I recently attended a talk given by Olivier Blanchard, Chief Economist at the IMF, on the economic impact of the recession. In addition to being a very interesting talk, it gave me a confidence boost. A key variable Blanchard used – and had to subsequently justify to some skeptical economists – was the change in expected GDP growth across issues of the IMF’s World Economic Outlook, a variable I had used myself independently late last year, hence the confidence boost! He argued that the change in this growth rate captures better than any other measure out there the change in an economy’s circumstances. This is particularly important for understanding what happened in the Great Recession of 2008/09… as well as what is happening in its aftermath, particularly the rebound in economic activity the world is currently seeing.

With the first World Economic Outlook of 2010 published, it is now possible to compare the first year of the economic crisis, when world economic output contracted 2.6%, with the second year, when it grew by 4.4%. Below, I examine who has been hit worst by the recession, and who has rebounded fastest. I do this by looking at an economy’s expected growth rate for 2010-2013. The main finding is that while it’s possible to characterise the type of economy that was hit worst (and not) by the recession, the same exercise is much more difficult to do with economies that have rebounded. With many different types of economy rebounding, this suggests that the recovery is relatively broadly based, which is surely good news.

The Impact of the Recession

So, with the dust settling, what happened the world economy in 2008 and 2009? It is probably no surprise that of the 180 economies in the IMF’s World Economic Outlook, only 23 saw higher growth in 2008-2009 than had been expected in early 2008. Most of those – including the largest surprise growers Iraq, Afghanistan, Lebanon, East Timor and Kosovo – can be explained by recovery from conflict or other unusual circumstances. What might be a surprise, though, is that a pretty long list of countries, about 65 in total, were only mildly affected by the recession, i.e. whose growth in 2008-2009 was at most 5 percentage points less than expected. The list of countries here includes some richer countries, such as the USA, Norway, Austria and Portugal, as well as some key developing countries, including China, India and Brazil.

At the other end of the scale, though, there were about forty countries severely affected by the recession, i.e. their growth over the two years was at least ten percentage points less than had been expected. Most of the worst affected were former Soviet states, “the Russia effect”, including all but two of the ten worst affected countries. Unlike the other BRIC countries, Russia finds itself among the worst affected countries. Another way of looking at this is openness: Hong Kong and Singapore, for example, both saw almost ten percentage points knocked off their 2008-2009 growth.

That has been the short-run impact. The focus now, however, is turning to the medium-term impact of the recession. What is interesting is that the WEO figures suggest – even before the recovery in world GDP in the middle of 2009 – that the medium-term impact of the recession would be milder than its short-run impact. To examine this, one can look at the total growth projected for the period 2010-2013. Doing this, one finds thirty-five countries whose fundamentals have actually improved during that time. There are some surprising inclusions on the list: I’d be curious to hear thoughts on why Ghana also made the list, while also on the list is Japan, whose growth propsects for 2010-2013 have improved by 0.5% a year.

At the other end of the spectrum, about fifty countries saw their growth rate for 2010-2013 reduced by two percentage points a year or more. It would be tempting to think that they were the same countries that were worst hit immediately. However, only five countries were among the worst twenty affected both immediately and in the medium-term: Russia, Estonia, Lithuania, Ireland and Moldova. Clearly, the immediate impact is not the full story. Egypt, for example, largely escaped the ravages of the recession, with very healthy growth growth of 12% in 2008-2009, just a little below the predicted 14%. However, its 2010-2013 growth rate was revised down by more than three percentage points in early 2009. It is a similar story for Vietnam, another FDI hotspot, and for fuel exporters Qatar and Ecuador.

The Impact of the Rebound from Recession

Since early 2009, when global GDP was contracting at a rate of 2.6% a year, economic conditions have improved considerably. The world economy is now expanding at a rate of 4.4% a year, its highest rate since early 2008 and close to its anticipated equilibrium rate. With such a swift rebound to growth, which economies have turned around fastest? Again, the appropriate indicator is the change in expected growth in a country, not its absolute growth as each country has its own healthy level of growth. To do this, one can use the difference between the IMF’s April 2009 and April 2010 World Economic Outlooks. The 2009 WEO captures growth prospects for 2010-2013 at the height of the recession, while the 2010 WEO will capture the revisions to those growth prospects.

Overall, the rebound has boosted the growth prospects of over one hundred countries. Many of the economics that have benefited most are resource-dependent ones, such as Qatar and Turkmenistan who have both seen about four percentage points added to their expected growth rate over coming years. Others are trade centres: Taiwan‘s expected growth is 2.5% higher, while Singapore‘s is 1.6% higher.

But perhaps the most encouraging thing is that there is no one type of economy that has strengthened in the last year. In addition to resource exporters and trade engines, you can find large developing countries, such as India (+1.6%) and Indonesia (+2.0%), OECD countries such as Australia (+1.3%) and Switzerland (0.9%). You can also find sub-Saharan countries like Chad (+2.2%) and Congo-Brazzaville (+1.9%) and Latin American countries such as Uruguay (+1.1%) and Brazil (+1.5%). Most developed countries – and China – have seen boosts to growth of less than 0.5% but that still represents an improvement in economic conditions, compared to what was expected a year ago.

The Overall Economic Impact of 2008 and 2009

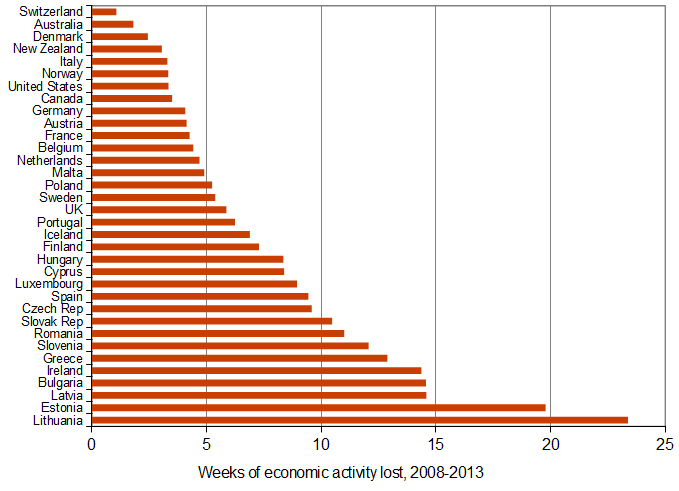

The first set of figures presented showed the impact of the first twelve months of the recession on a country’s growth prospects. The second set of figures showed the revisions due to the global economic rebound in the last twelve months. Overall, though, what have the past two years done to the world’s economies? The graph below shows the number of weeks of economic activity lost as a result of the recession in a selection of European and OECD countries.

All the data discussed above are available over on Manyeyes. I’ve put up a visualisation on Manyeyes too, which you can interact with below. The default is 2008-2013 overall impact, but you can pick just the 2008-2009 impact or the 2010-2013 impact, or indeed compare both. You can also zoom in to particular regions. All numbers are changes to a country’s annual economic growth rate, so 2008-2009 is comparable with 2010-2013.

The experience of Iceland – whose economic growth prospects were revised up between the 2008 and 2009 WEO, due to its swift action during the crisis, only to be revised substantially down in the 2010 WEO – is a useful caution about the limit of these figures. Nonetheless, they represent the closest thing we have to what economists would call a “counterfactual” about a world where the Great Recession didn’t hit. And the news from the last 12 months has been good!

Paul Mara ,

Damn, I knew I should’ve bought those investment properties advertised in IRAQ a few years ago.

Ronan Lyons ,

Well, Paul, you can always thank your lucky stars you didn’t invest in global vanilla centre of excellence Madagascar!

Frank ,

Sorry to say this but you sir are a failure.

Here is what you said “including the largest surprise growers Iraq, Afghanistan, Lebanon”

Do you know why this is ?

This is because the U.S.A is stealing all the oil from those countries making it look like there was growth but it was actually the opposite.

Be realistic and stop printing these lies, U.S.A. is the worlds enemy, it is run and controlled by selfish elitists.

Ronan Lyons ,

Hi Frank,

You might read the rest of the sentence mentioning Iraq et al, and then the rest of the paragraph, and then the rest of the post.

Who am I kidding? I’m guessing I’ve probably lost Frank – but to anyone else interested in the idea of what is and isn’t captured by GDP, have a read of:

http://www.amazon.com/dp/1595585192/ref=pe_606_17003650_pe_ar_t3

While economists are all too aware of the failings of the metric, politicians and markets seem to often forget them.