Over the past few months, a number of people have asked me whether I think it’s a good time to buy their first home, sell their investment property, etc. Their worry is two-fold: on the one hand, they don’t want to try to catch a falling knife and buy a property at 25% below peak when, say, it turns out the market falls a further 15% from the peak. On the other hand, they don’t want to be sitting paying someone else’s mortgage when there’s perfectly good value out there on the market.

Their mistake is obviously asking an economist: economists are not only not qualified to give financial advice but in fact are almost perfectly qualified to give equivocal advice! That said, economists can bring perhaps a dose of the analytical to what is generally quite a gut-driven decision. So what kind of analysis would an economist use right now?

Why a potential owner-occupier should care about rents

I’ve mentioned yields quite a bit in relation to NAMA and in my opinion the single most important metric one can look at, in relation to the health of a property market, is its yield. A yield is nothing more than the rent expressed as a proportion of the price of the house. Why should that be important for someone looking to buy-to-live, not buy-to-invest? The main reason is that the yield is an incredibly useful statistic about the health of a property market. Very low yields suggest either rents are unhealthily low or – much more likely – house prices are unhealthily high. High yields say something about the attractiveness of a particular segment of the market.

In that way, the yield can be thought of as equivalent to the interest rate you get on a savings account. A risk-free savings account might get you 2%. Money you’ve put aside into investments in stocks and shares might get you 10% a year on average but also contains an element of risk. Your investment in your house is somewhere in between: a less risky asset than shares but certainly riskier than a savings account. Therefore, the yield you should expect in a healthy property market is probably between 5% and 6% on average.

What do current yields on property reveal?

The problem with Irish property between 2001 and 2007 was that house price rose rapidly while rents were – more or less over the whole period – static. Not surprisingly, the yield on property collapsed from 6% or more to about 3%. The problem since 2007 (from a yield perspective) is that while house prices have fallen back, so have rents. The net effect has been to leave yields more or less exactly as they were at the height of the boom.

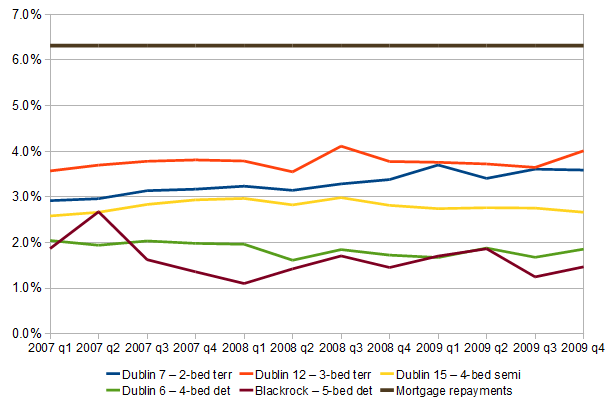

The graph below shows the yield from 2007 to 2009 for four different types of property, each of which is a viable family home (i.e. suitable for a generation or so, depending on the size of your family):

- A two-up two-down terraced house in Stoneybatter/Phibsboro

- A three-bedroom terraced house in Crumlin

- A four-bed semi-d in Castleknock

- A four-bed detached house in Dublin 6 (Rathmines/Rathgar/Ranelagh area)

- A five-bedroom detached house in Blackrock.

A sixth line is also included. It’s 6.3%, which is the percentage of your house price you would pay every year, if you had a 90% mortgage over 25 years, where the average rate of interest is 5% (not an excessively high medium-term average). The gap between the line at the top and the other lines is the percentage of each house price you would save each year, by renting not buying.

First things first: the maths behind taking the plunge now compared to 2007 don’t look that much more convincing. Nonetheless, no-one would deny that whatever about the relative level of house prices (compared to rents), the absolute level is a lot more attractive now than three years ago. The 2-bed in Stoneybatter is over 40% cheaper, the 3-bed in Crumlin 12 is over 35% cheaper, while the larger family homes are about 25% cheaper, in terms of asking prices. A second argument is that it certainly may be a lot cheaper to rent, but at the end of the 25 years, you don’t own the house – whereas you do if you pay the premium and take out a mortgage.

What would a 25-year cashflow look like?

However, just how important is it to own your home in this day and age? For example, how many people would be happier to pay €1,700 a month to live in a five-bedroom detached house in Blackrock, instead of €7,000 for the same privilege, and squirrel away the €5,000 savings a month – €60,000 over one year – into a fully diversified savings and investment portfolio?

Even taking account of (relatively) fixed mortgage costs, compared to rents which will probably drift up 2-3% a year with inflation over a 25-year time horizon, the savings from renting not buying based on current prices are substantial: from €100,000 in the case of the Crumlin home to €1.3m in the case of the Blackrock home. Is that enough to compensate for not owning your home?

Let’s take the middle house of the five – the four-bedroom semi-detached house in Castleknock. Currently, it rents for €1,635 a month, whereas a mortgage based on current asking prices would be €3,665. In 25 years, if rates stayed at 5%, that mortgage repayment would still be €3,665 whereas say 2% inflation in rents (on average) would mean you’d be paying €2,630 in rents by the end of the period. Taking that sliding scale of monthly savings – from €2,000 at the start gradually down to €1,000 at the end – the total savings add up to €470,000, oddly enough close enough the current value of the home.

Of course, those savings aren’t lying idle – the first month’s savings will have had 25 years to increase in value, the second month’s savings one month less, etc. An investment strategy spread across shares, bonds and deposit accounts that averages 5% a year would have turned into €1m by the end of the period. A slightly less successful portfolio – returning an average of 4% a year rather than 5% – would be worth €850,000 in 25 years time. Higher returns (e.g. 6%), naturally, mean your nest-egg is worth much more (6% turns into €1.2m).

And what of the house itself? What will it be worth in 25 years time? Well, nobody knows of course. The least unlikely guess is that – just as house prices did from when the Government started measuring them until the mid-1990s – house prices will match inflation. An average of 2.5% inflation would mean the home is worth €925,000 in 25 years time – right between the 4% and 5% return portfolios presented above.

How does one make a judgement call? After that, it really comes down to a couple’s preferences. How much is knowing you own the home worth to you? How much do you value freedom from property taxes or freedom to move at short notice if employment circumstances change? How much do you value having diversified savings with as much liquidity as your circumstances dictate?

All in all, given the variety of reasons for renting not buying, perhaps we will see something a swing towards long-term renting in Ireland. Ultimately, very few people lose out as someone still ultimately own the property, hence that part of the Irish economy that depends on home ownership needn’t be too afraid.

A nation once again?

What’s the point of all this? Well, the reason that property has been such a popular investment in Ireland since independence is that it has been one of the best bets against inflation in the country. Only in the last fifteen years did it actually create wealth, as opposed to protect it. Once it did, it dominated Irish investments so much that Bank of Ireland estimated in 2006 that three quarters of all Irish wealth was in property.

Looking ahead to the next twenty-five years, though, it would be unrealistic to expect property to do anything more than protect against inflation again. If people expect this, and act accordingly, this frees up Irish money to save and invest in all manner of ways, including in Irish firms. Becoming a nation of renters once again might in fact be a key part of our future economic success.

Conor ,

What do you think the average annual rate of inflation will be for the next 25 years?

I think your estimate above of 2% is maybe a bit low?

graham ,

An excellent piece. It confirms (for me at least) what I’ve come to believe over the past number of years as a renter. Renting is not dead money. Those who jumped on the property ladder are always quick to claim rent is dead money, but they ignore the amount of interest that they pay over the life of their mortgage, which is certainly dead money. They also miss the main reason renting is popular…You get to live in a great location without having to deal with the high price of property there and you can still save more money than you would if you were saddled with a mortgage (especially a crazy 100% 35 year mortgage!).

Ronan Lyons ,

Hi Conor,

That’s a fair comment – and I’ve gone for between 2% and 3% inflation in general prices (and thus of the house price), whereas only 2% inflation in rents. A higher rate in either would make the buying option more attractive, everything else being equal.

I’m going to see if I can put a simple-to-use version of my calculations up on a Google spreadsheet or similar, so people can put in their own figures. Will post any updates here,

R

John Heavey ,

Excellent article Ronan. I’ve been looking for this kind of non hysterical analysis for a while. Well done. Would be interested in the spreadsheet if you get it done.

townhomes_buyer ,

The homeownership rate in the U.S. is nearly 69 percent — indicating that homeownership is within reach for more Americans than ever before. In fact, it can be as affordable as renting, and in some regions of the United States, it can be more affordable. The following are some of the advantages of owning a home rather than renting. You can build equity; this means your wealth will increase as you gain more home equity. You can gain tax advantages, because mortgage interest is tax deductable. A home provides a permanent place where your family can live and grow, and you can decorate or expand a house the way you like to create your dream home.

Ronan Lyons ,

Hi all,

I’ve made version 1 of the spreadsheet available on Google Docs:

https://spreadsheets.google.com/ccc?key=0AnnEvMs5mzPBdDc3emZlb1N1ek9oaExSVnV5LVJXNnc&hl=en_GB

Let me know if you spot any bugs or improvements.

I’m thinking about how to factor in the value of flexibility versus the value of owning your own patch of land. When I’ve something on that, I’ll update the sheet.

Ronan.

FlyOver ,

One item you left out in calculating the cost of owning is the cost of upkeep. I purchased a house 10 years ago but since then have added new windows, new roof, new water heater, new heating system not counting the paint, and other basics that a house needs to be kept in good condition.

Digest – March 21 2010 – The Story ,

[…] Lyons does what he does best. In-depth analysis figuring out where the housing market is, and whether now is a time to buy or […]

Darren ,

Nice article of course the maths of it dont generally reflect the reality of life.

Somebody paying in your example the €1,635 a month is unlikely to save the €2,000 a month they would otherwise be spending on the mortgage. They are much more likely to only save a portion of it and spend some of it on luxuries. Whilst that in itself has no place in the matchs of which is better financially human nature is always a consideration.

also on the pure maths basis your ommitting 7 years of TRS, which could then be vested into a savings and investment portfolio.

you coud go a step further and work out rent a room into the equation aswell.

Ultimatly renting and owning have pros and cons and neither can be made solely on the basis of the financials.

Ronan Lyons ,

Hi Darren,

Very true – this post was just to show people that spending a little bit of time thinking about renting or buying will remove that “red herring” for want of a better phrase and leave them more to focus on the non-monetary/more important aspects to them. TRS is not included but as far as I know that’s being wound down anyway – no harm mentioning it though. Thanks for the comment,

Ronan.

Karl ,

To Darren, I am always amused to see the old “rent a room” argument thrown in. Seriously, why would you want to go to all the trouble of buying, and then rent out part of your house to a stranger?

Using the same argument – i.e. renting one of the rooms in a house either by way of a joint rental or a sublet, you would decrease the amount of rent you pay, so really its pointless to chuck that in.

I feel sorry for the quality of life of people who only managed to secure finance to purchase “their own 4 walls” by including rent-a-room income.

Darren ,

Karl fair point re rent a room, but at the same time it goes back to a core point.

if rent versus buying is purely a financial decison then rent a room has to be included in the maths.

now of course this isnt why people buy, but in the context of purely what is the best in terms of ROI over the long term you cant discount it.

Ronan Lyons ,

I don’t want to speak for Karl, but the point is that regardless of whether you rent or buy, say, a 3-bedroom home, you have the option of renting a room out and that amount gets added to/subtracted from both columns – so it doesn’t affect the decision.

R

Laura ,

1600 is still a fairly steep rent and you’d need a stiff income to pay that.

It is still possible to rent a one bed apartment say, suitable for a maturish person who at 60 isn’t going to want to share with 30-somethings. There is a fairly nice one in Stradbrook, Blackrock, for example, for 800 a month. Nice too.

A similar apartment in the same complex is currently selling for 200k. Thats around about the same mortgage – if you can get one. Ok so lets say you can afford and get a mortgage – so right now you will pay a bit more than the renter.

But you see, here’s the problem.

Currently the old age pension is 230 a week.

And lets consider that they have a modest contributory personal pension also of say, another 100 euros a week.

If somebody moves into this apartment today and retires in a year or two they will suddenly have to start paying nearly 65% of their entire income in rent.

People don’t just buy for 25-30 years they buy for life. With people living longer this means people need a home for maybe 10-20 years after retirement, so if people move away from buying there will then be a burgeoning crisis as renters retire and find themselves unable to pay rent or are forced to continue to work in order to pay it.

Can anybody here suggest what options are open to somebody who is now currently in their 30s, with no pension or maybe only a contributory pension, who might find themselves in this situation in 30 or 35 years time?

Mark O'Donovan ,

Intresting analysis, but what happens if you look at it over the next 40 years.

so say a 30 year old taking a 25 year mortgage, how much will they save in the 15 years between 55 and 70, by not having to pay rent. approx 600,000( assuming a 2% increse in rents each year)

If the home buyer lives another 10 years , their saving are over a million

Ronan Lyons ,

Hi Mark, Laura,

Thanks for the comments – Mark, I think you may have helped touch on some of the main issues in Laura’s post.

As I mentioned above, I’m hoping to put up a calculator on this so people can work their own assumptions and including the next 15 years, say, is a very useful potential addition to that.

R

Ralph ,

Excellent article Ronan in plain English your article shows that the ‘mucksavage maths’ of rent being dead money is flawed. When we add the flexibility of renting into the equation its a strong argument.

Ralph

Jimmy T ,

Very good artcile. Re. the poster who mentioned inflation, surely if the inflation figure is pushed higher it’s reasonable to assume that the average interest rate will also go higher?

Boaz ,

What about the 10% deposit on the house which would accrue interest for a renter over 25 years? You did mention that the mortgage is 90%.

Ronan Lyons ,

Hi Boaz,

Yep, that was an oversight – and it turns out a relatively important one in favour of renting – on my part. The rent-or-buy calculator I hope to post later this week will of course correct for this.

To give an idea, if invested with an average return of 5%, a 10% deposit on a €500k mortgage would be worth €170,000 after 25 years.

Thanks for pointing that out,

R

Your very own rent-or-buy calculator | Ronan Lyons ,

[…] St. Patrick’s Day post, A Nation (of Renters) Once Again?, compared a 25-year cashflow from buying and renting for a few types of houses. Based on current […]

Donogh ,

Very insightful!

You might find this US equivalent interesting/useful:

http://www.nytimes.com/interactive/business/buy-rent-calculator.html