The latest daft.ie report is out this morning, reviewing trends from around the country from the last three months and offering updated ‘from peak’ figures for each city and county in the country.

The press release is below, the full report and space for discussion is available on daft.ie, but here are some ‘Things We Know Now‘ from today’s report:

- House prices are not falling at the same speed around the country. Some parts of Dublin have seen falls from the peak of up to 35%, in particular the centre and southern parts. Most parts of Munster, on the other hand, have seen falls of 20% or less.

- There is evidence that this difference across regions in prices is having an impact on transactions. In Dublin, which has seen the largest falls, the total number of properties for sale has fallen 10% in the last year. In Munster, with much smaller falls, the stock for sale is still rising.

- The typical time a property stays on the site in Dublin has fallen from 5.4 months to 4.8 months since May, while elsewhere it’s still rising. In Connacht/Ulster, where the typical property coming off in May had been on for almost 9 months, the figure is now 13.4 months.

- Sellers in some parts of the country are moving in six-month steps as part of a wait-and-see strategy. For example, in the first quarter of the year, asking prices in Waterford city, Sligo and to a lesser extent Wexford were discounted by almost 10% in three months, something that happened in Westmeath in the final quarter of 2008. In the following three months (April-June), asking prices were much closer to static in each. The same pattern took place in Laois, South County Dublin and to a lesser extent Kilkenny in the second and third quarters. This quarter, prices in Westmeath, Monaghan and Galway city are amongst those with the biggest falls.

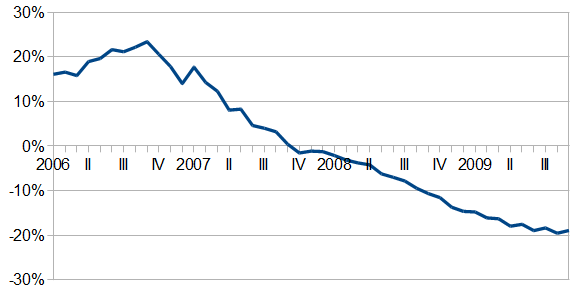

- It’s still too early to call, but the year-on-year rate of falls may be easing. The yearly fall rose from 10.7% in Q3 2008 through 14.7% and 16.3% in Q4 and Q1 to 19% in Q2 2009. The rate actually reached 19.6% in August but has eased back to 19% in September. It will be interesting to see if this easing of the fall continues. If the stock for sale countrywide starts to ease back month after month, like it is in Dublin, then we may just see this. You can judge for yourself in the graph below, which shows year-on-year changes from 2006 on.

—

Press release:

Asking prices for residential property around the country have fallen by 4.7% in the last 3 months, according to the latest report published by property website Daft.ie. The national average asking price now stands at €253,000. Asking prices have now fallen 27% from the peak in 2007 which corresponds to an average drop of €93,000.

The report highlights how asking prices in different regions around the country are adjusting at greatly varying speeds. Since the peak in 2007, Dublin and Meath prices have fallen 35% and 31% respectively, while in Munster, Kerry and Tipperary are down just 20% and 16% respectively. According to Ronan Lyons, Economist, Daft.ie, counties with larger percentage decreases in house prices are seeing better levels of transactions than counties where the falls are lower.

Commenting on the latest findings, Ronan Lyons, Economist Daft.ie said “These latest figures would suggest that the differences in asking prices regionally may be having an impact on the number of transactions taking place. Dublin has seen some of the greatest cuts in asking prices, and there is evidence that this is leading to a greater number of transactions, with the total number of properties for sale falling by over 12% in the last year. In Munster however, where price drops have been lower, the number of properties available for sale is still rising”.

He continued “Looking at the next 12 months, two factors in particular are important for Ireland’s property market. The first is the likely introduction of a universal property tax to replace stamp duty. If done correctly, this may not only remove uncertainty but also stimulate a healthy level of transactions.

The second is NAMA. Its enormous size is likely to set benchmarks in many segments of Ireland’s property market but nonetheless it cannot buck the market and the Government needs to ensure that NAMA is implemented following the most thorough research possible.”

JD ,

If only we know the selling prices! Perhaps this is just showing that sellers are hurting and refusing to lower their prices any more. The few who do will be the few who sell.