Six months on from the National Asset Management Agency Bill, outlining how NAMA will work, we are getting to the business end of things, with the first few loans expect to transfer over shortly. Many commentators are still doing their best to point out shortcomings with the NAMA concept and viable alternatives to it – see for example David McWilliams’ “Anglo is our Stalingrad” and Brian Lucey’s “Micawbernomics“. At this point, though, I have to confess I’m resigned to NAMA going ahead and, if that’s the case, the focus has to be damage limitation and to the elephant in the room that is the yield on Irish property.

In a way, this isn’t as hopeless as it sounds. NAMA is based on the concept of long-term economic value, i.e. relating the value of properties, in a time when markets are thin/broken, to what they could realistically fetch in rents, when out the other side of the Great Recession.

However, as I pointed out in the Irish Times in September, this relies on those running NAMA getting its core assumptions right. In particular:

- It has to get the fall from peak to time-of-transfer right.

- It has to get the yield right.

- It has to get how yields might correct right.

What’s the loan book worth now?

On the first, no harm reminding ourselves that NAMA is scheduled to take over the loans of properties that were, when the loans were issued, worth €88bn. The loans themselves were worth €68bn, although there’s about another €10bn in accruing interest, by this stage. As I pointed out six months ago, while there is some international diversification, the 6% of the loan book that’s not in Ireland or the UK just about offsets the 6% that’s up in Northern Ireland, let alone the 66% in the Republic.

In terms of getting the fall right, the big problem with NAMA is that, for all the detail we have – €110m in Czech developments compared to €90m in Italian associated loans – we just don’t know what’s in about €64bn of the original €88bn. All we know is that these are broken down into €32bn of land and €32bn of “associated loans”. It seems likely that about €21bn is in Irish land. This is the same land that, for what it’s worth, Judge Peter Kelly of the Commerical Court estimates has fallen in value by about 75%. Indeed, if some land is down 95% or more – like the land in Athlone over which he was judging – while other land is down by (only!) 60%, the original €21bn of land is probably now worth less than €5bn.

The focus then turns to the €16bn or so in Irish commercial and residential developments. It’d be a brave person who’d put €10,000 (or, if you like, €10,000 for every citizen in the State) on the average peak-to-trough fall in prices in both segments being less than 50%. (Asking prices – more than likely above closing prices – were 43% down from peak levels in Dublin city centre in late 2009.) So, looking purely at the Republic of Ireland, it’s hard to see how how falls of 50%-75% could average at 47%.

The vast bulk of the remaining €21bn of foreign land and developments is in the UK, either in Britain, where property prices are falling again after a supply drought had help them up, or Northern Ireland, where prices are over one third below the peak.

In short, even a 20% average fall in NAMA’s non-Irish loan book means that a 47% is already looking optimistic. The figures outlined above would suggest an average fall of 51%. (And remember, from this graph, every percentage point more on the way down makes the 10%-in-10-years argument increasingly risible. A 51% fall means NAMA needs a 25% rebound in property prices by 2020 to break even, give or take the token amount the banks would have to pay back to the state in such an occurrence.)

What’s the problem with yields?

The real problem for NAMA, however, is in relation to the second and third bullet points above, i.e. in relation to the yield on property. The following paragraph is from the supplementary documentation published with the NAMA bill, with my additions in italics:

A property yield is derived by expressing a year’s rental income as a percentage of the property cost. There is an inverse relationship between yields and property prices; as property prices rise, yields fall [assuming rents stay constant]. The prime yields broadly represent the market’s evaluation of the attractiveness of investment in property. It is clear from the table that follows the majority of European cities current prime yields [on commercial property] are higher than their long term 20 year average, particularly Dublin where the Prime Yield [on commercial property] is at 7.25% in comparison to a 5.56% long term average. As yields move towards their long term average this would indicate an increase in [commercial] property prices [or a decrease in commercial rents].

The good news is that by looking at yields, NAMA is looking in the right direction for long-term economic value. The bad news…

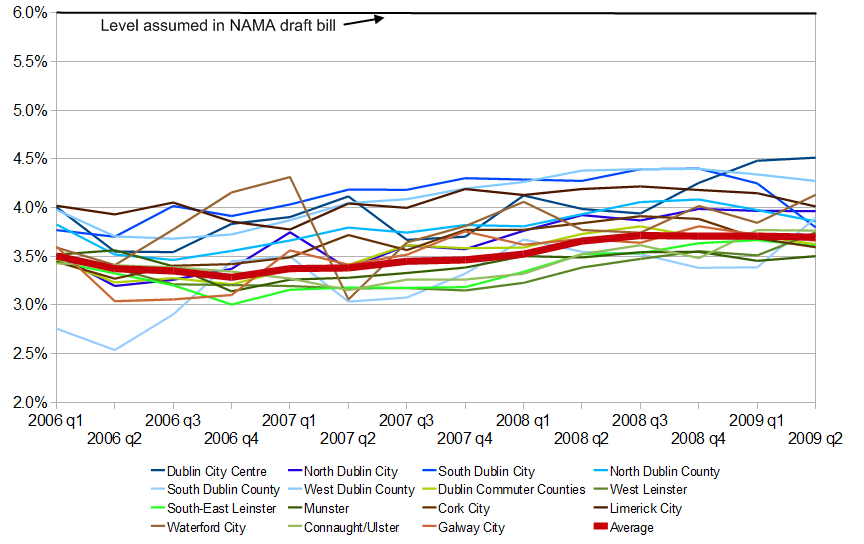

- This is only the yield for commercial property in Dublin. This is a subset (commercial) of a subset (development) of a subset (Dublin) of a subset (Ireland) of NAMA’s loan book – perhaps 5% of NAMA’s loan book. Surely we as the shareholders in NAMA deserve a better prospectus than this? A somewhat more representative set of yields, on residential property around the country, is presented in the graph below.

- By portraying prices as the only mechanism through which a yield can correct, the paragraph above shows either a stunning lack of understanding about the fundamentals of the property market or a conscious or unconscious willingness to direct attention to prices not rents. Yields can correct through either property prices changing or through rents changing. A glut of supply on to the market would mean rents would have to fall to balance the market.

This is exactly what we’ve seen in the residential rental market in the last two years as a result of boom-time over-construction. What is the prospect for commercial rents in Ireland? A February 2010 report by Savills on the Dublin industrial market contained the following eyebrow-raising statistics: During 2009, uptake of industrial space in Dublin fell by 33% to 110,000 sq/m. Meanwhile, about 1 million sq/m (nine years supply based on 2009 take-up) is sitting available on the market, up from 700,000 sq/m a year ago. As the report authors themselves say:

This has and will continue to put downward pressure on rents and force landlords to deliver more flexible terms than in the past.

The overwhelming evidence from Ireland’s commercial and residental markets is that rents are responding to boom-time over-construction by shifting downwards. (No bad thing, either, as Ireland seeks to get its property costs out of the global top 20.) This means that any positive “yield gap” could easily be corrected by changing rents, not increasing property prices. Not only that, the graph below shows that, for residential property at least, the gap between current yields and what NAMA assumes as a long-run yield actually goes the other way, and by some amount.

If NAMA could show that it’s aware of these very basic facts about Ireland’s property market before it starts taking over any loans, I would be a lot less worried about giving it access to tens of billions of euro worth of current and future taxpayers’ earnings. If it doesn’t, the elephant is very much still in the room. If it does, and taxpayers pay a fair price, cash-starved banks will mean a new elephant will take its place – nationalisation.

Joseph ,

Great article Ronan. I fear the worst case scenario.

Cian ,

Interested article.

Here’s another elephant worth mentioning:

Rental yields, are a function of the governments ability to pay rent allowance, since rent allowance set the ultimate floor on rental yields.

How long can the government keep supporting rent allowance at the current levels?

Brian Flanagan ,

Hi Ronan

Good stuff. FYI I blogged about the yield/price issue last October at http://www.planware.org/briansblog/2009/10/who-are-government-nama-trying-to-fool.html

Ronan Lyons ,

Hi Brian,

Thanks for that – good post.

Hi Cian,

Very important point. Although only about one quarter of ads on Daft seem to accept rent allowance (let me check that – but that’s what I remember last time I looked), it may set a floor for all concerned. I hope to be looking at this in probably 2/3 posts time in the property market section.

R

Brian Flanagan ,

Ronan

I have a big concern about Nama’s business plan as published last September. It relates to the accounting for rolled up interest arising post 2010. If you have the time and inclination, you can see my assessment at

http://www.planware.org/briansblog/2009/10/nama—the-real-default-rate.html#more

Jagdip Singh ,

Ronan,

The 47% drop in prices last September 2009, I understood this to represent the drop for the expected basket of NAMA assets. Crucially they weren’t all acquired at the top of the market and the big % drops like the field in Athlone compare peak-to-trough, yet this may not be representative of NAMA assets.

Could you summarily explain the relevance of the 10% in 10 years presumption with respect to property price increases in the NAMA business plan?

Great post by the way, informative and entertaining.

Jagdip Singh ,

Also could you explain the arithmetic of

“A 51% fall in the value of its loan book means that NAMA needs a 25% rebound in property prices by 2020 to break even.”

Can NAMA deliver? « Ireland after NAMA ,

[…] Posted by irelandafternama under Links | Tags: Nama, Ronan Lyons | Leave a Comment Ronan Lyons has an interesting post over on his blog discussing whether NAMA can deliver on its promises. His […]

Ronan Lyons – #NAMA Elephant « No2NAMA ,

[…] somewhat pessimistic) article regarding NAMA’s yield problem. You can read the full article here. “If NAMA could show that it’s aware of these very basic facts about Ireland’s property […]

Foolish Penny ,

Excellent article Ronan – very clear explanation.

We’ve linked from here http://www.no2nama.org.

Gavin ,

Lenihan mentions it here:

http://www.youtube.com/watch?v=pWlz1IKWfw4

UpsidedownA ,

RE: Yields on commercial property. Perhaps the Government is trying to ensure that the return to long term average will come through an adjustment in prices. This would explain the failure to sort out the upwards only rent reviews issue on existing commercial leases.

The Irish Economy » Blog Archive » Ronan Lyons on NAMA and Yields ,

[…] has updated his analysis on property yields and its implications for NAMA and long-term economic value. It […]

david mc williams ,

great article ronan, best david

Pat Donnelly ,

Excllent!

But the EU has to vet each transer does it not? One of the upsides of loss of sovreignty!

Ronan Lyons ,

I haven’t read through the EU’s role in full, but that would warm the cockles of the heart. In addition, Karl Whelan, over on irisheconomy.ie, suggests that the EU may have increased the discount factor, which seems like it’s going to be used by NAMA in some sort of way to reduce prices (the whole thing is quite opaque!).

If true, both are good things from the Irish taxpayer point of view (and also both make the nationalisation of the banks more likely).

Niall ,

Ads in the commercial property section of the Irish Times on Thursday last suggest that industrial/commercial units are already priced at well below their replacement cost. The oversupply makes a mockery of any idea that rental yields are not continuing to fall. Because of the artificial structures put in place around the purchase of many industrial units, the actual rent paid is quite opaque. Many landlords are connected parties to the tenant.

In relation to Cian’s point, the DSFA will shortly be publishing a review of rent supports. Already support limits are considerably above market rents in 90% of the country and a cut of 15% saving €75M is quite reasonable, See Dáil question Ref No: 5546/10.

Retail rents will also have to come down quite considerably, if shops are to survive.

Yes, Rónán your basic argument is correct, perhaps even understated!

Ronan Lyons ,

Niall,

Many thanks for the Dail reference. For those interested, you can find it from this link, http://debates.oireachtas.ie/DDebate.aspx?F=DAL20100203.xml&Page=2&Ex=3480#N3480. The text of relevance is as follows:

Deputy Joan Burton asked the Minister for Social and Family Affairs her views on further reductions to the rent allowance; the amount of money that is allocated for the rent allowance in 2010; if she will provide a breakdown of spending on the rental allowance by Dublin postal district for 2007, 2008 and 2009; and if she will make a statement on the matter.

The reply:

“The purpose of the rent supplement scheme is to provide short-term support to eligible people living in private rented accommodation whose means are insufficient to meet their accommodation costs and who do not have accommodation available to them from any other source.

Rent supplements are subject to a limit on the amount of rent that an applicant for rent supplement may incur. Rent limits are set at levels that enable different types of eligible households to secure and retain basic suitable rented accommodation, having regard to different rental market conditions that prevail in various parts of the State. The objective is to ensure that rent supplement is not paid in respect of overly expensive accommodation having regard to the size of the household and market conditions.

Setting or retaining maximum rent limits at a higher level than are justified by the open market can have a distorting effect on the rental market, leading to a more general rise in rent levels and in landlord income. This in turn may worsen the affordability of rental accommodation unnecessarily, with particular negative impact for those tenants on lower incomes.

A review of maximum rent supplement levels is in process and will be completed by 31st of March 2010. Preliminary findings of this review confirm that rent levels have dropped significantly and continuously since their peak in 2007 giving further scope for reductions for rent limits.

The provisional outturn for 2010 Rent Supplement is €509m, an overall year on year increase of 19m. This reflects the expected increase in rent supplement applicants in payment in 2010.

In the time available it is not possible to provide statistical information requested.”

In short, quarter 2 – April-June – could be a period of adjustment in the market, depending on the findings of the review.

FT Alphaville » Allied Irish Apocalypse ,

[…] Irish magic – FT Alphaville Ireland’s e-NAMA-ous property gamble – FT Alphaville Elephant in the room: NAMA’s yield problem hasn’t gone away – Ronan […]

EU scuppers “long-term economic value” as NAMA’s first tranche goes through | Ronan Lyons ,

[…] then, a 47% haircut based on an estimated fall in property values of 55% looks broadly in line with back-of-the-envelope figures I worked out earlier in March – and, by hook or by crook (i.e. however they’ve rounded down LTEV, for which I think […]

House Prices will Plateau thanks to NAMA? Bonkers | Stephen Kinsella ,

[…] of houses have some way to fall yet. There is the small matter of yields, the smaller matter of a vast oversupply of good quality property, and, oh yes, there are no jobs. […]