Last week, there was a brief discussion on thepropertypin of an interesting piece of economic history – in the 60 years following their construction in the late 1780s and early 1790s, the Georgian houses of Mountjoy Square fell in value by almost 94%. By comparison, nominal wages fell about 40%-50% during the same period, while the price of food – if bread is anything to go by – stayed largely the same (8 pence for a loaf of bread in the 1790s and in 1848). While I can’t claim to speak for anyone else reading, I would imagine the general perception was: “So property prices can adjust downward by percentages scarily close to 100% – but it probably takes a unique set of circumstances (Act of Union and all that).”

Yesterday, however, I read on Carpe Diem about the latest property price statistics from Detroit. Houses in Detroit are selling for an average of $11,500 at the moment, down an astonishing 88% from their peak values. That translates into a monthly mortgage payment of $50! And this happened not in 60 years of steady economic decline but in less than five years.

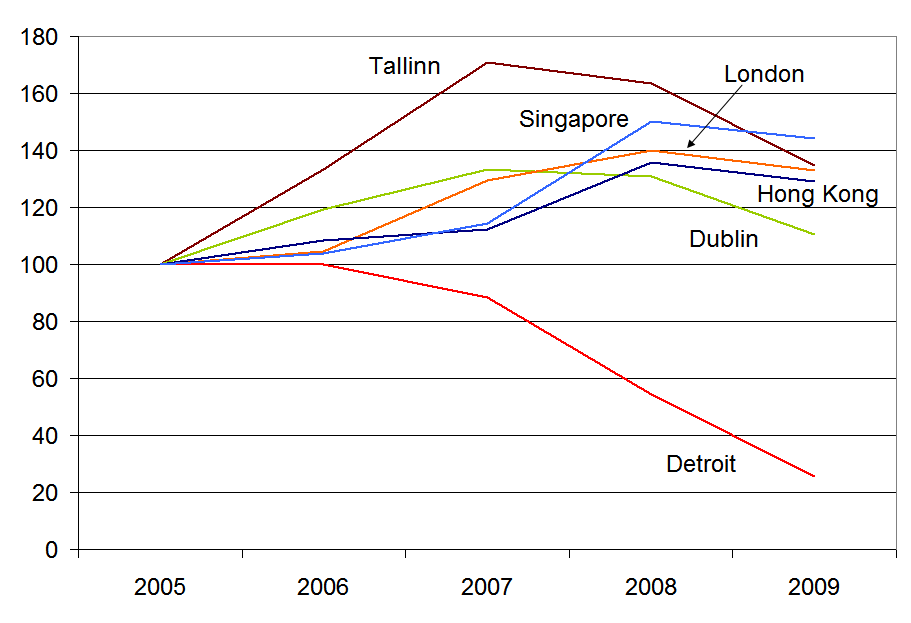

It got me thinking about Ireland’s property market in a global context, so I decided to do a little comparison of 2005-2009 for a smattering of cities. The cities were chosen in no particular way other than to give some global coverage, hence two Asian and one American cities, as well as two Western European and an Eastern European city. The figures refer to the start of the year concerned, with Jan 2005 set at 100 for all cities.

It was a slight surprise to see that, of the cities shown, none apart from Detroit had yet fallen below their Jan 2005 levels by the start of 2009. Indeed, some cities almost 50% above their 2005 levels. Dublin was closest – and more than likely has already fallen back to mid-2004 levels since the start of the year. Tallinn seems to be like an excess version of Dublin – rising and now falling faster. For Singapore and Hong Kong, 2007 seems to have been easily the craziest year, but the correction in 2008 was nowhere near as large. Meanwhile, Detroit props them all up.

For a view on how much more of a correction is needed for five economies, including the US, Ireland and Spain, you can have a look at property yields over the medium term here.

Stephen ,

While I agree mainly with your methods, when you add Detroit to the mix it’s a bit of comparing apples and oranges.

Those prices will only be for inner city Detroit, which for all intents and purposes is a failed city. It is on a downward spiral and should basically be bulldozed. Parts of Buffalo and Pittsburgh are the same, where you can pick up a house for less than $10,000. The suburbs of Detroit will be a completely different story, and I’m sure house prices in the suburbs wouldn’t show such a huge decline. Nobody with a job would ever live in inner city Detroit….too many drugs, gangs, and shootings. Doesn’t matter how cheap the houses are, you just can’t live there.

Dublin on the other hand (I live in North Co. Dublin) has been overpriced for a long time….people got too greedy and now they are paying the price for it. Personally, I see a couple more years of downward house prices in Ireland, mainly because there’s very few out there who can get a mortgage large enough to buy the average house on the average salary. For now I’m renting.

James ,

Developer madness.

Living in a small town in the midlands I witnessed the proliforation of badly planned and now empty or half estates in the area.

Given that the town has little to offer in the way of employment it strikes me as delusionary for banks to have sanction such developments and to give such obscene amounts of money to a motley crew of bandwagon blocklayers, plasterers and plumbers.

Be that as it may, the delusion continue, as these houses now lying empty and falling into disrepair still take pride of place in local estate agents windows for undisclosed amounts of money.

Given that these houses will never make it into NAMA and will not be sold for many years, I wonder what the reprecussions are for the towns that accomodate them and the people who tried to develop them.