Louise McBride, in a recent article in the Irish Independent, outlines many of the commonly held views about why ‘Ireland is different’ when it comes to a property tax. “It may work in practically every other developed country in the world”, this line of reasoning goes, “but in Ireland it will be next to impossible.” ‘Next to impossible’, by the way, is a direct quote from a taxation accountant in the article. McBride argues that it could take up to five years to bring in a property tax here. Nonsense!

My suggestion to the Government – and to the Commission on Taxation, if they’re not already well ahead of me on this – is that Ireland introduce an annual 1% residential property tax on all households. I’m not a taxation expert, let alone a property taxation expert, but the idea that we shouldn’t even try to stabilise Ireland’s tax revenues by plugging the €10bn hole in property tax receipts seems all wrong to me. A 1% annual property tax could raise in the region of €4bn a year, and would be a stable replacement for unstable transactions-based stamp duties, so this is definitely worth exploring.

Below are some of the issues that people brought up and my thoughts on each. Any further thoughts and questions are as always welcome.

1. “I’ve already paid stamp duty, so I would be double-taxed.” Well, there are those who argue that stamp duty was a tax on sellers during the boom years, not a tax on buyers as it would have gone to the seller if it hadn’t gone to the government. But I’m prepared to accept the argument in principle and would suggest ‘grandfathering’ it in by calculating everyone’s property tax liability from 2001 on, and counting as a tax credit any stamp duty paid from 2001 above and beyond what a 1% tax bill would have cost.

2. “Legislative changes would be needed.” It’s a national economic emergency – this can be done.

3. “Compiling a database of each home in the country this would take 18 months.” The Department of Communications was supposed to be compiling this database anyway for the new system of postcodes that’s coming in. Perhaps that’s behind schedule. If so, recently, the ESB stepped up to the plate, announcing huge investments and job creation over the coming years. They can step up to the plate again – ESB Networks can provide the government with a list of all homes in the country. An Post could do the same. (If a home doesn’t have electricity and is not receiving any post, it’s safe to say it probably wasn’t going to be paying too much in tax anyway.) This should then be paired with Census 2006 data, so that the attributes of each property is known.

4. “Valuing homes could take anything up to 3/4 years.” The Indo article assumes that there will be self-assessment and properties would be allocated to particular bands (e.g. €500k-€750k), with each band having a set fee. Why create this incentive for people to undervalue their homes? Why not instead use the real data that the Government has at its disposal to value every home in the country using statistically and mathematically sound methods? The Government almost by definition has access, through the Revenue Commissioners, to all the latest transactions, i.e. real prices. OK, some might say, but these days there’s very little being transacted, so how could we possibly tell the price of every property in the country from such a small sample? If you trust me, all I need to say here is that econometrically this is easy – establish the national average price and the ratio of a particular property to the national average.

If you don’t trust me, read on. There are a range of options, which the Valuation Office if it were smart would mix and match to make sure they are double and triple checking their results. Firstly, a cumulative regression could be run each quarter, with additional variables included for the latest period. This means that the wealth of observations from previous periods are not being thrown out. This helps establish relative prices. Very simply put, knowing that the average semi-d sells consistently for on average 80% the price of a detached house which is in all other respects the same means that we don’t need to worry if semi-d’s don’t show up this month around. In fact, controlling for all measurable attributes allows you to identify solely the time-based change in prices – and not changes in prices due to different properties coming on to the market.

Secondly, use other sources out there. Over the past five years, for example, the daft.ie database has grown to hundreds of thousands of properties, each listing a range of attributes from specific location to number of bathrooms. Granted these are only asking prices, but firstly some people are suggesting self-valuation anyway, hence this is no worse, while secondly, if Revenue Commissioners data can establish national average price, databases such as daft.ie’s can establish an individual property’s value relative to that average. Using hedonic price regressions, they can reveal the relative value of, say, the exact same house in New Ross and Gorey, or Limerick city terraced versus semi-d or Stillorgan 4-bed semi-d’s with 2 bathrooms instead of one.

What would be even better would be engaging in open-source collaborative modelling of Irish property prices. By making the model that the Government is using to track property prices available for experts to analyse, it can be improved.

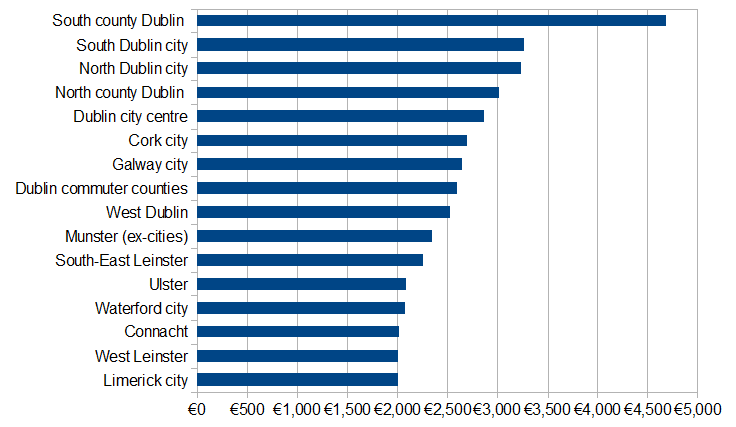

5. “This would essentially be an urban tax.” This isn’t a principled objection, this is just an objection by urban-dwellers – who not coincidentally are also the country’s wealthiest property owners. This is like saying “An income tax would essentially be a tax on people who earn more.” The gap between urban and rural will not nearly be as large on average as some people think. The chart below shows the average tax that would be paid now, taking current asking prices less 10%. As you can see, the vast majority of people would be paying tax of between €2,000 and €3,000. Only one in 20 households, those in South county Dublin, could have to expect to pay significantly more on average and even their bill is less than €400 per month.

6. “This tax would be difficult to collect.” I would suggest giving taxpayers as many means of payment as possible, such as online or direct debit. If the government really wanted this tax to be brought in smoothly, it should integrate it on a monthly basis with income tax. Deducting an extra €100 a month from someone’s paypacket is a much easier way than waiting for the end of the year and hoping they have it saved up.

—

There are lots of legitimate concerns that people have about a property tax, for example the effect it might have on urban sprawl – which requires solid county development plans – or the effect it might have on wealth-rich, income-poor households, particularly the elderly. These are debates worth having. On the latter, I’m not saying it will be easy, but there seems to be an unhealthy attitude in Ireland that whatever wealth we squirrel away in our property should never be touched. Wealth for its own sake is pointless.

The line of argument that we couldn’t even do it if we wanted, however, is a waste of valuable time. It frustrates me to think that people see problems, not solutions. They think of valuing almost 2 million households as a process that will take 2 million visits, evaluations and reports. IBM talks a lot about building a ‘smarter planet’ – using the trillions of interconnected sensors, chips and devices out there and the data they generate to bring about intelligent decision-making. Cities and countries seeing these possibilities are now doing what was previously thought impossible – real-time road user charging, carbon pricing or water quality measurement.

Meanwhile Ireland is worrying about whether it can value wealth. Of course we can bring in a property tax. We should stop worrying about the whether and start thinking about the how.

Dave ,

The TV license inspectors already have a detailed database of all homes in the country. I believe it is used by the emergency services as the reference of choice so availability is not a problem.

It would be nice to remove at least that herring rouge from the debate.

Ernie Ball ,

Nice to see a post here with which I can concur wholeheartedly. Property tax in Ireland is long overdue (as are taxes on wealth generally, as opposed to income). And any fair property tax should be based on the value of the home rather than the €1,000 per dwelling tax that’s been floated lately.. Virtually every municipality in the United States does this so it can hardly be beyond the abilities of the Irish state.

Gerard ,

Ronan,

What would you estimate the ‘cost of collection’ of this tax to be, bearing in mind that it would require joined-up thinking and strategy? Would the same tax ‘rate’ apply to residential, commercial, council and investment properties? Do you think that stamp duty would be replaced by a property tax, immediately? What about property outside of the State?

Should the ‘value’ not be based on something like a percentage (50%) of original purchase price and then indexed @ CPI?

I don’t see a huge problem with self-assessment as any shortfall in under-assessed tax could be collected on disposal/transfer at a future date. They could probably throw in a bit of a penalty to deter abuses. This would require long term planning but would probably get lost in the rush to get their hands on money, now.

Ronan Lyons ,

Hi Gerard,

Thanks for the comment. I don’t have an exact figure, but a lot lower than this ridiculous notion of 5 years knocking on doors. A smart programmer and a good statistician could do most of the work. If joined up thinking is going to be included as a “cost of collection”, it should also be included as a benefit. The notion of Ireland’s government actually breaking down old silo structures surely must fill us all with excitement. Think of the other productivity benefits!

What’s suggested above is just residential (which would include investment), but I’ve no problem overhauling the tax on commercial and industrial – but at least rates there are already in place.

Indexing something at CPI is a very poor substitute, when we actually have the price of the asset in question. The only benefit might be more stability, but in this climate that might mean overtaxing people.

I agree with your overall point, though – if it’s going to be done, let’s do it right, rather than rush it. The bond markets will be more understanding of one extra year’s borrowing where a sustainable plan is in place.

Ronan Lyons ,

Hi Dave,

Thanks for the comment – I was not aware of this… Yet another source, thanks!

R

Ronan Lyons ,

Hi Ernie,

Glad we’re on the same side this time! 🙂

garydubh ,

A National address database already exists in the for of the GeoDireCtory – owned and managed by An Post and the OSI – this is a commercial product which can be liecnsed at a cost.

The proposed National PostCode system is long since on Hold but a suitable system has already been created and tested in the form of PON Codes – http://www.irishpostcodes.ie

Ronnie O'Toole ,

Ronan,

Once at a meeting with Government officials I droned on about the economic advantage of a property tax, and ended with the note “this has to be done in a politically acceptable way”. The answer was: Thanks, suggestions on a postcard please.

The practical problems with a property tax are large, but the greatest difficulty is the political impossibility of it. People see it as a form of double taxation, and simply won’t stand for it (and I know the answer to this, but you try running on a property tax ticket). Trust me, a ‘PAYE’ automatic deduction of increased income tax has 1% of the political pain (the elasticity of pain if you will, or is that a rock band?) of similar revenue earned through an annual ‘written cheque’ of a new property tax.

The way forward is already here. We have a tax on property services (we don’t call it that, we call it a bin tax), and need to explore this further (quick saving of €50m+ by removing bin tax relief btw). If people are paying for a service, particularly where there is choice as there now is for bin taxes, they are more likely to accept a new charge. Water charges is the place to start, though I can see the day when estates will collectively ‘retake’ their shared spaces, and the Government’s responsibility will end at the estate entrance. Unfortunately, mgt companies in ireland have got off to a dreadful start.

Look, I’m babbling now, but the point is, the ‘propoerty tax’ per se is a non-starter, it won’t happen, get over it. We need to think of clearly defined user charges where there is a choice of providers, and maybe it will have the added advantage of rolling back Govt provision where it shouldn’t be anyway, and communities will start to take back the care of their estates.

Bernard Noel William ,

Would imposing a property tax equate to the abolishment of stamp duty for owner occupiers trading up in the future ?

Colm ,

What I would like to see is a discussion on what services we get in exchange for all these extra taxes the government have to impose. It seems to me that in the past 18 months between levies, childcare cuts, health expenses cuts, mortgage interest relief excise duty increases on diesel etc I have seen €500-€600 extra a month disappear out of my pay. It is hard to exactly calculate it but I know my monthly salary is significantly down and by the end of the month I am eating into savings. And this isn’t funding a lavish lifestyle. We have moved to shop in Lidl and Aldi, we aren’t taking a holiday this year, my car is 5 years old and we have cancelled sky sports and sky movies. I simply can’t give any more without taking food from my child’s mouth.

Now if I saw some benefit for that I would accept it but in exchange for that extra tax my local hospital has been downgraded (Clonmel), my child’s school lost 2 teachers and more to go over the summer, the planned upgrade of the route I drive to work has been cancelled (N24).

What will I get for a property tax? Bearing in mind that there are also Water rates and a carbon tax to come and probably increased levies and tax rates I simply don’t know where I will find the money to pay these charges. I’m sure some people will claim that the new fees are to fund the council maintaining my area but they don’t. I have to pay over €700 a year in management fees to the company that manages my housing estate. The council refuse to take over responsibility for the estate even though I pay the same tax rates to them as the inhabitants of the older estate down the road that they do maintain.

From what I can see my money has been used to bail out the developers, banks and paedophile priests. These groups have walked away scott free and I as a taxpayer have been punished even though I never committed any criminal activity.

We need to step back and reassess where Ireland is going. Countries like Sweden have a high tax high service culture that works well. Other countries like the US operate a low tax low service culture. However the Irish government strategy seems to be high tax low service.

Ronan Lyons ,

Hi Bernard, based on what I was suggesting above, I think it certainly should. It would be unfair to significantly tax both stocks (the value of the property) and flows (transactions).

R

Ronan Lyons ,

Hi Colm, you bring up an important wider point, which is proper management of public finances. I think a property tax would be a lot more acceptable if people knew where the money was going. I can only agree with you.

R

Ronnie O'Toole ,

Oh no we can’t … (part II)

If we are to have a property tax? What is the economic logic of a rate based on the value of a house? This is not just an issue of ruban vs rural equity. We should be structuring a system which discourages sprawl, for environmental and public service cost reasons. If someone wants to build a single house on a piece of land, they should pay more than someone who builds densely.

Con ,

Ronan, four observations.

First, in most countries, property taxes are levied by local government to pay the cost of local service provision. One consequence of this is that taxes charged at a high percentage rate on property are mostly restricted to areas with low property prices. For example, in the US, annual property taxes range from 0.1% to 3% of property value, but are mostly clustered around the 0.5% mark for counties with median property prices over €500,000. The really high rates occur almost exclusively in a subset of the counties with low property prices. (See: http://www.taxfoundation.org/files/proptax_county20k_bypercent-200812121.xls, and toss the data into a scattergram). I suspect that a thorough analysis of the impact of property taxes would show that the protection that this mechanism gives to owners of high value property plays an important role in keeping property taxes within sustainable limits. With the US example in mind, I’d urge great caution over implementing a property tax at a national rate over 0.5% of market value.

Second, there isn’t really a functioning market for residential property at the moment, so the price information available is distinctly dodgy. While property taxes could be imposed on the basis of values linked to the hopes of sellers rather than what most prospective buyers are prepared to stump up, this would take away from the tax’s legitimacy. It could also create a formidable problem – with returns on a tax that is supposed to provide some stability to government revenues dropping by maybe 15% a year (along with purported market prices) at least until the market clears.

Third, it seems inevitable that a property tax will ensure that the property market will eventually clear at a price level below that which would emerge without such a tax. And the higher the rate at which it is charged, the lower the price level at which the market will clear. While that doesn’t worry me much directly, it may be of interest to those who are concerned with the realisable value of the security against which many billions of euro in Irish bank loans have been made.

Fourth, my guess is that a property tax will tend to encourage householders to utilise their properties as efficiently as possible. This may slow down the decline in household size, and encourage those with houses larger or better situated than they need to trade down. More efficient use of the housing stock could postpone the date when significant numbers of new homes are required, possibly by a matter of years, postponing the rebound of the residential construction industry to normal levels of activity. And, again, the higher the rate at which property taxes are charged, the greater the greater the impact.

My overall point is that, if property taxes are to be introduced, the Government will have to strike a balance between competing policy priorities in their design, and in the rate(s) set.

Con ,

Oop. That should have been $500,000, not €500,000.

The debate begins - property taxes for Ireland - Smart Taxes Network ,

[…] Lyons takes up their challenge here with a well laid out demolition of their (mainly) logistical arguments in his well researched blog. Ronan does not seem to be […]

Sean ,

Property Taxes in the USA fund local Schools, and fund immediate local services such as the public libraries and fire and police services.

I am really cannot comment on Irelands’ thought of property tax but living in the USA reading this and other papers, it would seem the Governement has got its citizens in this mess, why are they not voted out?

Until proper management of public finances is implemented through honest and good people who are held accountable to the Citizenry, your public monies will be “stolen” (not is the commonly denoted sense, but more or less wasted through inefficiently allocated payment of public services and infrastructure, schools and etc…).

VOTE THE BUMS OUT is a common cry and occurance in the US when our representatives squander what we send them to do in Gov. Service — we have done that here in the US several times when dis-satified with those we have elected did, and it seems to me not enough of that happens (I could be wrong).

Where is the accountability?

M

IMF report on Ireland, competitiveness, wages, taxes and public expenditure | Ronan Lyons ,

[…] start to be taxed that’s way out of whack. They get it right when they say that Ireland must get back in line with the rest of the developed world and have a property tax, but they get it wrong when they say that ’significant administrative challenges’ mean […]

Dankoozy ,

This is ridiculous, all it would do is make sure that only rich people with an income to match could afford to live in high value properties.

1% is a lot of money, think about someone living in a million euro house, i don’t think too many people with those houses could afford to pay an extra 10k a year. especially not if they lose their job, they’d have to move out even if they owned their house outright. even .5% will be enough to have a fair few people be forced to sell the family home

there are an awful lot of people who bought their house when it was cheap, built their own house or whatever and these people are by no means rich but thanks to the property boom of recent years the value has increased and those people will end up paying a tax tailored for the stereotypical owner of a house with that value.

a tax based on ones usage of local council resources would be more fair as one could choose to consume less or live completely off the grid. but to tax someone every year for the privilege of living in their own house is a ridiculous idea, no matter how badly the government needs money

Fergal Daly ,

I agree with Ronnie above. If we’re going to have a property this tax (and I’m mostly for it), why would it be on the value of the house and not just the site? Assuming you set rates so that both methods raise the same amount of money, you should use the method with the greatest social benefit.

Taxing house value discourages me from improving my house, insulating, efficient heating, solar panels, nice garden, conservatory etc. It can also lead to the destruction of perfectly good building stock: http://www.propertywire.com/news/features/empty-property-rate-tax-owners-demolish-200811121945.html .

Taxing site value encourages good use of land, higher buildings (still within the planning limits of course) and it makes it expensive to hoard land in prime locations – supposedly a major problem over the last 10 years.

One downside of using site value is that it may encourage smaller gardens, and Amsterdam-style skinny tall houses. On the gardens front, maybe but people already choose to pay more for larger gardens. On the skinny tall buildings, I don’t know if that’s necessarily a bad thing as long as it doesn’t go crazy (I wonder how high the rates were in Amsterdam to really cause this effect.)

Ronan Lyons ,

Hi Fergal,

I agree entirely with your view that we should use any property tax to achieve the biggest possible social good.

My point was limited to answering some of the points used at the time (and still) to argue that Ireland can’t bring in a tax that every country has in some form or other.

A land value tax is the best suggestion I’ve seen so far.

Thanks for the comment,

Ronan.

Fergal Daly ,

Ronan,

thanks for getting back. What’s interesting about a land value is that no one is talking about it and any time I’ve mentioned it in company people are unfamiliar with it but agree that it seems like a useful idea – except for yesterday when it was strongly opposed by a work colleague who recommended I post a comment over here to see what you thought of it. Someone else told me that the word for me was a “Georgeist” ( http://en.wikipedia.org/wiki/Georgism ) but that it has never been implemented anywhere.

I’m pretty sure we will not get a site-value tax or anything more interesting than a blunt money-raising instrument out of the current govt or most of the opposition.

Larry Lain ,

I currently live in the US and am accustomed to property taxes. I pay about $1000 per month for an average (or slightly above average) house in NJ. The difference here is we know and have local control over the use of the funds generated by our property taxes. In simple terms, about 75% of the funds go to support local schools. The rest is used for stuff like local libraries, local police, roads and parks, which is also under local control.

This system, while generating massive revenues and supporting the education of our children has some serious drawbacks though:-

– It discourages property improvement which increases assessed value and therefore taxes.

– It creates unequally funded schools across different communities of differing incomes.

– If forces different generations to live far apart. On retirement, retirees on fixed incomes simply can’t keep up with ever-increasing property taxes so they move to areas with fewer children and lower property taxes, typically Florida or Arizona ot places like Colorado.

– It forces us all to see a home as a liability, not an asset. The sad part is this liability is as sure as death to keep getting bigger.

Ronan Lyons ,

Hi Larry, thanks for that comment. There has been a good discussion about what kind of property tax would prevent the perverse incentives you’re talking about and generate money, that would be used locally, but would not discourage investment in your home. Land value tax has been suggested as the best.

On the point about people living far apart, that’s an interesting one – although I guess one could argue that’s likely to be less of any issue in a country the size of Ireland. But still, it’s a consideration that needs to be borne in mind.

Falling house prices or not, Ireland needs a property tax | Ronan Lyons ,

[…] year ago, I outlined a number of reasons why Ireland should adopt an Obama-esque “Yes We Can” attitude to property taxes – as well as how to deal with issues like those who have paid a lot in stamp duty recently. […]

tom ,

Dont think this is a good idea at all look at the chaos it has caused in the usa! it bad enough that there arent many jobs around for alot of people but to add an extra bill to the ones that are already studying ? this country is fine it will get back on its feet if it wasnt for the corrupt government between back handing and fattening them selves we all lose out. money in this country is very badly spent ( e.g opened mail belonging to md of my company as if the wages arent bad enough they cut them on top of that they added half an hour to each day ) enterprise ireland had sent the company a cheque for 145 k and this company made ten million profit last year thats my two sense anyway

Ronan Lyons ,

Hi Tom,

The problem is we need more tax revenues in from everyone either way, so – as I said above – the choice is not between a property tax or not, it’s between a property tax and, potentially very few tax credits (e.g. first €5000 only is tax free), or a higher standard rate of tax (e.g. 25%), or abolishing child benefit. We might be able to struggle on with the current system for another year or two, but by 2015 we need to have a sustainable model in place. Which of the above options is the least bad?

Brendan Quinn ,

I believe a zoned land valuation tax would greatly benefit Irish society, contribute to a stable budget and create economic opportunities. LVT is different to property tax which in all respects makes matters worse. LVT taxes the land not the improvements to the land. LVT introduction would mean other taxes specifically, income tax, VAT and profit taxes could be reduce adding stimulus to the economy without the expense of borrowing to do and add to Aggregate demand in a meaningful way.