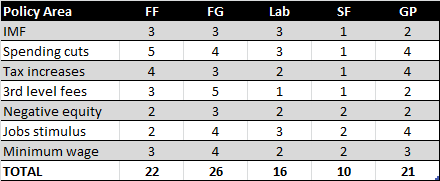

Last week, RTE published an interactive comparison of party manifestos. It was based on the ten most important election topics chosen by a sample of RTE’s audience. A simple yes/no score was developed by UCD’s David Farrell, UCC’s Jane Suiter and PhD students Stephen Quinlan and Mark Canavan, with quotations from each of the manifestos to back up the score given. I thought I’d go one better and score them out of five on each of the economic policy headings… This turned out to be across eight of the ten areas, which gives you an indication of how important people rate economic issues in this election.

I’ve grouped them into levels of urgency: immediate (sovereign debt), medium term (deficit) and long-standing (jobs and negative equity). In each, I outline what I would look for in an ideal manifesto and then try to summarise as briefly as possibly each party position, together with the score.

Immediate problems: Sovereign and Banking Debt

1. Renegotiate rate paid to ESF

What I am looking for here? I’m looking for a party to say that they will negotiate as hard-ball as is necessary until there is no premium on the ESF part of the IMF-EU loan, as it’s the EU not Ireland that wants to protect Ireland’s bank bondholders. This would effectively be a burning of the bondholders by 50% (i.e. Ireland is happy) without actually hitting the bondholders (i.e. EU is happy). The next item is:

2. Renegotiate with some bank bondholders

Which is a bit of a lame duck item, as there are a dwindling (and increasingly domestic) number of bondholders the banks have left. It’s the rate on the EU part of the loan where the action is at… Hence I’m merging the scores for items (1) and (2).

- FF (3/5): All three major parties want to renegotiate the rate of interest – but none seems to have grasped that 6% down to 5% won’t do it. To convince the markets a corner has been turned, it will have to be down to 3%, i.e. no premium at all on the rate the EU borrows at.

- FG (3/5): See answer for FF.

- Lab (3/5): See answer for FF.

- SF (1/5): Completely off the wall stuff – not going to take the IMF-ESF money so would effectively opt to choose 9% over 6%. The wrong direction.

- GP (2/5): Would take the EU money, so a step ahead of SF, but at a crippling rate, so worse than the big three.

Medium term problems: Spending and taxes

3. No further Social Welfare cuts

What I am looking for here? Unfortunately, while it would be great to say Ireland doesn’t have to cut total spending on social welfare, it does. The €20bn deficit hole between the Government’s €70bn in expenditure and €50bn in receipts cannot be closed without tackling the three biggest spending items: welfare (€20bn), healthcare (€15bn), and education (€9bn). If a party wants to preserve the particular rates of welfare paid, it will have to have a particularly good plan to reduce the number of people on welfare.

- FF (5/5): The party has the right target for reduced spending and, by stressing the cuts are the last resort, the right flexibility in relation to what it would or wouldn’t do.

- FG (4/5): It’s unclear what economic justifications there are for the safe list FG have, in particular the state pension, although it’s politically understandable.

- Lab (3/5): It doesn’t seem to have a target for savings or indeed any policy on social welfare payments whatsoever. No-one will be put off by the focus on “efficiencies” but this doesn’t actually mean anything without more details.

- SF (1/5): Reversing the cuts and increasing will deepen the government’s deficit, requiring more taxes and more debt borrowed at – if SF get their way – punitive interest rates.

- GP (4/5): No specific plan but they are committed to the National Recovery Plan, which is broadly in the right place.

4. Greater emphasis on tax in Budget

What I am looking for here? I’m looking for awareness by parties that Ireland sticks out in two ways when it comes to tax: our tax credits are too generous (people don’t pay tax soon enough) and Ireland is probably the only developed country in the world not to have a property tax. In terms of balance, I think the €15bn non-growth adjustment should come €10bn from cuts, €5bn from new taxes. Increasing the burden of taxation by more than one sixth in four years would be excessive, in my opinion.

- FF (4/5): The balance is probably right between cuts and taxes… but the details are sadly lacking in terms of finances. It seems they support an annual property tax, but I couldn’t find it. Assuming their plan is very similar to the National Recovery plan, I’ve given them 4.

- FG (3/5): Increasing VAT is a bad idea, given the low-hanging fruit in relation to income tax and property tax, which they rule out. If anything, FG may be too focused on cuts.

- Lab (2/5): Labour appear, according to FG, to support a property tax but don’t mention it in their manifesto. Given the size of the adjustment needed, a 50-50 split is also very unwise.

- SF (1/5): It may seem that I’m picking on SF, but their fair taxation scheme, although detailed, doesn’t add up. Three quarters of all wealth in Ireland is in property but while SF won’t tax this, they will still somehow raise €1bn from a 1% wealth tax. Their proposals for restoring the crazy tax credits that lasted until 2010 and abolishing the Universal Social Charge may also be popular but they are economically illiterate.

- GP (4/5): Not enough detail, but what is there is broadly on target, at least in my opinion.

5. Re-introduction of third-level fees

What I am looking for here? I’m sorry, much as this will lose me votes (oh wait, I’m not running for election), but this is entirely necessary. Our health system is chronically over-funded (relative to both our health status and what we get out of the health system). Our education system is generally well-funded but higher education is in an incredibly unsustainable position: the Government pays the fees and also sets the price. This gives the government a clear incentive to keep the price cheap… underfunding higher education. Deferred low-interest-rate loans might not be popular but they are necessary.

- FF (3/5): Up-front contributions are probably the worst of all options that involve paying. You don’t let people see the benefits of college education before asking them to pay.

- FG (5/5): A graduate tax sounds nasty but is actually quite close to deferred fees, particularly given that it only applies once you’re in a job above a certain level of income.

- Lab (1/5): Head in the sand. We can’t continue not funding higher education and to not charge fees is essentially to ask the urban working classes to pay for the further widening of the skill gap between the rural and urban middle classes and them.

- SF (1/5): As per Labour.

- GP (2/5): Lack of a policy only barely better than a bad one.

Long-term problems: Mortgage arrears and unemployment

6. Reverse minimum wage cut

What I am looking for here? I’ll be honest and say I’m not sure. This is a double-edge sword. High minimum wages are bad for those sectors most likely to be dithering about taking on new workers… but are clearly good for those who might be employed. As part of a general lowering of the cost of living in Ireland by about 10% (compared to the rest of the eurozone), I think a lowering of the minimum wage here is justified, if painful – provided it goes hand in hand with a lower of the “reservation wage”, i.e unemployment benefits. I’m aware this make me sound heartless, but really the focus has to be on jobs as the only real solution.

- FF (3/5): Presumably a silence on this issue, as they’ve already had to take the tough decision.

- FG (4/5): An imaginative solution to this thorny issue.

- Lab (2/5): I understand their policy, but don’t think a simple reversal is the best solution.

- SF (2/5): As per Lab.

- GP (3/5): As per FF.

7. Deal with negative equity

What I am looking for here? Ultimately, the real reasons for public anger are unemployment and negative equity, not bondholders or the IMF. It’s my opinion that nothing should be done about negative equity in and of itself – no-one worries about negative equity with their car, for example. Ireland only needs action for when a home is hit with both negative equity and mortgage arrears. The IMF has made €25bn available for further banking requirements. Alan Dukes and Morgan Kelly – a truly odd couple – both believe mortgage arrears to be the primary problem. Let’s use some of the €25bn to cushion the blow of arrears through part-ownership by the State of both the debt (the mortgage) and the asset (the house).

- FF (2/5): Like almost all the parties, FF is not prepared to solve the problem, just postpone it.

- FG (3/5): Fine Gael are slightly more detailed than the other parties but ultimately do nothing about the root problem of negative equity combined with mortgage arrears.

- Lab (2/5): Slightly worse than Fianna Fail in that it reads as little more than kicking the can down the road. Their jobs plan would need to be pretty amazing for this plan to be sufficient.

- SF (2/5): Debt-forgiveness without compensating equity forgiveness is not smart. Worse than that, though, changing systems of recourse (i.e. whether you can just send the keys back) mid-mortgage is asking to deal a hammer blow to what’s left of Ireland’s financial system.

- GP (2/5): As per Fianna Fail and Labour, sounds relatively unoffensive… and thus so graded.

8. Jobs stimulus

What I am looking for here? The only real solution to Ireland’s long-term problems is to create jobs, not to develop fancy tricks to get around mortgage arrears. I am clearly not trying to be populist when I say that it will not be possible to get unemployment back down to 4% within the next decade. Getting unemployment down to 8% involves, unfortunately, losing 20,000 a year to emigration, but also creating in the region of 170,000 jobs. Employment multipliers mean that Ireland needs to target creating 100,000 new jobs directly (as every 10 jobs typically spin off a further 7 jobs indirectly). About 10,000 could come from developing education as an export, while a further 20,000 are possible from a national retrofit program and other infrastructure projects. Realistically – given job churn – no more than 30,000 net jobs can be expected to come from foreign direct investment. So the remaining 40,000 direct jobs must come from indigenous industry, including Enterprise Ireland. These are the sort of numbers I would hope to see.

- FF (2/5): Quite vague and I’m not sure that capital-building programs should take centre-stage in a labour-employment strategy.

- FG (4/5): More detailed, aware of the limited life-span of capital programs and the importance of red tape and PRSI – although I don’t agree with the VAT proposal. Welfare to work is tricky to get working right, but better than welfare-for-welfare. Also on top of education as an export.

- Lab (3/5): Not a million miles from the FG plan, but not as well thought through, in my opinion.

- SF (2/5): It’s unclear where the money would come from for this, particularly if the National Pension Reserve Fund is required to pay public servants’ salaries and unemployment benefit, as seems likely if SF had their way with the EU-IMF deal.

- GP (4/5): Well, their headline figures are about right and they’ve the National Retrofit Programme in there. It’s a little Green-focused, although no-one would be complaining if the jobs were created.

Disclosure: I voted FG in the last general election! I did this scoreboard, however, to understand how I should vote, not to validate any preconceptions I may or may not have.

Ronan Lyons ,

For political reform, it is well worth checking out the Political Reform Scorecard:

http://www.reformcard.com/

Declan ,

Ireland has two economies in one not the export and domestic but the people with plenty of money and the people with plenty of debt.

60% of Irelands houses have no mortgage the remaining 40% percent carries a debt of 148 billion euro.

When interest rates go up the debt payers will get murdered, young couples are been bullied into paying these mad mortgages instead they should be advised to moving to the UK and declare themselves bankrupt.

The Irish government needs to increase taxes for all and start the tax bands at zero capturing the unemployed and pensioners at 20%.

The Mortgage holders should be able to write off tax for over payments’ of more than 75% per annum against income Tax at the higher rate. In return the lender would be required to charge no interest for that year .This could reduce the loan by 30% over 3 years allowing the banks debtors to get the banks out of trouble.

The Goverment also need to incourage the 60% with no Mortgage to start spending again and stop worrying and moaning about other people’s problems. Many of these people’s houses could seriously do with an Energy up grade any related costs should be written off at the higher rate of Tax creating construction jobs and starting a real multiplier effect.

We have a serious problem with rubbish talk and promises in Ireland There is currently lots of talk about creating jobs in the smart economy of the future .Totally forgetting that we had 300,000 people employed building houses most of whom are poorly educated and nearing 40 years of age and currently holding massive mortgages that are not been repaid.

Nama and the banks are holding a massive amount of housing off the market in order to prop up the sales and letting market .Clancy quay in Dublin is just one example 400 units complete ,sitting empty for 4 years rental Value 1150 euro per month Dublin is flooded with such developments.

Joseph ,

I think I will just vote for you. It really is a buggins’ choice isn’t it? No really great leadership from anywhere just when we need it.

AndrewSB49 ,

This IS all your own opinion and not written by Fine Gael with the word-proofing done by Fianna Fail!

David Quaid ,

Terrific post Ronan – so clear and well summarised. Rather than state that the biggest spends have to be cut, you quantify how much they actually are and why you think they should be cut.

Why can’t politicians do this?

Dublin South Central: Who Gets Your Vote? | Drimnagh is Good ,

[…] the second one is from Ronan Lyons who took it step further and scored the main parties out of five on each of the economic policy headings. This post from Ronan is quite detailed & you will need some time to sit & read what he has […]

Maura Fenlon ,

Thanks Ronan, so clear, concise, and really well structured.

Ronan Lyons ,

Hi all,

Thanks for the comments. Readers interested in this might also find this in-depth treatment of taxation by PWC interesting:

http://www.pwc.com/ie/2011irishelection

Ronan.

Rory ,

Re SF comment above. The reason we are at 9% instead of less is that we are carrying the bank debt as sovereign debt. I have yet to hear anyone tell me that they have asked bond holders, buyers in Beijing, NY, London etc what they would charge if we refused that debt. Can you tell me? That is the real question that has not even been addressed. Just pooh poohed by FF, FG, Lab etc saying we will have no money if we don’t accept the deal. GO ASK FFS!

MichaelG ,

As the amount outstanding to bondholders is reducing all the time I think we need to look at what Bondholders were paid off and how much they were paid since the Bank guarantee was given in September 2008. Prior to the guarantee bonds were severely discounted on the secondary markets but became whole again at the announcement of the guarantee.

The discounts prevailing in Sept 2008 should applied to the bonds redeemed in full to date and this amount should be discounted against the EFSF fund allocated to Ireland. The ECB should pick up the tab for this amount as they were totally remiss in their oversight of Irish banks. This would be the equivalent of renegotiating with the bondholders retrospectively without burning them: The ECB should feel the pain instead!

Edmund Burke ,

You neglected to include Public Sector pay, which despite recent deductions is still about the highest in the EU, and completely at variance with pay in the real economy, especially at the lower pay grades.

Anthony Murphy, now with the Fed in Dallas did a lot of work a couple of years back in a review of Benchmarking 2.

Shane Dempsey ,

Good analysis but I’ve a different perspective on some of what you suggest.

A graduate tax is more problematic than a non-recourse student loan scheme. The former could simply incentivise people to leave Ireland, taking their expensive education with them. We need graduates and we need them to be more cognizant of the true burden of their education on the tax payer but I’d prefer the amount “up fronted” rather than subject to another tax that may have perverse incentives and be manipulated by future governments.

I presume SF would just not pay back any of the various bank debts (oustanding bonds, promisory notes, recapitalisation money etc.) Obviously there’s a whiff of populist anarchy about this but the lesson from Iceland is that the more debt we can dump and the more favorable terms we can get on the outstanding amount, the faster our gov bond rate will drop. I presume SF aren’t admitting that in the short term this would threaten the jobs of the entire public sector but everything is negotiable. A referendum would go a long way to creating an impasse for O. Rehn and co. and provide us with a big stick to negotiate with. Outside Germany, most investment bankers don’t care if the ECB donates the cost of the outstanding bondholders. This may look like burning the ECB but it’s just forcing it to act like a central bank.(As MichaelG points out above) It actually makes Ireland’s “management team” look smarter and the country a better bet. We also have many many Chinese investors who view distressed economies like Ireland as a great way to enter the European market. It’s already underway with some smallish projects in Athlone but I’ve been reliably informed there’s significant Chinese investment available even for initiating large but potentially repeatable engineering projects like Spirit of Ireland. Just requires a political will and the nerve to upset the EU. Economic recovery often requires bold and unpalatable moves, beyond just taxing everyone to oblivion.

The MC Hammer approach: Ireland’s new Programme for Government | Ronan Lyons ,

[…] Browse in Irish Economy « Scoring the General Election manifestos on economic policy […]

Brian Sammon ,

Me thinks we should see a Summer Report Card; how would you peg the aggregate score for FG and Labour in these subjects?