Hair of the dog: With rents fallings, ECB cuts the only thing likely to drag yields above borrowing cost

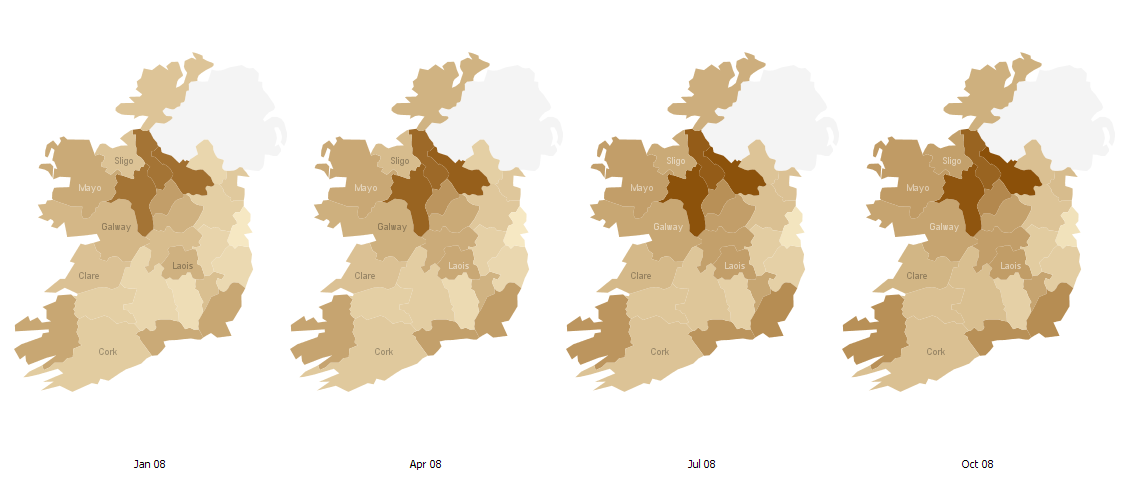

The third and final (for 2008 anyway) instalment in the visualizations of Ireland’s property market takes a different look again to my recent posts on trends in prices and stock. Building on the measure of affordability on page 10 of each daft.ie rental report and a suggestion made on thepropertypin.com, it measures the gap between the expected yield and the cost of borrowing.

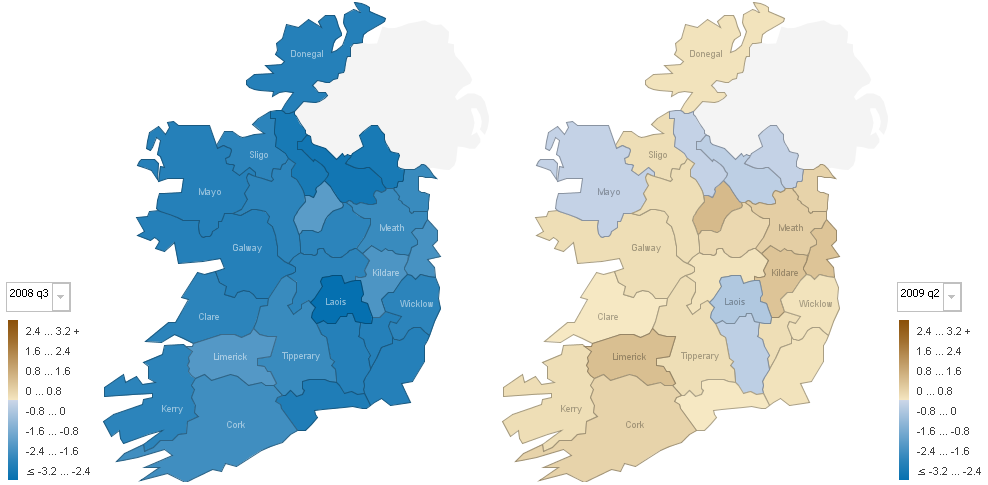

The result is here on Manyeyes. Blue means the cost of borrowing is greater than the expected yield, while brown means the opposite. Below, two quarters are shown – 2008 q3 and an estimate for 2009 q2.

What is clear is if that one takes a measure of this gap as a measure of market disequilibrium, the market remains overpriced. (There are of course plenty of reasons why rents as a proportion of house prices may not be the only measure of a housing market in balance, particularly where rental markets are small or negligible, but bearing that in mind, let’s proceed…)

To look ahead and see if this mass of blue is likely to change any time soon, I made some assumptions about interest rates, asking prices and rents, based on what we know now. I assumed that interest rates fall to 1.5% in June 2009, and that house prices and rents both fall 5% quarter-on-quarter in the first six months of next year, as high levels of stock in both segments take their toll. I’ve also assumed landlords will still get 11 months of the 12 in rent and that the rate at which first-time buyers borrow remains about 1.1% above the ECB rate.

I’m sure there are plenty of ways people might disagree with particular aspects of those assumptions, but I think they make, if nothing, else a starting point for discussion. (Take them as a straw man if you don’t like them!) Anyway, if those assumptions were to be borne true over the coming six months, the first thing to note is that yields would be largely unaffected – i.e. not going in the direction they should be, up towards the equilibrium long-term average cost of borrowing somewhere north of 4%. (It should be pointed out at this stage that yields in certain market segments, e.g. West Dublin 1-beds, are already very close to 5%, so averages certainly hide some interesting sub-county variations. For more check out page 10 of the last Daft.ie report.)

However, a collapse in interest rate – albeit gradually – in a steady-as-she-goes ECB version of the Fed’s record peak to trough interest rate journey would have the not unexpected consequence of turning all those blue spots brown. Well, most of them anyway. Once again, the prognosis is not good for Leitrim and Cavan, two of the counties with among the worst stock overhang in the country, on a per capita basis. Even with interest rates collapsing to record lows, that would not be enough to make the rate of return on property greater than the cost of borrowing.

Is the cure the world is adopting a central banker’s version of the hair of the dog that bit you? Or are we entering a phase of the world economy where caution is so predominant that low interest rates are the appropriate response?