You may not have noticed it – with everything from IMF bailouts to general election developments happening the same day – but yesterday saw the release of the latest Daft.ie Report on the rental market. Its headline finding was that, for the second quarter out of three this year, rents rose slightly. As of October, rents were typically about 2% below where they were a year ago, a far cry from 2009 when rents were falling at a rate of almost 20% year-on-year.

How should we interpret the latest figures? John Fitz Gerald of the ESRI provides the commentary on the latest report. His point is that – for all the pandemonium currently happening with the Government finances – the real economy keeps ticking away:

Amid all the uncertainty and excitement concerning bail-outs and banks it can be easy to lose sight of what is important to long-term growth prospects – the performance of the real economy. One important aspect of this is the housing market. While the dangers of a housing bust were well flagged, its full consequences, especially in terms of the financial system, have proved even more serious than anticipated. For the housing market itself we have seen a collapse in prices since 2007 and, as a result, a collapse in building. Unthinkable though it may be under current circumstances, eventually new building will become profitable producing an inevitable supply response…

The first sign that things are beginning to turn will be a move towards rising rents. This will predate any recovery in house prices and any new building. As of today it is clear that rents have stabilised. From now on I will be watching the DAFT index seeking signs that rents are beginning to rise. I don’t expect to see much action over the coming year but time will tell.

This is a relatively upbeat message. In short, house prices are built around rents (much as Irish logic typically runs the other way), and rents are based on demand – trends in income and in the labour market – and supply. If rents are stabilising, and we know that supply is not being restricted, that must mean demand is levelling off, which reflects some sort of floor in income and in jobs.

If true, this reflects not a return to the Celtic Tiger era, but the end of things getting worse. A stabilisation in rents is also more concrete than export figures, which while very impressive do not always turn into jobs. And from that point of view, this could very well be the first step in a long process to economic recovery.

But, if rents do reflect economic stabilisation, it’s already clear that that recovery will have a different timetable in different parts of the country. Rents in Dublin and the other cities rose in the third quarter of the year – 0.7% in the capital and average of 1.5% in the other cities. However, rents outside the main cities fell by an average of 0.7%. For the cities, it was the second quarter in three that rents rose, but for non-city areas, it was the thirteenth quarter in a row that rents fell.

What is interesting is that despite the change in market dynamic since the start of the year, the average fall in Dublin (29%) is still greater than the average fall in the non-city areas (25%). This suggests that the correction will probably be of similar scale across the country but that the larger size of the city markets means that they are finding their new floor faster. What I have just written could equally apply to house prices: asking prices in Dublin are down by up to 45%, but in some parts of the country are down by less than 30%. We should expect Dublin to turn around first.

Back in the rental market, what is driving this levelling off? For example, is it being driven by demand for family homes from couples not buying? Or is it being driven by people moving out of home and into 1-bedroom apartments? To examine this in more detail, I recalculated the rental index for three different regions of the country, looking firstly only at three-bedroom houses and secondly only at one-bedroom apartments.

As you can see, looking at much smaller segments of the market like this makes the series a good bit more jumpy. But the overall trend is remarkably similar across all segments, from 3-beds in Dublin to 1-beds in rural areas. So it’s clear that there aren’t wildly different trends by segment. Only in the last few months have family homes in Dublin – whose rent had fallen by more to start – performed significantly better than 1-beds in the capital. Rents for 3-beds in Dublin have risen by 5% in recent months, compared to an increase of 1% for 1-beds.

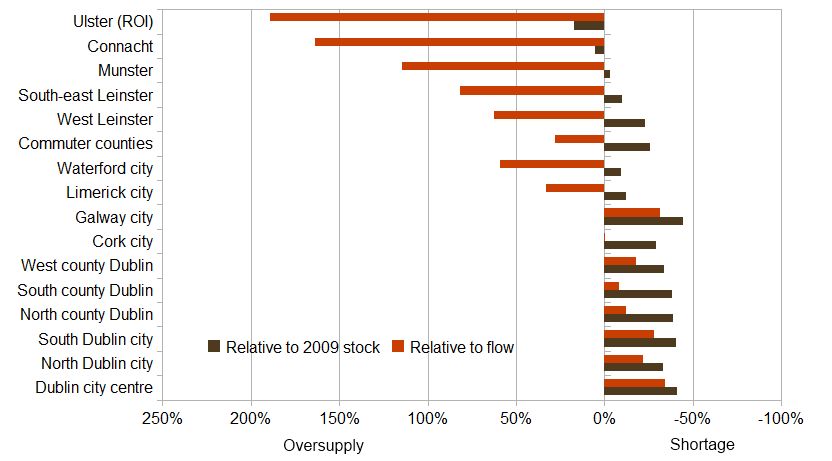

That’s the price side. The other thing economists look at is quantity: what volume of people are coming on to rent their properties or to find a new place to live? The second graph, below, shows two figures, representing two different ways of looking at how the oversupply of rental properties has fallen in recent months, across sixteen regional markets in Ireland. The dark brown line shows the fall in the stock available to rent on the 1st of November, 2010, compared to the average level sitting on the market in 2009. But one could argue that this is just relative: if somewhere has three times too much stock, it will take a 67% fall for the market to get back in balance. And in truth we don’t know exactly how much each area was over-stocked in 2009.

Therefore, there’s a second line, the red line, which shows how the stock sitting on the market on the 1st of November compares to what the market has typically processed each month since the start of 2009. This a reasonable rule of thumb, based on the life-cycle of a rental ad. Both series are put on the same scale, so a bar to the left indicates a glut of properties still remain, while a bar to the right suggests a shortage of properties.

This is probably the clearest way of showing the significant gap between some of the city areas and rural areas. Dublin, Cork and Galway have seen huge falls in the number of properties available to rent at any one time – almost 50% in some parts. With the exception of Cork – which looks like the number of properties on November 1 exactly matched the typical monthly throughput on the market there – these cities also look to have a shortage of properties compared to monthly traffic.

This is the market at the moment, of course. Significant tax increases in the Budget – or an unexpected change in property tax – could affect the balance currently being seen in the city areas. But the overall picture emerging from the property market is one of two tiers: cities and the rest.

Pete345 ,

Hi Ronan,

I accept the daft information to be a good indicator of rent prices. However it is only based on asking prices and I dont believe the asking price in some parts of Dublin represents the actual rent negotiated. I would believe that it is being negotiated down in many cases. I am currently looking at properties to rent in north dublin city so I have been to see many agents and properties recently. 2 large developments I have seen in these areas have been taken off the for sale market by either the developer or the bank and they have put the apartments up for rent instead because they feel they cannot get the sale price they want. They are releasing these apartments slowly onto the rental market obviously to keep the rents higher and not to flood the market. Yet the rents they are seeking still seem too high and not in line with todays sale price. So I think there are alot of apartments being held back from the rental market, at least in the north Dublin city rental market. I have been told that value of property can be calculated using the formula (monthly rent *12*20). I visited a new 2 bed apartment in north city for rent. It was approx 70sqm and the rent was advertised for 1250 per month (which is above average for the area). Using the formula that values the property at 300,000. However when I asked the agent what the asking price was for these properties I was told 250,000 which would mean the apartment rent should be 1050 per month max. As I stated I do believe Daft to be a good source for rental market data, I would be interested to see a report of actual negotiatted rental prices versus asking prices.

Eddie Lewis ,

Ronan

Have read your recent blogs with interest.

Regarding rent levels have you considered the impact of rent supplement on rent levels in different parts of the country. There is a feeling, based on anecdote rather than evidence, that rent supplement is holding up rent levels in certain areas and within certain segments of the market. Does this have any bearing on your conclusions.

Eddie

Ronan Lyons ,

Hi guys,

Thanks for the comments.

@Eddie

About 80% of landlords don’t accept tenants on rent allowance, so while I agree it could easily put a floor under market rents, there is also the possibility that with those numbers market rents are a separate market and their price could go lower than the State market, if landlords placed, say, a 10% premium on not having a State-supported tenant.

@Pete345

You’re right to point out that these are asking rents. This is most likely to be a problem in a falling (or indeed rising) market, where changes shown don’t reflect the full extent of the changes. Haggling presumably goes the way of the person with the upper hand. That wouldn’t tackle, however, why rents are rising throughout the city areas, as no landlord has an incentive to price themselves out of the bidding process to begin with.

The trouble with anecdote is that they work both ways. A friend of mine went to see a rental property and 23 couples turned up. That rent was only going one way from its advertised price and it’s not down! It’s best for Daft to stick to their econometric analyses of the thousands of rents posted every week, and then report the results – and then people can use their own judgement calls on whether closing rents/house prices differ from asking rents/house prices.

Thanks again for both comments,

Ronan.

Paul Mara ,

Hi Ronan

You say “no landlord has an incentive to price themselves out of the bidding process to begin with”.

Does this mean that you think there are little or no nama related properties in the daft rental database?

Do you think nama related properties might have an incentive to price themselves out of the bidding process?

Thanks for another interesting article

Paul

Tommy ,

Hi Ronan, I value your work, but I have to question the validity of your statement “About 80% of landlords don’t accept tenants on rent allowance”

This press release states that 96,000 are in receipt of rent supplement. http://www.irishpressreleases.ie/2010/10/10/over-96000-people-now-in-receipt-of-rent-supplement-costing-e98-million-per-week-%E2%80%93and-still-5000-homeless-nationwide/

Over 96,000 people now in receipt of Rent Supplement, costing €9.8 million per week

Now I acknowledge that every recipient may not equal 1 housing unit – but 9.8m/96k = 102 per week, this conservatively amounts to 2 recipients = 1 housing unit. So 48,000 rents are being paid by the state. Given that the state is practically the largest holder of real estate in the country. Don’t you think that the IMF will see an obvious way for the state to save 1/2 billion per year in rent supplement.

What would be the knock on implications for the private rental market. Carnage, I suspect

Sinead F ,

Hi Ronan

I agree with Eddie. Your assertion that 80% of landlords don’t accept rent allowance doesn’t make sense when you consider that 50% of all rentals are to rent allowance tenants

http://www.rte.ie/news/2010/0610/rent.html

I rent on an average income – spouse at home having recently lost his job, we have a couple of kids – and I can tell you, the working poor are completely shafted by the rent allowance racket. Aside from the artificial floor set on rents by RA, a working family has now lost €800 a year tax relief on this rent. I wish we heard more about this in the media but it tends to get drowned out by the vested interests on one side (Shure isn’t everyone a landlord now?) and the poverty industry on the other.

Ronan Lyons ,

@Sinead & Tommy,

Thanks for those links. I’m just going by what percentage of ads on daft.ie tick the “We don’t accept rental allowance” box. All better sources of information for what proportion of the market is State-determined are of course welcome. But if indeed half of all rentals are State-supported, that just moves the puzzle back one step: are landlords moving out of the private sector into the State supported sector? And if that explains the fall in urban supply, why are we not seeing the same thing in rural areas?

To Tommy in particular, I would be very much in favour of the State minimising its distortions of the accommodation market. Whether it’s the Government or the IMF, taxpayers shouldn’t be paying over the odds when they are supporting people to rent.

R

Ronan Lyons ,

Hi Paul,

I think at the moment that NAMA properties are by and large not on the market. However, I think also that when they do come on the market, it’ll be because the owners need the income and so they will probably price if anything below market price, rather than above. Although if you have an alternative line of thinking, I’d be very interested in hearing it, as that’s just my initial thoughts on this.

Thanks,

Ronan.

Paul Mara ,

Hi Ronan

I am surprised that most NAMA properties are not on the market. From that, it sounds like the majority had not have been completed before they went into NAMA.

Would the NAMA landlords not prefer to keep rents high? I wonder if a slow but steady number of tenants at a high price would be similar to many tenants at collapsed prices in terms of income. It might also have a bonus of increasing the number of high price tenants if demand goes up (which seems to be what you are suggesting is happening in Dublin).

Also, I’m not very aware of how the Internal functions of NAMA operate. Could a part of NAMAs processes hold another bonus to banks/developers if they have their rents high?

Personally, I have a vested interest. I like to have a roof over my head. If prices come down, I’d hopefully have more money left over after paying for that roof :-). I get the feelinig that a lot of people would like a similar situation and not just in rents but also in purchase prices.

Well, thanks for another interesting reply.

Paul