As part of the new website set-up, twice a week on average, I’ll be posting links that I find interesting, typically from either an Irish or a global perspective. I’ll try and keep the list of links short, as there are plenty of economics bloggers out there with longer lists.

So, without further ado, here’s some suggested reading – today’s lot is from an international perspective:

- Can GDI inform us about recessions and their turning points better than GDP? Texas State’s David Beckworth argues that it might, standing on the shoulders of James Hamilton and the Fed’s Jeremy Nalewai.

- When does trade liberalization produce the largest gains? Thanks to very kindly reproducing his evidence for the Shadow Committee on US Trade Policy, Dani Rodrik argues that the US should focus on three things: (1) How large are the current barriers to trade? (2) How likely is it that liberalisation will ‘aggravate a pre-existing market perfection’, e.g. technological spillovers)? (3) Is liberalization likely to worsen income inequality? My thesis having been on skill premiums, I was very interested to see Rodrik refer to some really interesting KSG Harvard research on “place premium” – i.e. what are the wage differences for identical workers in different locations.

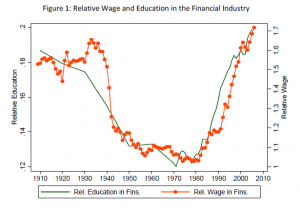

- Has the financial services sector gobbled up society’s talent and wages? Thomas Philippon and Ariell Reshef suggest that is has, in their analysis of the wages and human capital profile of the financial services industry over the last century. They find that just like the 1909-1933 period, the 1980-2008 period was one where the financial sector was a high-education, high-wage industry. Starting in the 1930s, finance lost its human capital and its high wage status – by 1980, wages in finance were similar to the rest of the economy. It will be interesting to see whether the sudden rise from 1980 to current peaks will be mirrored by a fall like that between 1930 and 1950 – Figure 1 of their research is reproduced below.

Leave a comment