Each I time I look at the figures behind NAMA, I have two reactions: Firstly, “Why, oh why, can’t they standardise their accounting headings?” And secondly, “Wow, and I thought they gave us hardly any information LAST TIME!”

Yesterday, NAMA released its latest figures, this time for the second tranche of loans it is taking from the banks under its care. And, once again, I had both reactions above. The amount of information they are giving us this time is truly scandalous. The only figures in the one-page press release this time around are the totals for each bank… and even then, EXCLUDING Anglo, whose loans comprise more than half of the second tranche! Compare that with last time around, when they had seven pages of tables. What seemed at the time a paucity of information, given the sums involved, would now be a treasure trove of figures, compared to the latest release.

Perhaps it’s my economic history upbringing with Kevin O’Rourke, but I remained undeterred that something could be gleaned from a remarkably small set of numbers. I’m not the only one, as Karl Whelan leads a discussion of the latest information over on irisheconomy.ie. Let’s start with what we know.

So what are we taking on again?

It’s no harm recapping the basics, otherwise the figures below won’t make much sense.

- There is a total of €77bn worth of core loans that NAMA is taking over, based on €88bn worth of property (at the peak).

- About €49bn of loans is in the form of land and development, while the other €28bn is in associated loans (chiefly, it seems, property-related investments).

- There was also an interest roll-up last Autumn of €9bn. Somehow, €77bn and the interest roll-up of €9bn adds up to a total expected transfer from the banks to NAMA of €81bn. (Answers on a postcard or in the comments below…)

In September 2009, NAMA gave figures for land, development and interest roll-up (i.e. excluding associated loans) for each of the banks. In terms of NAMA-related assets:

- AIB owned €23bn, three quarters of which were Irish loans,

- Anglo owned €18bn in loans, about 60% of which was Ireland-based

- The other large bank, Bank of Ireland, owned €12bn in relevant loans, 57% of which was Irish.

- The remaining loans were mostly Irish Nationwide, €5.6bn (about half Irish, half UK), with EBS making up the final €500m, almost all of which was related to Ireland.

The total by that September 2009 breakdown: €59bn.

What about the rest?

Ah, I’m glad you asked that. The total expected transfer to NAMA is, of course, €81bn, as per the March 2010 breakdown. Where does this other €22bn come from? These are associated loans, mainly investment properties.

- AIB and Bank of Ireland seem largely free of these – or at least they are not being transferred to NAMA – as their September 2009 and March 2010 breakdowns of €23bn and €12bn match (in a round number sense).

- The small size of EBS makes it difficult to tell whether investment loans are a worry… but in the grand scheme of things, its €1bn in property loans is small change.

- It is Anglo and INBS, however, where the investment loans are most definitely a concern. Loans worth €45bn are being tranferred from these two institutions. But land, development and interest roll-up only account for €23bn, which means that the other €22bn from these institutions – over €18bn of it Anglo lending – is in the nebulous associated loans/investment property category.

OK, and what happened in Tranche 1?

In Tranche 1, the biggest 1,200 loans worth €15bn were transferred to NAMA. The bulk of this, €9bn, was Anglo loans, with AIB making up over half the remaining €6bn. At time, NAMA provided its stakeholders, the citizens of Ireland, with a pretty small set of figures on which to analyse the job it was doing. Still, there was a breakdown by geography and by loan type (although not subdivided by bank), as well as estimates of long-term economic value relative to current market value.

The important take-away from Tranche 1 was that it was disproportionately Anglo (whose haircut was given as a very round 50%), disproportionately investment properties, and (perhaps surprisingly) disproportionately UK: 40% British, compared to 20% overall for NAMA.

What’s new in Tranche 2?

We literally only know the top-level figures for the second tranche. In fact, as we knew the loans to be transferred in Tranche 2 from earlier information, the only new information is the “hair-cut” being applied to the second tranche loans. First some basics about Tranche 2.

- The total: Tranche 2 involves the transfer of €13bn of loans in total. The press release only makes mention of about €5bn of loans, though, almost all of which are AIB and BOI loans, as – for some reason – Anglo Irish Bank loans are not ready to be transferred.

- Where’s Anglo? Not to worry, we can work out at least some of what’s going with Anglo through changes NAMA has made to its files. The Tranche 1 file I mentioned above has been updated since it was first released. The change is that €0.7bn of Anglo loans that had been scheduled for transfer in Tranche 1 will now occur during Tranche 2 (or at least so goes the plan). If this happens, Anglo Irish Bank will again account for about 60% of loans transferred in the Tranche, in this instance €7.3bn.

How tight are the new haircuts?

Quite a good bit tighter, actually.

- In Tranche 1, AIB’s haircut was 43%, now it’s 49%.

- Bank of Ireland’s was 35%, now it’s 38%.

- For what it’s worth, given the relatively small sums involved, EBS’s was 36% and is now 46%.

- But it’s INBS which is generating the headlines. Its average haircut had been a pretty drastic 58% in the first tranche. In the second tranche, however, its haircut is 72%. The summary is that, excluding Anglo, the average haircut has worsened from 42% to 45%.

- We really have no way of knowing what’s going on with the Anglo loans. Now that it’s part of the State apparatus, it seems exempt from the same reporting procedures as the rest of the banks. However, suppose its haircut for the first tranche actually was the 50% reported and worsens at the same rate as the rest of the banks for tranche 2. This means Anglo’s haircut would be 53% on average in Tranche 2.

- Due to Anglo’s large size in the first tranches, this would increase the average haircut in Tranche 2 to 51%, up from 47% in Tranche 1.

The overall haircut for the €28.5bn in the first two tranches – including Anglo loans yet to transfer – would be 49%.

How much more of this will there be?

Anglo is the worst of the three large banks. So the good news is that after tranche 2, about half of its loans will have been transferred. Bank of Ireland and AIB have transferred between a quarter and one third of their loans, while INBS and EBS have transferred about 15% of their loans.

As mentioned above, the first tranche in particular was unrepresentative. (A side-note: despite this, NAMA’s revised business plan was based entirely off first tranche figures.) Future tranches will contain much more land, the vast bulk of which will be generating no income and some of which will be worth close to zero, as developments less than 30% complete will have to be destroyed before it can even be sold as agricultural land.

I don’t want to overstate this point – only €28bn of loans are for land, so there are other things in the loan books that may cause one to be more optimistic, particularly the 28% of the loan book not on the island of Ireland. But the point is still important: a full €28bn of loans is backed against land and nothing else, the vast bulk of it Irish land.

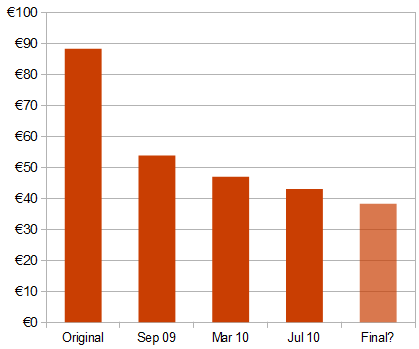

A reasonable projection is that the three percentage-point slide upwards in the haircut between tranches 1 and 2 would continue into remaining tranches. Should this continue, the final haircut will likely be 53%, not 39% as originally estimated last September. This means the total payment by NAMA to participating institutions for loans on property worth originally €88bn would be as low as €38bn. This sliding value of NAMA’s underlying collateral, property, is shown in the graph below.

The good, the bad and the neutral

All of these means that there is good news, bad news and neutral news for the taxpayer in the latest figures from NAMA.

- The good news is that, for the set of property loans we’re taking over, we’re paying a smaller price, reducing our exposure to losses. Paying €38bn for property originally worth €88bn means factoring in a fall in property values of 57% from the peak.

- The bad news is because for Anglo and INBS, it looks as though the taxpayer will be funding their capital shortfall either way. So for those two institutions, we’re hit either way.

- The neutral news reflects that fact, counterintuitive at first, that the smaller price paid doesn’t increase NAMA’s chance of making a profit. NAMA hasn’t changed the faulty assumption at its core, i.e. that long-term economic value is 11% above November 2009 prices. Instead, we have an uneasy balance between that assumption and the EU, which via its inclusion of costs and discounting has effectively struck off long-term economic value. If NAMA decides to pay less for the properties than originally estimated, that’s because the ability of these loans to ultimately generate income is less than they thought.

Hugh Quigley ,

Good analysis, Ronan. If the Long Term Economic (Dream) Value of 11% above Nov 2009 values that formed the basis of NAMA’s business plan is not realistic, what is the likely impact for the unfortunate bewildered ultimate owners of NAMA? Perhaps one of your nice graph charts would be enlightening. Hugh Q

Jack ,

Interesting analysis, thanks. However, this is all that is available to us as NAMA is not subject to FoI requests, hence increasing obfuscation and limiting the public gaze to analysis (however meaningful) and one-page press releases.

Ronan Lyons ,

Hi Hugh,

The graph here, http://www.ronanlyons.com/2009/09/25/the-importance-of-getting-namas-core-assumptions-right/, might help. It shows the rebound needed to break even, based on September 2009 figures, i.e. based on paying 38% less given the value had fallen 47% by that time.

The further the market slips below the level NAMA assumes, the greater the rebound needed. The good news is that the European Commission has reduced this gap between 38% and 47% (NAMA’s long-term economic value) to practically zero. So as long as NAMA keeps reducing its figure in line with what’s going on now (i.e. ignoring the November 2009 given date), the less likely we are to lose money. (At least through NAMA – we may still lose it having to capitalise the banks.)

Pat Deselby ,

So its not longer the runaway train wreck it once threatened to be?

Interesting analysis but its based party on guesswork and assumptions is it not? Not that it could be any other way given that Nama’s inner workings and accounts are almost totally opaque and not subject to any meaningful standard of public scrutiny. I thought lack of regulation and oversight was what got us into this horrendous mess in the first place?

Your educated guesses may well be correct and the estimation of the cost associated with the bailout is unlikely to deteriorate much further at the tax payers expense but I doubt it…

I am writing this in the center of Budapest where within a stone’s throw of my pleasant Lizst Ferenc Ter seat there are several Irish owned investment buildings lying idle and more eking out a modest income with little hope of attaining anything more. The recent bar-b-que in the Irish Ambassadors garden was polluted with down on their luck, insolvent developers masquerading as businessmen. As anyone in the market here at the time would have told you, these idiots brought a tsunami of credit with them and when the great wave of Irish buyers receded so to did local prices. Not that you, I or indeed any kind of Irish government or EU oversight will every know what sort of discount these assets will be bought in at. But from the conversation at the party, things are looking up for our local property mafia…

Ho Ho Ho, the NAMA Santa may be forced to follow EU guidelines in Ireland, but as you pointed out, there are enormous sums invested overseas and safe from the prying eyes of, well, anyone, I wonder what kind of investment the Irish taxpayer is making in places like the square where I am sitting…

Why is it that nobody can really tell me why exactly NAMA exists at all? If its not about re-capitalizing banks then isn’t it really about nationalizing the liabilities of the developer class? And why, in that case, should we continue to offer any deals at all except perhaps to bolster the price of overvalued Irish assets in an economy where almost nobody has the ability to buy anyway? I certainly can’t see how saving from collapse a few developers in Budapest is worth a few billion to the Irish taxpayer…

Ronan Lyons ,

Hi Pat,

You’re absolutely right – there’s a lot of guesswork and assumptions in there, and as you note, it’s unfortunately all out of necessity.

Thanks for the anecdote re Budapest. I’ve a Hungarian friend who attests to how crazy things were a few years ago.

Your question about the role of NAMA is more pertinent than ever. It’s clearly not going to recapitalise the banks enough, so what will it achieve?

John Heavey ,

Never mind Pat, it’s all good in Biffostan.

FERGUS O'ROURKE ,

Good stuff, again, Ronan.

However, I do wish that you hadn’t slipped into the habit of equating the loans being transferred with the properties on which they are secured. Until and unless NAMA forecloses on the hopeless loans, it owns no property. There is no practical difference in some cases, but in others it is very practical indeed.

The confusion, or a similar one, leads to the ridiculous story in today’s Indo which has people scoffing at the idea that “builders in NAMA” will be permitted to undertake infrastructure projects in the NDP.

I suspect that we can also blame it for what I regard as the more than slightly ridiculous High Court action by Mr McKillen.

Ronan Lyons ,

Hi Fergus,

Thanks for that reminder – my dash to numbers and economist’s perspective sometimes leads me astray of the legal facts of the matter…

R