If you like political bingo, make sure you read Ireland’s new Programme for Government. Perhaps it’s an inside joke from the people writing it, but within the first page alone, the following phrases are used, apparently with a straight face: “democratic revolution”, “political whirlwind”, “fractured society”, “shared future”, “darkest hours”… Heck, they even squeezed in “parity of esteem” as if this were some bitter, long-standing sectarian feud!

Once the quasi-comical Statement of Common Purpose ends, the true programme starts. Even if you didn’t know beforehand that this was something signed off in the wee hours of a Sunday morning, its incoherent and rambling structure would give you an indication pretty quickly that this is at best a preliminary draft.

Before the election, I did my best to summarise the issues as I saw them, grouping them under three different timescales: immediate issues, issues to be dealt with over the lifetime of the government and more long-term issues. Below, I use that same framework and give my own perspective on how the new Programme for Government shapes up.

Immediate problems: Sovereign and Banking Debt

When discussing Irish debt, the Programme’s overall goal is as clear as it is blindingly obvious: a “solution to the banking crisis that is perceived as more affordable by both the Irish public and international markets, thereby restoring confidence, growth, job creation and the State’s access to affordable credit from private lenders”. Unfortunately, the rest of the policy does not instill much confidence that having grasped the severity of the crisis facing Ireland, the new Government knows what to do to overcome it.

For example, they’ve hit a brick wall by the second bullet point in their plan, which is to “re-commit to structural reforms required to accelerate growth, job creation and debt sustainability”. Does this mean that key to solving Ireland’s banking crisis is job creation? But the overall goal above stated that solving the banking crisis was a prerequisite for job creation? Which is it? If it’s both, what is the plan to overcome this chicken-and-egg problem?

The strategy on the debt crisis has twelve parts, but most of them are either vague (“replace emergency lending with affordable financing” anyone?) or of secondary importance (“ending further asset transfers to NAMA”, as if a zombie bank is a better home than an organisation run by the state for the common good). On the most urgent task it faces, the EU-IMF deal and how that will be changed, I will now repeat in full the entire plan that the new Irish government has:

“We will seek a reduced interest rate as part of a credible re-commitment to reducing Government deficits to ensure sustainability of our public finances.”

That’s it! Let’s do a quick recap. The EU in its various guises is lending Ireland €45bn as part of the deal, which at a 6% interest rate will cost the Irish taxpayer €2.7bn a year. There does not seem to be an iota of recognition in the document that some fiddling around with this interest rate to say 5% would save Ireland the grand total of €450m. I think everyone recognises that it was not for the sake of €450m that Ireland got forced off international bond markets.

Medium term problems: Taxes and spending

On the underlying deficit, the new Government hopes to close the deficit to 3% of GDP by 2015, an ingenious compromise between Fine Gael’s 2014 deadline and Labour’s 2016 deadline! For two parties that boasted about how their proposals were so thoroughly costed, there is a remarkable dearth of detail on what will happen. All we’re left with is the MC Hammer list: “can’t touch this, can’t touch this, can’t touch this…”

For example, on the tax side, there are no plans to change corporation tax, marginal income tax rates (both good things) or income tax credits (a very bad thing). Also safe are employers PRSI and the VAT rate (which will go no higher than 23%). So where will new tax revenues of €5bn come from? Perhaps amazingly for a Programme for Government, it is not said! Two areas that may generate revenues – in an incredibly unpopular but much needed areas – are water charges (a meter will finally be installed in people’s homes) and property taxes (a site valuation tax that funds local government will be introduced).

Another move that could help – if introduced in the right way – is the establishment an independent “Fiscal Advisory Council”. As is the case with a site valuation tax and a water charge, an Independent Fiscal Council is a key recommendation that Stephen Kinsella and I make in our chapter “A Return to Managing the Irish Economy”, which is part of Next Generation Ireland, a book I have been working on over the last year and which is launched later this month.

The new Government lists, though, as the main functions of the Council, to advise almost exclusively on taxation issues. Unfortunately, this is a Fiscal Council done backwards: any government has only indirect control at best over the level of revenues, which depend on private economic activity. On the other hand, Governments can have almost complete control over spending. A good Fiscal Council should target levels of spending, having considered the likely level of revenues, not the other way around.

On spending, twenty pages and one National Development Plan 2012-2019 in and you would think with all the spending promises the new Government is making that this was a 2007 Programme for Government! When it does come, the depth of detail on the priorities for spending cuts is given in one sentence:

“We will conduct a Comprehensive Spending Review to examine all areas of public spending, based on the Canadian model, and to develop multi-annual budget plans with a three-year time horizon.”

Don’t get me wrong: there is lots of great talk about performance measurement, cost-benefit analysis, and balance sheets for public service organisations. I wholeheartedly welcome putting the public finances on the right foundations for the 2020s and 2030s, if it happens. But this is not the same as identifying where €10bn of savings is going to come from in a system where almost three quarters of spending is on welfare, health and education.

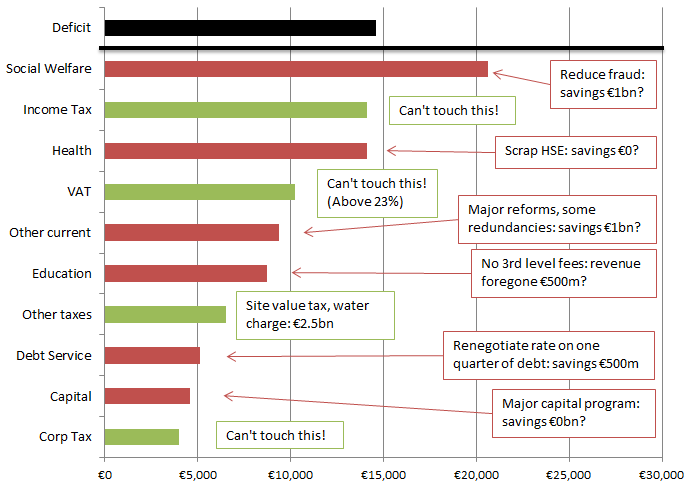

The graph below shows along side the deficit the ten major areas of government spending and government revenue: red is spending, green is revenue. I had hoped to show line-by-line where the €10bn adjustment is coming from. Unfortunately, the best I can do is speculate about where the savings might come from. And even then, the amount falls far short of the €10bn needed. A lot more work to be done here.

Long-term problems: Mortgage arrears and unemployment

There are many long term challenges facing Ireland. The document has some very interesting ideas on lots of these, from large-scale ones such as a Smart Grid for Ireland’s energy requirements and education as an export to smaller-scale initiatives, such as making teacher web-casts available online or boosting tourism through developing a Genealogy Quarter. Then of course there are some ideas which are hopelessly naive, such as this humdinger of an unkeepable promise:

“In local services, we will establish a website – www.fixmystreet.ie – to allow residents to report problems with street lighting, drainage, graffiti, waste collection and road and path maintenance in their neighbourhoods, with a guarantee that a local official will respond within 2 working days.”

But ultimately, the two most pressing issues that will face Ireland throughout this decade are mortgage arrears and jobs.

Mortgage Arrears

The new Government has what it calls a “radical approach” in relation to distressed mortgages. It is in fact a six-point plan (don’t tell Enda!). Three are effectively the same point: a hope that the problem of unemployed people with mortgages goes away (increasing mortgage relief for first-time buyers, switching resources from Rent Supplement to Mortgage Interest Supplement, and a two-year moratorium on repossessions). One is an attempt to forego one 25 basis point increase in standard variable rates (no harm I guess, but when we’re looking at ten 25 point increases over the lifetime of the Government…). The new Personal Debt Management Agency will definitely be of use to some families, in particularly those currently not in a position to drive a good deal with their lenders. But really the only substantive initiative in there is the proposed change in bankruptcy laws. I’ll leave the reader to decide whether this classifies as radical.

Jobs & Unemployment

Ultimately, everything would be made that bit easier if unemployment weren’t such an issue. For example, negative equity would be a chore, rather than a threat. From the Government finances point-of-view, creating 100,000 jobs would reduce the deficit by about €2bn directly. Of course, it’s no easy job, as all politicians discover.

The Programme for Government perhaps recognises this, with its main promise being the the Government will publish a Jobs Strategy within 100 days. For all the talk of a €100m Microfinance Start-Up Fund, R&D tax credits for SMEs and a new Export Trade Council, the key will be the sector-specific strategies. Four are highlighted in the document: agri-food, tourism, education, and green jobs. But I think a credible jobs strategy would not attempt to promise more than 10,000 net new jobs in any one broad sector, so the Government needs to look at ten areas that would provide 10,000 net new jobs over the coming five years.

A little done, a lot more to do…

On urgent issues, the new Government seems to completely misunderstand the nature of the Ireland’s debt crisis. Only a halving of the EU interest – or something equivalent such as burden-sharing with senior bondholders – will convince international markets that the problem has been tackled.

On more medium term issues, the Programme for Government is a big disappointment. Both sides got their vetoes in, but the voter has a right to know how exactly this Government proposes to close one of the largest deficits in the developed world.

On longer term issues, there are many good ideas in the Programme for Government, on topics such as reforming the constitution, politics, schools and local government. The most pressing long-term issues, though, are mortgage arrears and unemployment. On arrears, there is no radical plan as is claimed. On jobs, it seems this is one area where both parties knew the limitations of a last-minute programme for government and so all eyes turn to the new Government’s soon-to-be launched jobs strategy.

Barra ,

The parts on local govt reforming were incredibly disappointing I thought. Removal of planning guidelines that prevent local authorities from rezoning everything in sight; no (much needed) regional layer of local government that actually might be able to manage property charges; and changing the name of the county/city manager. Even the more national elements of political reform are kicked to touch, though lets see how it progresses.

The parts about spending reviews etc were remarkably similar to An Bord Snip – as in almost copy and paste job.

Eileen ,

Great, thought-provoking post. That link to Next Generation Ireland doesn’t appear to be working though. Cheers.

Ronan Lyons ,

Hi Eileen,

Thanks for that – that link should be fixed now. If anyone else is having issues, it’s: http://www.blackhallpublishing.com/index.php/forthcoming-books/next-generation-ireland.html

Ronan.

dearieme ,

“property taxes (a site valuation tax that funds local government will be introduced)”: the absence of such a tax was the greatest surprise I got when first reading about the Irish plight.

“water charges (a meter will finally be installed in people’s homes)”: is that sensible? I have the impression that in the UK water metering makes economic sense in the drier, eastern half of the country, but not in the wetter, western half.

Rob Murray ,

Hi,

why do you believe that the fixmystrret site is a humdinger of an unkeepable promise?

It would appear to be a reskinning of a commercial-off-the-shelf fault tracking and resolution services.

A “guarantee that a local official will respond within 2 working days.” doesn’t mean that the problem will be fixed in 2 days, anymore than it does for a computer software bug. It is simply an acknowledgement that the problem exists and has been entered into a (online, transparent and visible hopefully) workflow to assess, assign a priority, and eventually inform as to a possible fix date.

This is something that should be in place for all public facing waiting lists, whether it’s schools or missing fetac certs which today leave people in the dark for months /years.