Russia and Japan accounted for a further 20%.

Asia – the bulk of the world’s population and for so long the bulk of its economy – accounted for less than one quarter of all economic activity. The fall in relative power of Asia took place most dramatically in the century between the end of the Napoleonic Wars and the start of World War 1, when China alone went from being one third of the global economy to being less than 10%. India’s fall was more prolonged but just as severe. By contrast, the four Anglo-Saxon offshoots went from just 2% of the world economy in 1820 to 20% at the eve of World War 1.

While that is interesting economic history, what can it tell us about the future? At the risk of being trite, it is of course very difficult to say anything about 2050 with certainty. However, we do know something about demographics and can thus hazard a reasonably good guess at population by region in 2050. It looks currently as though there will be about 10 billion people living on the planet at that point, about 3.3 billion in China and India, a further 2.3 billion elsewhere in Asia and 2.1 billion in Africa. Europe and its offshoots, including North America and Russia, will be home to about 1.3 billion.

This is an excellent starting point, as calculations about the size of the world economy use population combined with real per capita income. So, let’s suppose people in “developed economies” were to have a standard of living about twice as good in 2050 as they enjoy now (i.e. they enjoy growth of about 1.5% a year between now and then). The overwhelming evidence from post-Industrial Revolution global economic history is of regions one-by-one catching up, by and large, with the better-off regions. Should this process continue to happen over the coming four decades, we might expect to see living standards in India, Latin America and Africa reach about half of those in Western Europe, with China and Eastern Europe somewhere in between.

That scenario is outlined in the graph above, which shows the approximate percentage of the global economy constituted by various regions in 1AD, 1500AD, 2000AD, and – somewhat ambitiously – 2050AD. The likely dramatic resurrection of India and China as economic powers over the next forty years – and the propulsion of the rest of Asia and of Africa into the limelight – stands in stark contrast to the recession of Europe and its offshoots into the shadows. The sheer size of population means that we may see the African economy rival the European and North American economies combined by mid-century.

As I see it, there are three lessons for Europeans to take from this overview of economic history and maths of demographics:

- Firstly, the economic histories of India and China in particular show that economic pre-eminence is not guaranteed. As the case of China shows, even a few decades is a long time in economics.

- Secondly, the emergence of new regions – as Oceania and North America have shown – means that the world will not simply revert to old pecking orders. There are no new continents to physically discover, but population growth means some continents – Africa and Asia in particular – are certainly getting bigger.

- Thirdly, even if the wealthiest humans continue to live in Western Europe and North America, the maths is unforgiving. The weight of population and the track record of region-by-region catch up means the balance of power will shift.

Western European countries in particular are currently engaged in a Canute-like effort to hold back the tide of economic power. Unlike Canute, though, who used the exercise precisely to show the limits to his power, Western European countries seem to want one last go at being the big shots. The sooner they realise the lessons of history and maths, the sooner they can adapt to the realities of the 21st-century world economy.

There may be a certain irony in having an Asian head of the IMF telling Europe how to put its financial house in order – after decades of the opposite – but there is also a certain justice.

John Mack ,

Interesting, but if you go by the older – and I think more accurate – discipline of political economy, you will realize that the role of stable governments is critical – their policies, their ability to moderate corruption, their avoidance of or engagement in war, their moderation of income inequality, their reining in of the banking sector toward prudence and away from speculation, and their ability operate a pretty good rule of law.

The irony: EU governance may turn out to be a destroyer of governments, an ultimately destabilizing factor in Europe, as Niall Fergurson (spelling?) points out.

John Mack ,

Forgot to add: stimulating perspective. Thank you. Needs to be part of every MBA and economics curriculum, but in the context of obligations to corporate stakeholders (not just shareholders, as Bill Clinton has pointed out) and public policies that encourage political stability and, as the Chinese like to put it, “widespread prosperity,” prosperity beyond the elite.

Greg Heaslip ,

This is a interesting article that reflects the views of Martin Armstrong who also reminds us of the shifting centers of finance and capital concentration throughout history. Although, refering to the US, he does point out the dangers of currency devaluation, rising debt and expanding public wage bills like during the fall of the Roman Empire. With the conviction of Rajratnam in New York recently we may see more and more hedge funds heading East – following the head offices of some the the larger banks. Also, the Chinese are now the largest producer and purchaser of gold which suggests that they intend to shift some of their foriegn currency(USD mostly) reserves into something more reliable. Europe is trying to swim against the tide at the moment, hopefully it will swim to shore, take a deep breath and sort out the “Mitterand-Kohl Pet Project” before we all drown.

Oliver ,

How about a similar chart which shows how much was actually produced? The current state of the world may look somewhat irrelevant in the grand scheme of things if time is the only metric, but weighting it according to percentage of total human output to date might be interesting.