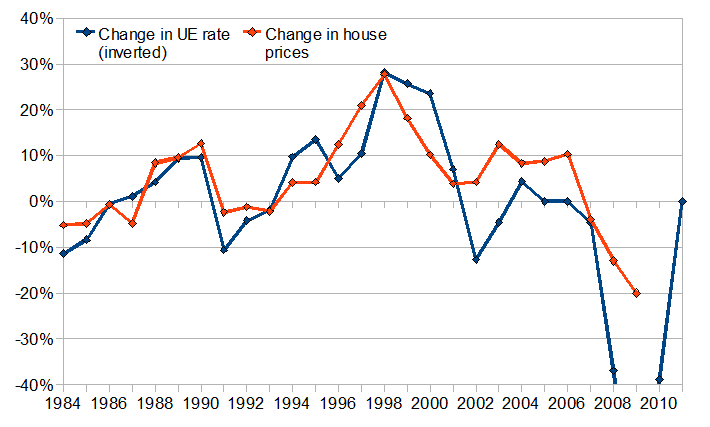

In the midst of a pronounced domestic recession, it can often be difficult to see the wood from the trees. So, in the spirit of parsimonious economic models, I thought I’d post a quick graph today which would be my one graph if I had to predict when house prices will level off.

The graph below shows the change in the unemployment rate (inverted, so a rising blue line means falling unemployment) and the change in real house prices (i.e. house prices less general inflation). I’ve trimmed the axes at +/-40%, but for those curious about just how bad 2009 will be, if unemployment were to average 11%, that would be an 80% increase in the unemployment rate. To go out to 2011, as the graph does, I’ve assumed that unemployment averages 15% in 2010 and also 2011. I’ve taken 20% as the fall in house prices in 2009.

While it’s not a perfect relationship (for example, this measure breaks down when unemployment can go no lower, as in the 2003-2006 period, when house prices rose), and of course correlation is not causation, there is certainly a strong relationship between the change in unemployment and the change in house prices. The correlation from 1984 to 2009 was above 80%.

This suggests demand, rather than supply, has driven real house prices over the past generation. It will be interesting to see, if unemployment does level off in the second half of 2010 or in 2011, whether (over)supply kicks in or whether the correction between 2007 and 2011 will have factored in supply factors already.

seamus ,

Ronan,

although you do include the caveat that correlation is not causation, the rest of your piece seems to be based on the premise.

Couldn’t you try to predict unemployment based on house prices as much as the other way around?

Ronan Lyons ,

Hi Seamus,

Thanks for the comment – the idea here was not to prove beyond doubt that changes in unemployment cause changes in house prices, but rather to show that a very strong relationship has existed between them in Ireland over the past generation. Perhaps I should have left the reader free to consider what the most plausible explanation for this is – there may be some other variable that causes both, for example, or indeed as you suggest changes in house prices might cause changes in unemployment. To me, the most plausible explanation is this graphs shows demand-side factors have had a huge influence on house prices – but of course to prove that conclusively, I would need a fancier economic model (which unfortunately negates my first point above!)

Ste - statusireland. ,

The correlation between property and employment levels aren’t really surprising. We Irish seem to love property as our core investment vehicle. Even now, after everything that has happened, we are living on concrete IV looking for that bounce in the market (we’ll more than likely have a dead cat bounce first – early next year).

Where is the housing market going in 2012? | Brian M. Lucey ,

[…] , inflation have all been seen as important drivers. See here for Central Bank analysis on this, here for an analysis of the importance of unemployment. The most recent IMF analysis suggests that […]

FAUGH45568 ,

Hi Ronan

I was wondering could you do an update in relation to this.

thanks